Medical Management

Telemedicine Growing But Obstacles Remain

As Concentra moves forward with an aggressive effort to provide telemedicine services for treating occupational injuries nationwide, it is uncovering limits imposed by existing state workers’ compensation regulations.

Those limits raise due-diligence considerations for anyone weighing the implementation of telemedicine programs providing treatments, such as first doctor visits following a workplace injury and follow-up exams.

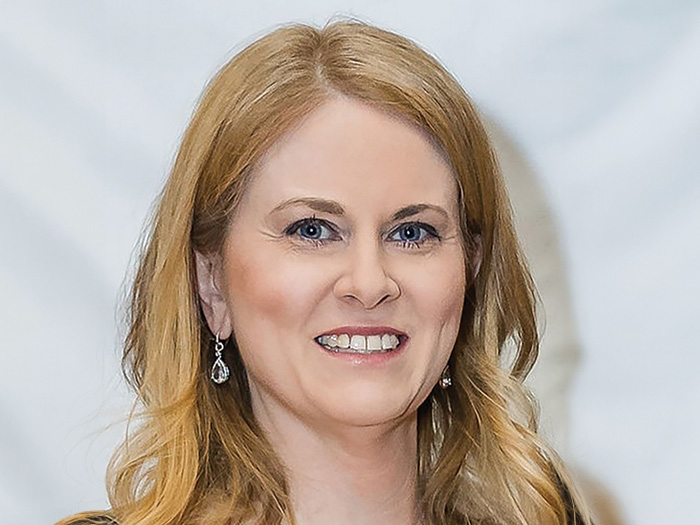

Telemedicine holds great promise for providing such injured-worker care and is poised to expand significantly. But an array of established workers’ comp laws and regulations are slowing its advance into some jurisdictions, said Ann Schnure, VP of Concentra Telemedicine.

In some states, laws remain silent on treating worker injuries through telemedicine. But given a strong interest in telemedicine, the potential for laws to emerge in those states must be considered. That potentially creates risks for implementing telemedicine systems before knowing what parameters such regulations could bring, she added.

“You are making a risk decision going forward in a state that says ‘we are going to make regulations, we just haven’t written them yet,’ ” said Schnure, who is passionate about telemedicine’s potential.

Concentra, a national employee healthcare provider, currently offers telemedicine occupational injury treatment in California and will soon launch those services in Illinois, Michigan, and New Mexico. It expects to add many more states to its roster after that.

In attempt to spread Concentra’s workers’ comp telemedicine offerings into additional jurisdictions, Schnure is methodically discussing each state’s existing regulatory environment with their workers’ comp regulators.

Despite existing impediments, Schnure expects state laws will evolve to favor telehealth. But it could be a few years for that to occur nationwide. Meanwhile, she believes moving forward requires careful due diligence, as she has found a few states where it is not yet a good idea to implement telemedicine.

“I think telemedicine is game changer,” she said. “ But you can’t [instantly] turn the switch on. You have to really think through what you are doing and what state you are in.”

Jill Allen, president and CEO of Consumer Health Connections, said that amid recent legal and regulatory advancements, every state now allows for telemedicine.

“Telemedicine in the last year and a half has been very widespread and very accepted,” Allen said. “There is nothing saying you can’t do this in workers’ compensation. It is very favorable.”

Actual implementation of workers’ comp telemedicine systems, however, has moved slowly. But it is expected to accelerate in 2018 and into 2019, said Allen, whose company provides telehealth solutions.

“I think 2018 we are going to see a massive uptick [in workers’ comp]. The interest is enormous with payers and employers asking how do I get it implemented.” — Ann Schnure, vice president, Concentra Telemedicine

Schnure also believes 2018 will be a year of rapid growth, especially with telehealth’s expanding adoption for non-occupational health care treatment.

“It really is exploding,” Schnure said. “I think 2018 we are going to see a massive uptick [in workers’ comp]. The interest is enormous with payers and employers asking how do I get it implemented.”

While state laws may not specifically prohibit telemedicine’s application in workers’ comp there are, however, other existing regulations that can be impediments in some states, Shnure said.

Some states, for example, require a “wet signature” for documents the injured worker and treating physician must complete . An electronic signature is not allowed, defeating telemedicine’s promise of eliminating employee travel for doctor visits.

While discussing the current regulatory environment with Washington officials, as another example, Schnure said she learned that the state’s workers’ comp code requires a medical report completed by a doctor who conducted a “hands-on” physical exam.

In other states, fee schedules have yet to include modifier codes for billing telemedicine services. Does that mean such treatments will be considered “unapproved care?”

There are other areas of uncertainty. California, for instance, does not currently have regulations stipulating whether specific requirements exist when using medical provider networks and telemedicine.

Regulators in states where such ambiguities exist are often helpful and will provide advice on what they think eventual regulations may say. But that is not the same as having regulations in hand.

New regulations, meanwhile, may emerge in other areas of workers’ comp telehealth services.

So far, most states have been silent on the application of physical therapy services known as Telerehab, said Mary O’Donoghue, chief clinical and product officer at MedRisk, which offers the services nationwide, but currently provides them in six states.

Few limitations for telerehab’s application for workers’ comp treatments exist. But regulatory rigor will likely follow an increased used in the services, O’Donoghue added.

“I think over time that will change,” she said. “As the volume increases I think there will be more regulations making sure there are certain things in place, like making sure you have HIPAA-compliant technology.”

That assessment, though, implies that the telerehab use will expand. &