2017 Teddy Awards

The Era of Engagement

Employee engagement, employee advocacy, employee participation — these are common threads running through the programs we honor this year in the 2017 Theodore Roosevelt Workers’ Compensation and Disability Management Awards, sponsored by PMA Companies.

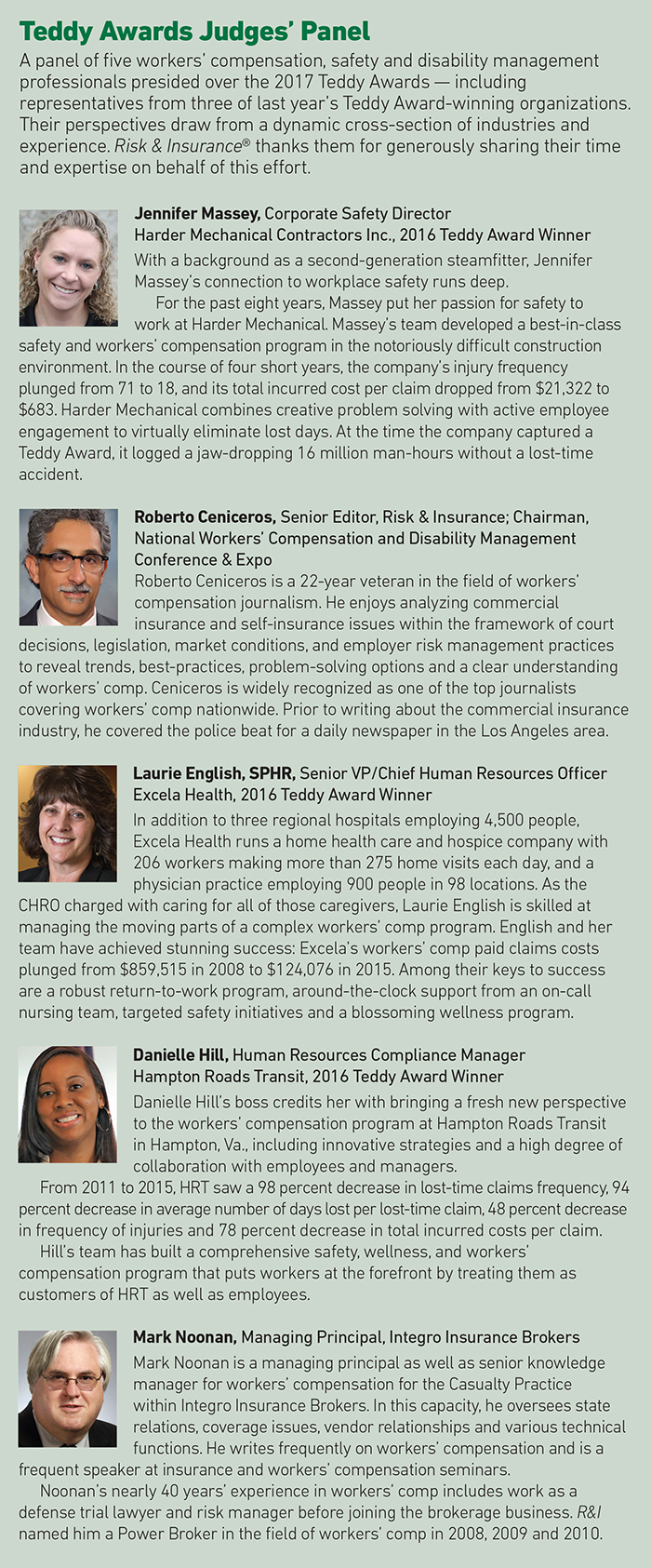

A panel of judges — including workers’ comp executives who actively engage their own employees — selected this year’s winners on the basis of performance, sustainability, innovation and teamwork. The winners hail from different industries and regions, but all make people part of the solution to unique challenges.

Valley Health System is all-too keenly aware of the risk of violence in health care settings, running the gamut from disruptive patients to grieving, overwrought family members to mentally unstable active shooters.

Valley Health employs a proactive and comprehensive plan to respond to violent scenarios, involving its Code Atlas Team — 50 members of the clinical staff and security departments who undergo specialized training. Valley Health drills regularly, including intense annual active shooter drills that involve participation from local law enforcement.

The drills are unnerving for many, but the program is making a difference — the health system cut its workplace violence injuries in half in the course of just one year.

“We’re looking at patient safety and employee safety like never before,” said Barbara Schultz, director of employee health and wellness.

At Rochester Regional Health’s five hospitals and six long-term care facilities, a key loss driver was slips and falls. The system’s mandatory safety shoe program saw only moderate take-up, but the reason wasn’t clear.

Rather than force managers to write up non-compliant employees, senior manager of workers’ compensation and employee safety Monica Manske got proactive, using a survey as well as one-on-one communication to suss out the obstacles. After making changes based on the feedback, shoe compliance shot up from 35 percent to 85 percent, contributing to a 42 percent reduction in lost-time claims and a 46 percent reduction in injuries.

For the shoe program, as well as every RRH safety initiative, Manske’s team takes the same approach: engaging employees to teach and encourage safe behaviors rather than punishing them for lapses.

For some of this year’s Teddy winners, success was born of the company’s willingness to make dramatic program changes.

Delta Air Lines made two ambitious program changes since 2013. First it adopted an employee advocacy model for its disability and leave of absence programs. After tasting success, the company transitioned all lines including workers’ compensation to an integrated absence management program bundled under a single TPA.

While skeptics assume “employee advocacy” means more claims and higher costs, Delta answers with a reality that’s quite the opposite. A year after the transition, Delta reduced open claims from 3,479 to 1,367, with its total incurred amount decreased by $50.1 million — head and shoulders above its projected goals.

For the Massachusetts Port Authority, change meant ending the era of having a self-administered program and partnering with a TPA. It also meant switching from a guaranteed cost program to a self-insured program for a significant segment of its workforce.

Massport’s results make a great argument for embracing change: The organization saved $21 million over the past six years. Freeing up resources allowed Massport to increase focus on safety as well as medical management and chopped its medical costs per claim in half — even while allowing employees to choose their own health care providers.

Risk & Insurance® congratulates the 2017 Teddy Award winners and holds them in high esteem for their tireless commitment to a safe workforce that’s fully engaged in its own care. &

_______________________________________________________

More coverage of the 2017 Teddy Award Winners and Honorable Mentions:

Advocacy Takes Off: At Delta Air Lines, putting employees first is the right thing to do, for employees and employer alike.

Advocacy Takes Off: At Delta Air Lines, putting employees first is the right thing to do, for employees and employer alike.

Proactive Approach to Employee Safety: The Valley Health System shifted its philosophy on workers’ compensation, putting employee and patient safety at the forefront.

Proactive Approach to Employee Safety: The Valley Health System shifted its philosophy on workers’ compensation, putting employee and patient safety at the forefront.

Getting It Right: Better coordination of workers’ compensation risk management spelled success for the Massachusetts Port Authority.

Getting It Right: Better coordination of workers’ compensation risk management spelled success for the Massachusetts Port Authority.

Carrots: Not Sticks: At Rochester Regional Health, the workers’ comp and safety team champion employee engagement and positive reinforcement.

Carrots: Not Sticks: At Rochester Regional Health, the workers’ comp and safety team champion employee engagement and positive reinforcement.

Fit for Duty: Recognizing parallels between athletes and public safety officials, the city of Denver made tailored fitness training part of its safety plan.

Fit for Duty: Recognizing parallels between athletes and public safety officials, the city of Denver made tailored fitness training part of its safety plan.

Triage, Transparency and Teamwork: When the City of Surprise, Ariz. got proactive about reining in its claims, it also took steps to get employees engaged in making things better for everyone.

Triage, Transparency and Teamwork: When the City of Surprise, Ariz. got proactive about reining in its claims, it also took steps to get employees engaged in making things better for everyone.

A Lesson in Leadership: Shared responsibility, data analysis and a commitment to employees are the hallmarks of Benco Dental’s workers’ comp program.

A Lesson in Leadership: Shared responsibility, data analysis and a commitment to employees are the hallmarks of Benco Dental’s workers’ comp program.