Marijuana liability

The Contradictions of Marijuana

It’s an industry that could soon be worth upwards of $40 billion per year, yet its key participants can’t get hold of either a bank loan or a credit card. Welcome to the paradox that is the legal marijuana business.

Marijuana (cannabis) is a divisive substance; scourge of society and red hot investment; illicit high and essential medication; crime and cure. Whatever your opinion, the drug is already big business, and on the cusp of even bigger things.

“This is a murky and historic time period,” said Steve Gormley, chief business development officer at OSL Holdings, which offers financial management and financing for cultivators and dispensaries of legal marijuana across the United States.

“Just like the alcohol industry three or four years before prohibition was repealed, there are potentially enormous rewards, but without federal backing there is a higher risk level,” he said.

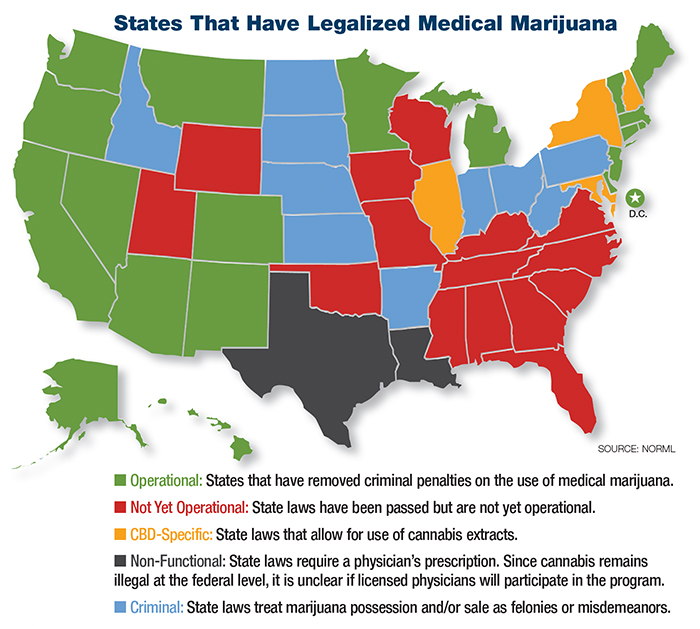

It’s already legal to cultivate and sell marijuana for medicinal purposes in 27 states, and for recreational use in four plus the District of Colombia. Yet at the federal level, the drug is still rated as a Schedule I illegal substance, alongside the likes of heroin and cocaine.

But Gormley believes that with more than half of states permitting some kind of legal trade and 11 more likely to follow suit in the very near future, the tipping point has been reached, and decriminalization is “inevitable” in the next five to seven years.

Barred from Banking

Until that day comes, cultivators, dispensaries and other marijuana businesses find themselves cut off from the banking system. Funding the production and sale of a Schedule I drug, regardless of its legality in certain states, skirts too dangerously close to money laundering for any mainstream banks to go near the industry.

Credit unions offer one source of finance, while companies like OSL also attract investment from high net worth individuals and other investors with the appetite for high risk, high reward opportunities. But on a day-to-day basis, many marijuana cultivators and dispensaries have little choice but to operate as cash businesses, escalating the risk of theft.

“These operators can be carrying tens of thousands of dollars in cash and product, and the location of facilities is made public by the states, adding to the risk,” said Matt Gunther, an insurance agent at Seattle-based specialist broker Cannarisk.

Gunther noted, however, that recent legislation in some states will now permit third-party vendors to offer armored transportation services, reducing the risk of theft and allowing cultivators to transfer some risk to the security firms.

Gormley said that the absence of banks could also present some operators with problems when it comes to selling their businesses to acquirers after years of self-reporting.

“In a cash-only environment, states in which marijuana is legal have to rely on the retail operators and cultivators to report their own earnings and furnish sales receipts. Underreporting of revenue is common, but some operators who may want to go corporate in the future might not have accurate sales figures to create

stable valuation metrics for their potential acquirers,” he said.

“More savvy operators who have a view on being acquired by a major multinational and developing a brand need to follow the letter of the law and pay their taxes so that they are in a position to present a genuine valuation on their business.”

The risk landscape will improve significantly for marijuana businesses if and when the drug is eventually downgraded to Schedule II.

“Just like the alcohol industry three or four years before prohibition was repealed, there are potentially enormous rewards, but without federal backing there is a higher risk level.” – Steve Gormley, chief business development officer, OSL Holdings

“That’s when banks and institutional money will come off the sidelines in the U.S. and invest directly in retail cultivation, where all the money is,” said Gormley. “The floodgates will open and the banks will be in a mad dash to get involved. It’s a huge business and they are all investigating how to position themselves to capitalize on a nascent industry — a Greenfield, if you pardon the pun.”

Insurance Challenges

But it’s not just banks that have so far steered clear of the sector. While a handful of insurance carriers do service the legal marijuana sector (and the number is slowly growing) the majority of major insurers do not. And industry insurance buyers were dealt a blow in May of this year when the Lloyd’s market — until recently a key provider of specialist coverage for the sector — instructed its underwriters to cease insuring the industry until marijuana is decriminalized at the federal level.

The market’s self-imposed ban is comprehensive, extending to crop, property and liability cover for those who grow, distribute or sell any form of marijuana, as well as cover for banking or related services provided to these operations.

A Lloyd’s spokesperson told Risk & Insurance® that as long as marijuana is listed as a Schedule I drug under U.S. federal law, Lloyd’s is concerned about impeding federal anti-money laundering (AML) laws, adding: “Lloyd’s will continue to monitor developments under U.S. law and will reconsider this position if and when the conflict of laws is resolved.”

Insurers are also wary of the lack of loss data and legal precedents stemming from the marijuana business. “In other industries, insurance agents create risk management strategies to properly indemnify their clients from loss interpreted and measured in case law. Marijuana commerce-related risks are completely unchartered with no precedent,” said Gunther.

“Marijuana commerce-related risks are completely unchartered with no precedent.” — Matt Gunther, insurance agent, Cannarisk

From heightened theft risk to public health concerns, there is little or no loss history in the marijuana industry, and insurance buyers are at the mercy of a small band of wary, first-mover insurers offering limited capacity, low limits, high deductibles and inflated premiums.

The lurking giant of a risk that scares insurers the most, Gunther said, is the public liability risk posed by carcinogens. While both medical and recreational marijuana must undergo extensive testing before being cleared for human consumption in states in which the drug is legal, Gunther said the industry has “all the right variables in place for class-action lawsuits.”

“There don’t seem to be clear studies on whether years of consumption can lead to lung cancer or inhalation diseases of some sort. With legal structures in place, plants are tracked from seed to sale, and it is easy to find where a certain plant was produced.

“Information is public so law firms could easily collect the necessary statistics they need to file a class-action lawsuit — it could be the tobacco industry all over again, but without the hoops of filing subpoenas to do so,” he said.

Gunther noted that some of this risk is transferred from cultivators to the third-party laboratories tasked with carrying out the tests on marijuana products, but the potential for laboratories to make mistakes still exists and the industry as a whole is potentially exposed.

“Getting insurers to provide product liability coverage has been extremely difficult. The policies aren’t priced as accurately as they probably could be, but we don’t expect them to be with uncertainty over what the loss future entails,” he said.

“Marijuana businesses will continue to pay higher premiums until losses and precedents become more established.”

Weed and the Workplace

Workers’ compensation coverage is also proving elusive for many cultivators due to the high perceived risk of explosion at certain facilities.

“Here in Washington State, we have a state-funded workers’ compensation system, but finding private sector carriers in other states who accept workers’ compensation has been one of our biggest challenges,” Gunther said.

While the cultivation of cannabis plants carries no more risk than most manufacturing endeavors, the extraction of chemical concentrates can be dangerous if done with butane-powered machinery, he said. The risk of explosion can, however, be mitigated or reduced by using alternative fuels such as CO2 or solvent-free means, as well as by implementing proper ventilation and safety protocols.

The problem for insurers, said Gunther, once again lies in a lack of loss data.

“[Insurers] may be influenced by what they learn from the hysteria-leaning media, which isn’t always the facts. But there is a big opportunity for workers’ compensation carriers to come into this industry and we wish they would do so more aggressively,” he said, adding that private sector carriers could potentially learn more about these risk exposures through collaboration with state-funded insurers.

Indeed, as more is learned about marijuana risks and more carriers enter the market, conditions should improve for cultivators and dispensaries, but education is vital, and brokers and the marijuana companies themselves both have a role to play.

If Gormley is correct, and federal legalization is an inevitability, it won’t be long before the banks open their doors to the sector, and insurers won’t be far behind.

“Lloyd’s’ exit certainly hasn’t held back other carriers,” said Gunther. “A handful do exist and more are entering the arena. It is just a matter of time.”