Sponsored: Healthesystems

Focus on the Patient, Not the Pain

The upcoming release of the new ACOEM opioid treatment guideline reflects new evidence associated with opioid risks. Of note, one of the recommendations is to significantly lower the maximum daily morphine equivalent dose (MED) to 50 from the 120 MED recommended in earlier guidelines. Morphine is the standard against which the potency of all other opioids is measured. While it is tempting to focus on the MED reduction, the real story is the opportunity the new guideline presents for payers to redefine their opioid strategy.

Robert Goldberg, MD, FACOEM, an occupational medicine specialist and chief medical officer at workers’ compensation PBM Healthesystems, expects the new guideline to help reshape the opioid discussion. “Once physicians consistently approach pain relief as a tool for helping speed recovery instead of as the ultimate goal of treatment, everything will change,” noted Dr. Goldberg. “When physicians focus on pain relief as the primary goal and prescribe opioids on the first visit, they open up patients and payers to well-documented risks. The outcomes data show that this approach is not working.”

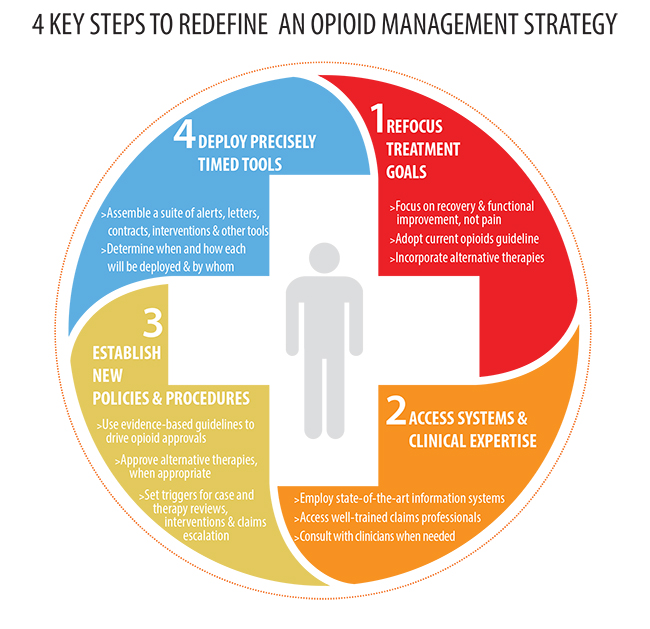

A past president of ACOEM, Dr. Goldberg recommends payers include four key steps when updating or redefining their current opioid strategy. The steps involve developing a new treatment philosophy; gaining access to the right information systems and clinical expertise; establishing new policies and procedures to support the new approach; and deploying precisely timed clinical tools and strategies to keep claims on track.

Step 1 – Refocus treatment goals

The most effective opioid strategy is one that takes a holistic approach and makes recovery and functional improvement the ultimate goal of treatment. Dr. Goldberg advises physicians and payers to refocus the goal of treatment as a critical first step in updating their opioid strategy.

“A key principle in occupational medicine is to minimize the effects of an injury and help injured workers remain at work whenever possible, or regain function and return to work,” explained Dr. Goldberg. In addition to reframing treatment goals, he recommends implementing these supporting strategies:

- Focus on adequate pain relief — reduce pain sufficiently so that injured workers can participate in treatment plans to speed recovery.

- Follow the updated opioids guideline — use non-steroidal anti-inflammatory drugs (NSAIDs) or acetaminophen as a primary treatment and physical therapy when indicated.

- Incorporate alternative therapies — adjunctive therapies such as cognitive behavioral therapy, massage, yoga, chiropractic and acupuncture can aid in pain relief and help injured workers cope with the presence of some pain.

Step 2 – Gain access to the right information systems and clinical expertise

Another step needed to update an opioid strategy is to ensure that the claims organization has access to the right data and expert analysis so they can identify claims requiring close attention. To achieve this, payers should:

- Develop state-of-the-art information systems — or rely on a PBM — to provide reliable data that can quickly identify cases that are moving toward prolonged or accelerated use of opioids.

- Work with a team of well-trained claims professionals and nurse case managers who can coordinate efforts and make good decisions.

- Tap the expertise of clinical pharmacists and knowledgeable physicians.

“The ultimate goal is for a patient to physically recover, not to simply manage their pain. Once physicians consistently approach pain relief as a tool to help speed recovery, everything will change.”

— Dr. Robert Goldberg, Occupational Medicine Specialist and Chief Medical Officer, Healthesystems

Step 3 – Establish new medical policies and procedures

Clear policies and procedures that reflect the most current evidence-based medical guidelines are an important component of an up-to-date opioid strategy. Dr. Goldberg recommends payers revise policies and procedures to:

- Approve opioids only when appropriate, per current evidence-based guidelines.

- Approve alternative therapies such as cognitive behavior therapy and physical therapy to reduce reliance on pain medication when appropriate.

New policies and procedures should delineate:

- The jurisdictional and professional guidelines that will be applied.

- What circumstances will trigger clinical interventions — such as MED levels, a defined number of prescriptions or prescribers or other factors.

- Which cases will be escalated for higher level clinical intervention — such as claims that reach a certain dollar value or involve certain complex conditions or injuries.

- Which tools and interventions will be deployed and by whom.

Step 4 – Deploy precisely timed tools

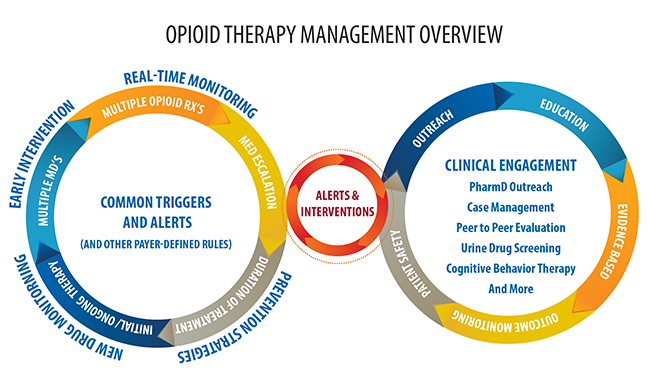

An updated opioid strategy should include a robust suite of tools and clinical expertise, as well as define how and when to use them to help keep opioid therapies on track. Claims organizations need a strategic PBM partner with a robust toolkit and a deep bench of clinical expertise to guide them in deploying tools such as:

- Alerts to pharmacies and claims organizations about issues involving prescription dosing, quantities, early refills and other concerns.

- Monitoring and analyzing MED levels to ensure patient safety.

- Real-time therapeutic interventions as part of a prior-authorization process to help prevent risks.

- Letters of medical necessity that document the need for opioid therapy.

- Informed consent forms that alert injured workers to the risks associated with opioid therapy.

- Pain contracts with injured workers that detail what is expected of them while they are receiving opioid therapy.

- Peer-to-peer interventions by clinical pharmacists or physicians.

- Screening and assessment tools for substance abuse, opioid risks, depression, pain and other conditions that contraindicate opioid therapy.

- Compliance monitoring programs using urine drug testing.

- Drug regimen reviews.

Everyone benefits

An opioid strategy that focuses on achieving functional improvement will yield benefits for the payer, patient and employer that include:

- Reduced length and cost of opioid drug treatment

- Reduced adverse effects of treatment

- Enhanced recovery

- Increased likelihood that the injured worker will return to work quickly

- Decreased temporary and permanent disability

- Reduced overall medical and total case costs

For more information on opioid strategies, request a subscription to Healthesystems’ RxInformer clinical journal or access the latest issue on the app for iPad through the App Store.

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with Healthesystems. The editorial staff of Risk & Insurance had no role in its preparation.