Sponsored Content by AIG

5 Reasons to Update Your Disaster Plan Now

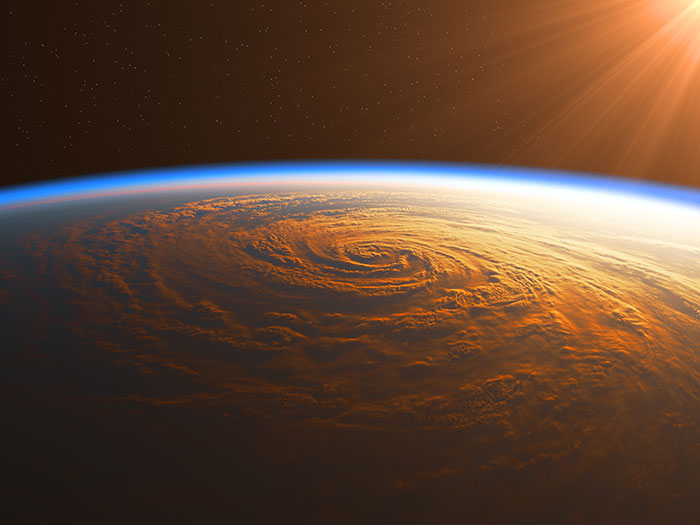

With the 2018 hurricane season underway, communities impacted by the historic 2017 season have just barely recovered. And forecasters say we may be in for a repeat.

Despite the Atlantic’s colder-than-normal temperatures during winter, scientists surmise they will warm rapidly throughout the summer. Combined with cool Pacific waters, it’s a recipe for punishing storms. Of course, early predictions are never 100-percent accurate; after all, was there any modeler who foresaw the triple threat of Harvey, Irma and Maria?

“Catastrophes are going to happen. It’s not a question of if, but when. You have to be prepared no matter what the forecast says,” said Dean Owens, AIG’s Head of Property and Special Risk Claims, U.S. and Canada.

Last year’s storms did, however, offer some lessons in crisis management. Their aftermath illuminated five critically overlooked risks that companies should consider in their response and recovery plans before disaster strikes this year.

1. Flood Control Actions May Actually Increase Flood Risk

Dean Owens, Head of Property and Special Risk Claims, U.S. and Canada

As Hurricane Harvey dumped feet of rain onto Houston residents and businesses, rapidly rising water levels placed excessive pressure on the city’s reservoir walls. The Army Corps of Engineers decided to proactively release water from the reservoirs to prevent a catastrophic collapse. Though the move mitigated larger-scale damage, it also increased flooding of thousands of structures in the immediate area.

“They were trying to be proactive, but it may have caused some damage that otherwise may not have happened,” Owens said. “Homes and businesses in the area experienced flooding as a result of flood control operations. That’s not a consequence most people would think about.”

“If you’re located downstream from a flood control project, how might that impact flooding on your property? What can you do to prevent it?”

Potential mitigation solutions could include temporary barriers that can be quickly and easily assembled. After Harvey, for example, some Houston residents implemented canvas barriers that can be easily set up around a property and keep out flood waters as high as three feet.

2. Lack of Electricity and Accessibility Hinder Repairs Indefinitely

Most crisis management plans will detail how a company can best prepare for an impending storm and prevent as much damage as possible. But not all will consider the post-storm conditions that could hinder their recovery efforts.

Access is one issue.

“On an island like Puerto Rico, logistics are a challenge. If ports and airports are damaged, how will you get resources there?” Owens said. Even in a landlocked city, roads and highways may be too flooded or debris-covered for repair crews to get through. After Hurricane Sandy in 2012, for example, vehicle restrictions made it difficult for adjusters to get into New York City.

“It was difficult to move around because of all the debris,” Owens said.

Lack of power may also present an ongoing problem. After Maria struck Puerto Rico in September, the island remained in the dark for months.

“You have to be prepared to not just weather the storm, but to deal with whatever the aftermath will be weeks or months after,” Owens said. “Make sure you have access to fuel and generators, so you can at least turn the lights on and survey your damage.”

3. High Demand Means High Prices for Labor and Materials

After any major storm, there will be a surge in demand for skilled labor, materials, and claim adjusters.

After any major storm, there will be a surge in demand for skilled labor, materials, and claim adjusters.

“Everyone needs a contractor, and all of the contractors need sheet rock and plywood and roof materials. That demand drives up the price of those materials, so you might be paying double what you anticipated, depending on how widespread the damage is and how quick you were in ordering those materials,” Owens said.

In a multi-storm scenario like Harvey, Irma and Maria, remediation companies and adjusters will be all the more stretched.

If a company has storage space offsite, it should consider stockpiling some materials before a storm to avoid the rush in the aftermath. It should also consider local providers who may not be under the same pressure as national firms to respond to disasters in other areas.

“Sometimes the guy around the corner can do a great job for you, and he’s right there,” Owens said.

4. Affected Workers Might Not Return Immediately

A disaster response plan should designate a chain of command and provide instruction for all employees. But a workforce dealing with damage to their own homes and the same struggles with lack of infrastructure or electricity may be unable to perform their designated duties.

“You have to think about employee care at the same time you’re trying to get your facility back up and running,” Owens said.

A crisis management plan should establish a method and timeframe for communication after a storm so employees can relay their circumstances to managers and those in charge of executing the recovery plan.

5. Disrupted Supply Chain Spells Big Business Interruption Loss

Even companies outside of hurricane-prone coastal regions need to be attuned to these risks if they have suppliers who may be affected. Sitting outside of a storm’s path can lull businesses into a false sense of security.

“If you have a sole-source supplier in a heavily-damaged region, you could potentially have a significant contingent business interruption claim,” Owens said.

Major auto companies experienced this after the Thailand floods of 2011, which inflicted heavy damage to component parts suppliers in the region. The health care industry experienced similar ripples after Hurricane Maria knocked out pharmaceutical manufacturers in Puerto Rico, where medicine constitutes the majority of exports.

“Sometimes the conversation about engaging backup suppliers doesn’t happen until the event occurs,” Owens said. “By that time the damage is done.”

Reliable and Well-Resourced Support

Even the best-laid plans, though, can fail if a company does not have the liquidity to get the supplies and labor they need to set recovery efforts in motion. Having the support of a well-resourced insurer is critical to any crisis management strategy.

Even the best-laid plans, though, can fail if a company does not have the liquidity to get the supplies and labor they need to set recovery efforts in motion. Having the support of a well-resourced insurer is critical to any crisis management strategy.

After Harvey, AIG advanced $60 million in initial payments to impacted insureds within the first 30 days, and about $15 million to insureds impacted by Irma in the first 30 days.

“No matter how large the loss, we follow through on our Claims Promise. Once we agree on a damage estimate, we forward 50 percent of agreed debris removal, property damage repairs and extra expenses within seven days,” Owens said. “This supports our clients’ cash flow and business continuity.”

AIG’s roughly 500 in-house property engineers are deployed locally and work in the field with clients, ensuring a quick claim turnaround. Forensic accounting teams work with clients specifically on business interruption losses, which for some companies may be larger than their property loss.

“Some of the resources that were brought to bear for Harvey, Irma and Maria were getting stretched thin before Maria even happened, but that was not an issue for AIG,” Owens said.

“If you’re going to place your trust in a carrier, you want that carrier to be able to respond no matter how many events that you have.”

To learn more, visit https://www.aig.com/business/insurance/property.

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with AIG. The editorial staff of Risk & Insurance had no role in its preparation.