Sponsored: Liberty Mutual Insurance

Treating Injuries without Employer Pain: Managing the Challenges of Opioids and Marijuana

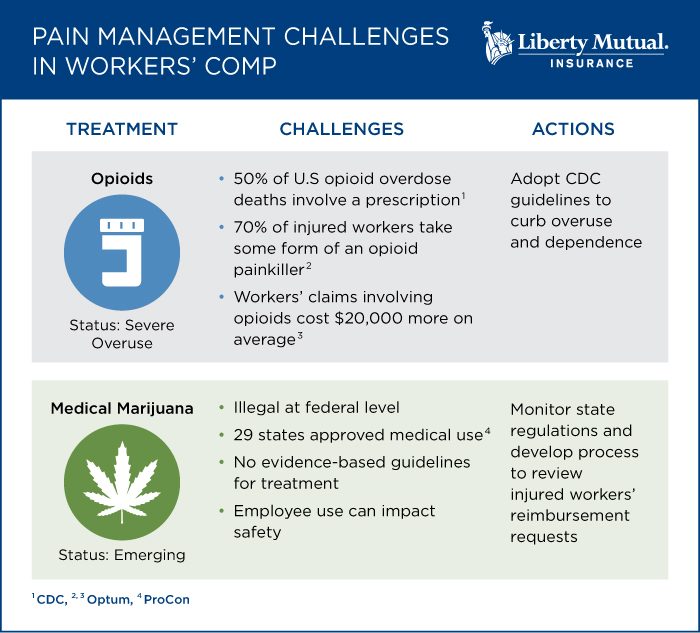

Most employees have peace of mind that while a workplace injury may cause pain or disrupt their lives, they’ll be treated as quickly and effectively as possible through their employers’ workers’ compensation programs. Employees also know that they’ll have treatment options that best fit their conditions and medical needs. Two potential treatments, however, present unique challenges for employers: opioids and medical marijuana.

Updated medical guidelines, new laws, and cultural shifts have driven the rise of these two classes of drugs as potential forms of treatment in workers’ compensation cases. While opioids and medical marijuana are in very different stages as treatment methods, complications exist that could put employees and businesses at risk if not managed effectively. Their potential impacts mean employers need to have a forward-thinking claims framework in place to help keep employees safe and minimize risk.

The Rise of Opioids in Workers’ Comp

Doctors and nurses must ask patients to rate their pain on a scale of one to 10, and treat it accordingly. That subjectivity, in part, has given rise to the over-prescription of opioids. “Historically, opioids were used appropriately to alleviate pain associated with cancer and similar severe pain conditions. Over time, physicians prescribed opioids for far less severe pain conditions. The resulting rise in availability has also contributed to the current epidemic in the United States,” said Maureen McCarthy, SVP and Manager, Workers’ Comp Field Claims, Liberty Mutual Insurance.

The Centers for Disease Control and Prevention (CDC) estimate that nearly half of all U.S. opioid overdose deaths involve prescription opioids – in 2015, there were 15,000 prescription-related opioid deaths1.

Its impact is also being felt in the workers’ comp space. Seventy percent of injured workers take some form of an opioid painkiller – and workers’ comp claims involving opioids cost, on average, $20,000 more than claims without2.

A Flexible Framework for Evolving Claims

Opioids aren’t the only change impacting workers’ comp; emerging treatments like medical marijuana are also on the rise. Liberty Mutual Insurance built a flexible claims management framework to address evolving treatment methods.

The framework’s foundation is in Liberty Mutual’s deep industry knowledge and engagement with experts and institutions. For example, when the CDC was drafting national guidelines to help doctors prescribe opioids appropriately, Liberty Mutual’s regional medical directors provided feedback during the comment period.

“There were two things in the initial draft that were concerning to us. One was the lack of emphasis on functionality. If opioids are not helping patients achieve functional improvement in their day -to-day lives, the risk of continuing or increasing dosages might outweigh the benefits,” said Dr. Craig Ross, Regional Medical Director, Liberty Mutual. “We were also concerned about the combination of opioids with benzodiazepines, which significantly increases the risk of overdose.”

“Both of these issues were addressed in the final guidelines, and we were able to quickly incorporate these guidelines into our claims framework to help mitigate opioid misuse and abuse,” stated Dr. Ross.

A Data-Driven Approach to Flagging Risk

Liberty Mutual also focuses on early intervention and communication. Identifying high-risk claims early on is key to protecting employees from opioid dependence. The company’s analytics team uses a data-driven approach to flag these cases. Often, the psychosocial factors of a claim provide good indicators of whether an injured worker is at increased risk for drug dependence.

In addition, the company’s pharmacy benefit management partner helps provide a complete view of an employee’s opioid use by monitoring overall dosage. Liberty Mutual can also track physician prescription patterns and identify those who may be prescribing too early or frequently.

Conversations from the Start

“If an injured worker is prescribed an opioid, the claims handler receives a system alert to review the prescription,” McCarthy said. “The next step is to reach out to the treating physician and to connect with one of our nurses or regional medical directors for a strategy consult.”

“We train our claims handlers to ask questions,” Dr. Ross said. “If the prescription doesn’t adhere to the CDC guidelines, why not? Is it improving functionality? If not, can we explore some alternative treatment options?”

Relaying that information and guidance to an injured worker is delicate and nuanced. Every patient’s case, personality, and disposition is different. It’s important to make complex medical information simple. Because Liberty Mutual equips its claims handlers with strong client relations skills, they are able to explain to patients why their prescriptions may not be appropriate for them.

Applying the Claims Framework to Medical Marijuana

The Liberty Mutual claims management framework – evidence-based treatment, proactively identifying high-risk cases, engaging providers and patients early and often– can be applied to any emerging risk, including medical marijuana.

While not yet common in workers’ comp cases, medical marijuana is likely to gain popularity as more states pass laws that legalize use.

“There is little evidence that medical marijuana is an effective treatment for workplace injuries,” Dr. Ross said.

Liberty Mutual’s claims team carefully monitors the legal and regulatory environment in each state. “As part of our approach, if an injured worker asks to be reimbursed, we hold a roundtable discussion with the claims team, legal team, and a regional medical director to determine if it’s the most appropriate path,” Dr. Ross said.

The top concern for employers is that medical marijuana will impede a worker’s ability to do his or her job, potentially resulting in injury to themselves or to coworkers, or property damage.

“We work with employers on a case-by-case basis to determine the exposure and work within the confines of their workplace safety programs and policies,” McCarthy said.

While the use of medical marijuana is still in its infancy in workers’ comp, Liberty Mutual’s problem-solving framework helps businesses tackle changes as they come, always pursuing the best outcomes for injured workers.

To learn more, visit libertymutualgroup.com/workerscomp.

1 https://www.cdc.gov/drugoverdose/data/overdose.html

2 http://helioscomp.com/insights/influence/opioids

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with Liberty Mutual Insurance. The editorial staff of Risk & Insurance had no role in its preparation.