Sponsored: Liberty Mutual Insurance

A Year of Opportunity for U.S. Manufacturers

2018 is shaping up to be a year of historic shift for U.S. manufacturing. Tax reform, favorable regulatory changes, advances in industrial technology, and an improving economy and unemployment rate all present opportunities for organic growth.

“Many manufacturers expect to increase sales in 2018, both domestically and abroad,” said Stacie Graham, Senior Vice President and General Manager, National Insurance, Central Division, for Liberty Mutual Insurance. “Recent tax and regulatory changes in particular present opportunities to increase exports to international markets.”

But there are persistent operational challenges that could block manufacturers from seizing these opportunities. An industry-wide talent shortage and skills gap hinder growth potential for U.S manufacturers. To overcome them, apprenticeships and efficiency tools like co-bots could be the way forward.

Talent and Skills Shortfall

According to a 2017 report by Deloitte and The Manufacturing Institute, the U.S. manufacturing industry could be short by about two million workers over the 2015–2025 period.

“The labor participation rate will continue to drop through 2026 according to the Bureau of Labor Statistics. This shift is largely driven by aging workers who are retiring—and there isn’t enough new talent in the pipeline to replace them,” Graham said.

The manufacturing sector — like many others– needs to invest more in attracting and training talent. Some of the difficulty could stem from what Graham called an “image problem.”

“There’s a perception that manufacturing is not a viable career path, because automation is taking over, or because it’s dangerous, or simply because many jobs on the factory floor seem repetitive,” she said. Less than five in 10 Americans surveyed by Deloitte believe manufacturing jobs are interesting, rewarding, clean, safe, stable, or secure.

The increasingly technical nature of manufacturing work may also present challenges, as potential job candidates may not have the right skills.

Manufacturers are feeling the pinch. In a recent survey by the National Association of Manufacturers, companies indicated that attracting and maintaining a quality workforce is a top challenge.

Now is the time for manufacturers to address these operational challenges so they can be successful in the long term.

Bridging the Gap

When it comes to training new skills, earlier is better for both employees and businesses. Manufacturers that invest in apprenticeship programs targeting younger applicants can help to teach the necessary skills to a pool of talent early in their career journeys.

For example, Germany adopted an apprenticeship model in the mid-2000s, which helped decrease the youth unemployment rate from a high of 15.9 percent in 2005 to 6.6 percent in 2017. In the U.S., the youth unemployment rate reached 10.1 percent in 2017.

“There is a big opportunity to tap into that pool,” Graham said. “And if apprentices have good experiences, they’ll spread the word among their peers, helping to cultivate a continuing pipeline of talent.”

Talent development and training may not completely bridge the gap created by a mass exodus of retirees, and that’s where collaborative robots —or co-bots — come into play.

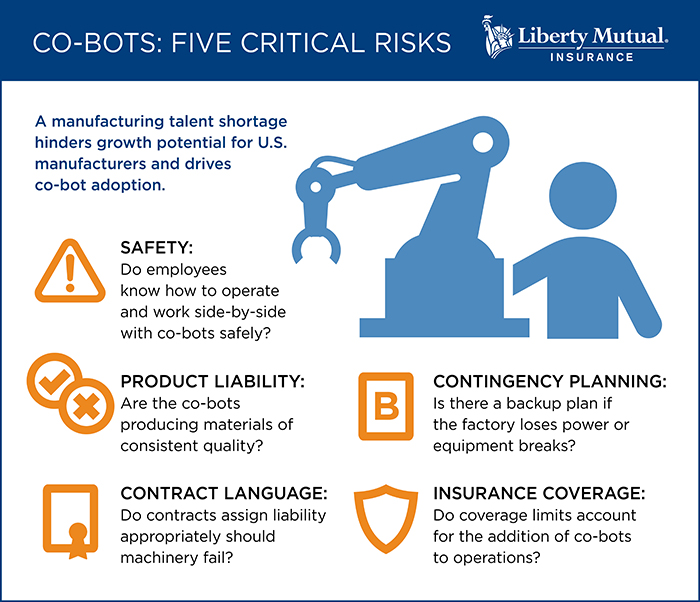

Co-bots: 5 Key Areas to Address

As the name suggests, co-bots work alongside human workers, not replace them entirely.

By performing tasks that pose ergonomic or other safety risks to employees, co-bots can free up employees for higher-level thinking tasks like quality control or the actual programming of co-bots.

“Co-bots boost worker efficiency and can reduce the total number of employees on the floor,” Graham said, but they don’t come without their own challenges.

Brokers can play a key role in helping their clients take advantage of the efficiency gains promised by co-bots while mitigating the risks. Here are five areas brokers should address with their clients to help them effectively implement co-bot technology:

- Safety: Have you conducted a risk assessment to make sure employees know how to safely operate and work side-by-side with co-bots? Using co-bots correctly should reduce workers’ exposures to more dangerous tasks, but misuse could place employees in harm’s way.

- Product Liability: Are co-bots producing materials of consistent quality? If programmed incorrectly, co-bots could produce faulty work that increases product liability exposure.

- Contract Language: Have you consulted with legal counsel to put contracts in place among the co-bot manufacturer, programmer, and end user to assign liability appropriately should machinery fail?

- Contingency Planning: Is there a backup plan if the factory loses power? Are you able to quickly repair or procure co-bot machinery if needed?

- Insurance Coverage: Do you have appropriate coverage limits on property, equipment breakdown, business interruption, and operational replacement costs to account for changes to your operation?

The Right Risk Partner

The right insurer can help brokers address these areas and help their clients take advantage of the business opportunities ahead.

Liberty Mutual’s team of risk control consultants can help create company-specific safety checklists to help ensure that co-bots don’t present a bigger threat than opportunity.

“Members of our risk control team specialize in manufacturing. They sit on health and safety committees and take part in discussions about standards for industrial robots and co-bots,” Graham said. “They help ensure we’re keeping up with industry changes so we can provide the right guidance.”

Industry-specific expertise is complemented by broad range of coverages, from standard to E&S lines, offered by Liberty Mutual and Ironshore, now a Liberty Mutual company.

“We have such a wide breadth of products available for manufacturers, from small and mid-size to very large. Whether it’s a guaranteed cost policy or a loss responsive policy, we can build a program that makes the most sense for that company,” Graham said.

Liberty Mutual also offers specific endorsements for industrial equipment, metal, plastics, and food manufacturers, including commercial general liability enhancements and E&O coverage claims-made and defense within limits.

“Our job is to make it easy for brokers to find the right mix of coverage and services their clients need to be successful. “We’re able to do that with our risk control resources and flexibility in building program structures that work.”

To learn more, visit https://business.libertymutualgroup.com/business-insurance/industries/manufacturers-insurance-coverage.

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with Liberty Mutual Insurance. The editorial staff of Risk & Insurance had no role in its preparation.