Property Risk

That Sinking Feeling

Whether you buy into prevailing theories on climate change and mankind’s influence on the environment or not, few deny that human action is exacerbating a worrying trend of land subsidence.

Groundwater extraction diminishes subterranean water levels and is thought to be playing a major role in the sinking of land in locations around the globe, including the U.S.

In its most extreme form, subsidence can lead to building collapse or the formation of sinkholes, which can result in total property losses and casualties. But a much bigger, quieter concern is the gradual sinking of coastal cities, which in combination with accelerating sea level rise (SLR) is putting billions of dollars of property at risk.

Some experts warn that more commercial properties than we think may be exposed to flooding and structural damage in the event of storm surge.

Storm surges are becoming more violent, and urban development is robbing rain and floodwater of natural drainage routes while insured values continue to rise. Some experts warn that more commercial properties than we think may be exposed to flooding and structural damage in the event of storm surge.

“These risks are significant and carry the potential for large claims,” said Mark Way, head of sustainability, Americas, for Swiss Re, whose “2015 SONAR Report” highlighted soil subsidence as an “underestimated risk” not adequately factored into many CAT models and property insurance portfolios.

“It’s not potential sinkholes that keep risk managers awake at night — it’s the potential for 10 or 15 feet of flood water,” said Lou Gritzo, vice president at research-based insurer FM Global.

But it’s not just property at risk. The hidden danger lies in the potential impact on supply chains, he said.

“Risk managers should think about where their products are coming from and have a contingency plan in place in case a storm affects one of their supplier’s locations or a port their supplies are coming through.”

With U.S. businesses increasingly globally connected, this is a pertinent point.

Way noted that in some parts of the world, cities are sinking 10 times faster than sea levels are rising — Thailand has sunk over three feet since the 1970s; Jakarta may be the fastest sinking megacity, having sunk more than 12 feet in 35 years; while in France, subsidence-related losses have increased by more than 50 percent in the two decades prior to 2011, he said.

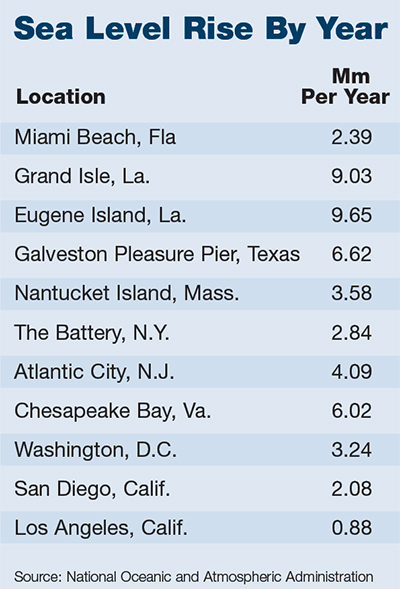

Yet, American risk managers are, on the whole, relatively ill-informed on the creeping effects of land subsidence and SLR, which can vary significantly depending on location. Hotspots in the U.S. include areas with significant coastal infrastructure such as New Orleans, New York, New Jersey, D.C.-Virginia, and parts of Florida and Texas.

Yet, American risk managers are, on the whole, relatively ill-informed on the creeping effects of land subsidence and SLR, which can vary significantly depending on location. Hotspots in the U.S. include areas with significant coastal infrastructure such as New Orleans, New York, New Jersey, D.C.-Virginia, and parts of Florida and Texas.

“There is still a relative lack of awareness of the scale of the problem among businesses – even those operating in areas where there could be substantial risk,” said Ray Monteith, senior vice president of HUB International’s risk services division.

“SLR and land subsidence are relatively slow onset events, measured in incremental changes. There is a tendency for this kind of risk to creep up on people, and there is a failure to act.”

Florida-based Andrew Kiernan, senior director of captive services at Franklin Street, noted that his home state has a high concentration of wealth built not on rock, but sand.

“People continue to build right up to the water’s edge,” he said. “Miami Beach has extremely tall condos containing levels of multimillion dollar units on a sandbar that may not have existed 300 years ago. Palm Beach exists on a sandbar measured not in miles, but yards.”

“It is hard to quantify future risk because we can’t predict the level of future development and subsequently changes in exposed values. Similarly there is some uncertainty in the rate of change to the hazard.” — Andy Castaldi, head of catastrophe perils, Americas, Swiss Re,

Andy Castaldi, head of catastrophe perils, Americas, for Swiss Re, agreed that short term thinking is blinding people to the potential long term consequences.

“It is hard to quantify future risk because we can’t predict the level of future development and subsequently changes in exposed values. Similarly there is some uncertainty in the rate of change to the hazard,” he said.

“Nevertheless, we are aware of it and are trying to educate civil planners to think about the risk 10, 20 or 50 years down the road. You can’t build for today without thinking about tomorrow.”

Recent storm and flood catastrophes have at least prompted many businesses in areas with heightened flood risk to take defensive measures such as moving data and other valuable assets above ground level. The floodwall business is also booming in Florida in particular, Kiernan said.

Invisible Threat

While brokers and insurers may help companies identify potential risks and mitigation measures, SLR and subsidence are largely ignored as far as property insurance coverage is concerned.

“As of yet, the washing away of foundations is hardly factored into underwriting pricing — people worry more about glass windows and roofs,” said Kiernan.

Monteith said there may be “significant challenges” in obtaining flood coverage for damages related to the slow onset of SLR and subsidence as there would be no clear flood “event” to account for the loss.

“This is something any business owner should be aware of and speak to their insurance representatives about,” he said.

Kiernan explained, however, that the inclusion of “earth movement” rather than “earthquake” in policy wordings is a key differentiator. Earth movement covers a broad range of perils, including sinkholes and land subsidence, whereas earthquake covers only losses from tectonic shifts — a small but vital consideration if a property is to be covered against the potential effects of SLR and subsidence.

“It is important to make sure your policy is clear on what it does and doesn’t cover — for example, earth movement or earthquake cover. Are you clear on what the differences are? You better be,” said Duncan Ellis, Marsh’s U.S. property practice leader.

Gritzo urged risk managers to “double and triple check” the scope of their property coverage.

“Sit down with your insurer and throw out some scenarios — ‘What happens if a storm comes through and washes 10 feet of water into my building? What is covered and what isn’t?’ Those are great questions.”

Ultimately, the best defense is for property owners to take ownership of their risk management — from ensuring the right due diligence is conducted prior to developing land or purchasing a property (flood risk information should be obtainable from either local, regional or national government agencies, for example), through to bolstering physical flood defenses.

“We urge business owners to take control of their own destiny,” said Gritzo. “There are more certified physical loss prevention products out there to keep water out of your building than ever before, and we can thank Superstorm Sandy for that — it motivated manufacturers to come up with new innovative solutions.

“We recommend putting defenses up to the 500-year flood level — there is a 0.2 percent probability of this occurring each year. At the minimum, you should have a response plan. It doesn’t take long to put one together and every company should have one.”

In 50 years, cities like Miami and New Orleans could look very different than they do today.

Lawmakers and developers would be foolish to ignore SLR and subsidence when building coastal centers, and there is no time like the present for risk managers to begin taking steps to minimize their exposure.