Long-Term Care

Underwriting Reassessments Drive Long-Term-Care Reform

After years of public scorn for massive premium increases and internal wrangling over mispriced contracts, new forms of long-term care (LTC) coverage are seeing a notable uptick in sales.

Professional and public organizations are digging deeply into the underwriting and actuarial assumptions that were behind traditional LTC policies in hopes of avoiding the same mistakes for the newer hybrid or combination contracts that are based on annuities or permanent life insurance with riders for LTC and disability.

There is, however, not yet any good answer for what to do with the traditional policies that remain in force.

“The cost has never really been a low as people wanted it to be, and carriers were never able to capture the [younger and healthier] people looking ahead.” — Robert Kerzner, president and CEO, Limra, Loma and LL Global

Robert Kerzner, president and CEO of Life Insurance Marketing & Research Association (Limra), Life Office Management Association (Loma), and LL Global, said that traditional LTC coverage was caught between multiple mandates.

“The cost has never really been a low as people wanted it to be, and carriers were never able to capture the [younger and healthier] people looking ahead,” he said.

“The LTC contracts sold were primarily to those close to the age where they would use them. So the business never really got off the ground. There were never a lot of carriers and also not a lot of distribution.”

External factors exacerbated the struggles of traditional LTC coverage. Two in particular were killers: low lapse rates and low interest rates.

“What were the lessons learned?” Kerzner asked rhetorically. “The industry did not have a lot of historical data. We all want to be innovative. I push the industry to innovate. But consumer behavior is not always logical. Another factor was medical breakthroughs. Those changed the game.”

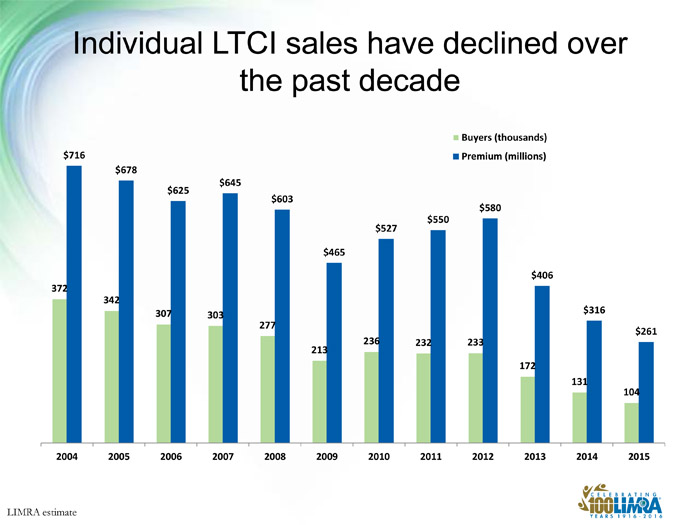

The ideas for LTC 2.0 — hybrid or combination contracts — came from research as sales and premiums for traditional policies shriveled.

“People don’t like paying for insurance and getting nothing back,” said Kerzner. While one of the criticisms of traditional coverage was that they were too complicated, he said, the riders and options on combination contracts are seen as adding value.

Bruce Stahl is vice-chair of the LTC Reform Subcommittee of the American Academy of Actuaries, which expects to publish its analysis and recommendations of LTC by the end of the year.

He is frank about the value of what amounts to forensic underwriting in LTC. “It is helpful to understand the assumptions of the ’80s and ’90s. People made assumptions that were at the time reasonable estimates. The assumptions being made now on newer contracts are more conservative,” especially regarding interest and lapse rates.

“In the early ’90s, the assumption was that lapse rates for LTC coverage was going to behave like Medicare supplement policies, which were about 6 percent at the time. Actual lapse rates for traditional LTC contracts have been less than 1 percent. That has had a strong effect because of more benefits paid out.”

“Insurance companies are designed to be profitable. If traditional LTC is not profitable, it won’t be offered.” — Jesse Slome, executive director, American Association for Long Term Care Insurance

Jesse Slome, executive director of the American Association for Long Term Care Insurance, said that it is difficult to document the traction that hybrid LTC contracts are gaining because they are so new, and also because they are spread among permanent life and annuities.

“No one is really tallying the data, but at the Limra-Loma Conference in New Orleans [where he was chair of a panel discussion in September], I was told by carriers that on something between 50 percent and 80 percent of their new life policies, the insured checks the option to get an LTC payout.”

Slome is forthright about the future of the line. “Insurance companies are designed to be profitable. If traditional LTC is not profitable, it won’t be offered. If hybrids are, they will be offered.”

That still leaves the question of what becomes of the early adopters from the ’80s and ’90s, the ones who thought they were being economical and responsible and are clinging to their traditional contracts at the confounding lapse rate of less than 1 percent.

For years, the financial press has been full of horror stories of premium increases of 50 percent, 60 percent and in some cases more than 100 percent. Carriers have been bombarded with outraged complaints, as have regulators and even Slome’s organization.

“What to do about old policies?” asked Slome. “I don’t know. But I suspect the few carriers remaining in that market are counting on state regulators continuing to approve premium increases, and also counting on interest rates rising. Shares of Genworth [the largest issuer of traditional LTC contracts] have become in effect a type of interest-rate play.”