Cover Story

SANDY: One Year Later

A year after a storm bigger than the country of Mongolia hammered the northeastern United States, many commercial clients are still slogging through the claims adjustment and review process.

But for all of the complexities and intricate calculations required, the outlook is mostly sunny. That’s a good thing because Superstorm Sandy “is not a freak event by any means,” said Claire Souch, vice president of Model Solutions, Risk Management Solutions (RMS).

In fact, in the future, she said, “there could be more severe storms than Sandy hitting the northeastern U.S.”

As risk managers continue to crunch numbers, agonize over policy terms and negotiate their way through the claims adjustment process, they should also make sure to acknowledge shortcomings in disaster planning and risk transfer strategies.

As always, too many organizations did not protect themselves from flooding, thinking their properties were immune. That came back to haunt many of them.

“Business entities should not look at insurance as their only way to plan for what happens if there is a natural disaster,” said Marty Frappolli, senior director of knowledge resources at The Institutes, a nonprofit educational organization that provides professional development and research for the insurance industry. “They should have an enterprise risk management approach, or an agent or broker should serve in the risk management role.”

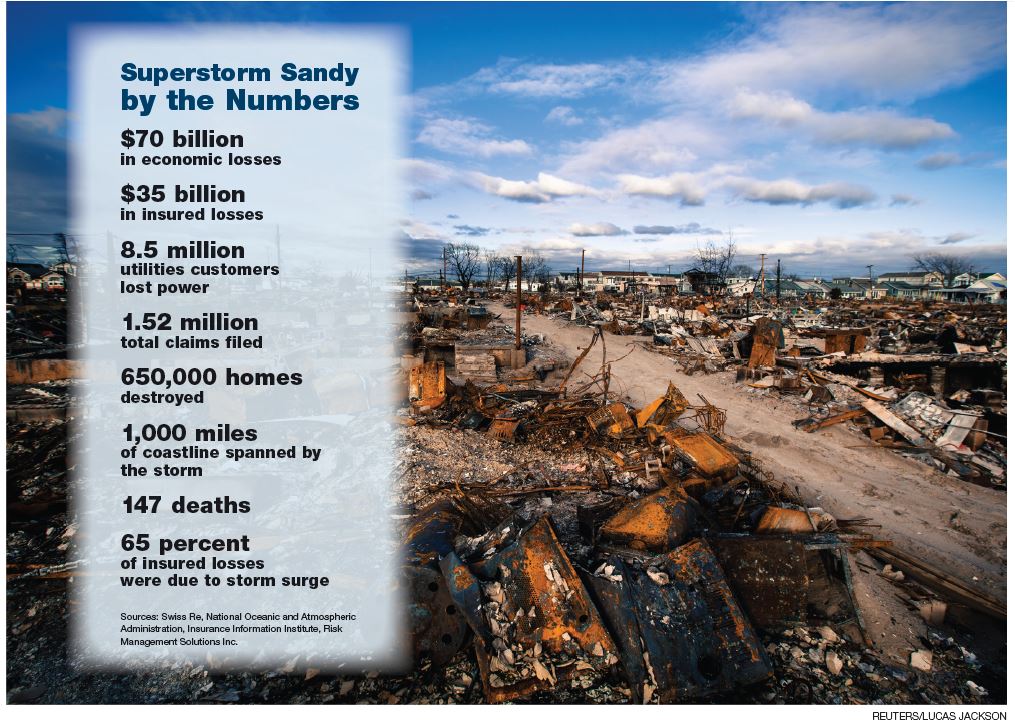

Superstorm Sandy, which remained at hurricane strength until just before making landfall near Brigantine, N.J., about 7:30 p.m. on Oct. 29, was close to 1,000 miles in diameter, according to the National Oceanic and Atmospheric Administration (NOAA). While the effects were felt as far west as Wisconsin — and resulted in blizzards in some areas — the states most affected were New York and New Jersey.

Total economic losses have been estimated at up to $70 billion or higher, with insured losses between $25 billion and $35 billion. Souch said about 65 percent of the insured losses were due to surge-related flood damage, with the remainder caused by wind-related damage.

But nothing is simple when adjusting property, business interruption or contingent business interruption claims, particularly in this situation, when the affected geographic area was so large.

A business could have multiple locations and each location could have been affected in one or different ways — flood, water, power outage, evacuation orders, ingress/egress — and that’s before determining whether coverage was triggered and what sublimits, deductibles and waiting periods applied.

“You have all of these different factors applying on a massive scale, all at the same time,” said John Shugrue, an attorney and partner with Reed Smith. “And the larger the claim, the more likely it is to be resisted by insurers. It’s sort of the law of large numbers.”

For all of the immensity of the damage, it’s important to remember that it was insurance professionals who were the “second responders,” Frappolli said.

“First responders get a lot of praise and attention for putting their lives on the line during a disaster,” he said. “But the very next day, insurance people with water, meals, supplies and checkbooks start to provide the grease to the economic engine.”

Insurers sent in tens of thousands of adjusters and experts to “get a jump start on claims,” he said. Liberty Mutual, alone, assigned 18,000 employees to respond to Sandy.

Claims Surge to 1.52 Million

The catastrophic commercial losses from Sandy were not all that different than the losses sustained in hurricanes Katrina or Ike. What was different was that New Yorkers just don’t expect hurricanes to hit their businesses or homes the way residents in Florida or North Carolina do.

“The Northeast region is not accustomed to handling property claims [resulting from named windstorms], even though they did get somewhat of a wake-up call with Hurricane Irene,” said Clark Schweers, principal and lead, Insurance Claims Service Practice in the United States for BDO Consulting.

“Sandy was a different scale,” he said. Plus, the Northeast is denser, with both people and buildings, than further south. That ratcheted up the difficulty in preparing for the storm and in responding to it.

More than 1.52 million total claims were filed for losses resulting from Sandy, according to the Insurance Information Institute (III) and Property Claim Services (PCS). About 13 percent were from commercial clients, which accounted for 48 percent of the insured dollar losses.

III reported that 93 percent of all claims had been settled by the six month anniversary of the storm.

“By and large, the vast majority of these claims, they were filed, they were settled and they were closed,” said Robert Hartwig, an economist and president of the III.

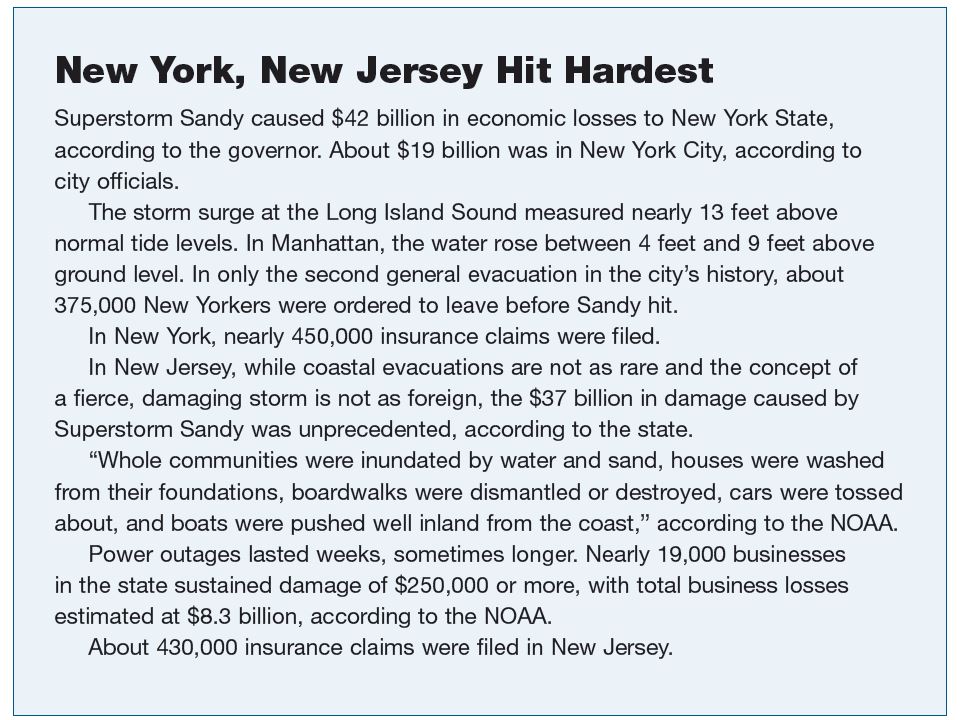

In just New York and New Jersey alone, nearly 880,000 insurance claims were filed. About 36 percent of commercial claims filed in New Jersey were closed without payment. New York does not keep separate numbers for business or personal claims. In all, 19 percent of New York’s total claims were closed without payment.

Bill Krekstein, an attorney and partner at Nelson Levine de Luca & Hamilton, said the interactions between insureds and insurers have been mostly positive.

“It appears most people would tell you the majority of insurance claims are going pretty smoothly,” he said. “I think carriers are stepping up. They are being very proactive in the adjustment process.”

Obviously, the first step was establishing the cause of loss. It may sound simple, but it’s not.

“The term that really bubbled up was ‘storm surge,’ ” said Frappolli. Surge is defined as rising ocean water driven by wind, so is it a flood event or a wind event?

“The insurance carriers,” said Al Tobin, national property practice leader at Aon Risk Solutions, “very much tried to push ‘surge’ into the definition of flood. … They were not as successful as they would have liked to have been, so ‘surge’ still remains in windstorm for key customers.”

Concurrent Damage

Then, there is the question of whether coverage is triggered when damage is caused by a combination of wind and flood. That’s when a policy’s “anti-concurrent causation” (ACC) exclusion plays a big role in determining whether a payout will be forthcoming.

Say an insured has coverage for wind damage but not for flood damage — and it suffered both wind and flood damage. The ACC clause will exclude the loss, in whole or in part, because the act occurred concurrently with the excluded act of flooding.

For example, when New York companies lost power after a lower Manhattan substation of the city’s utility ConEd exploded on Oct. 29, their coverage may have depended on the cause of that explosion, said Reed Smith’s Shugrue.

If the power failure was caused by flooding that resulted in arcing, then a company’s business interruption coverage, as well as the sublimits or deductibles that would apply, may depend on its flood coverage, he said. If it was caused by an explosion or mechanical failure, the coverage situation may be quite different.

The ACC exclusion, said Finley Harckham, an attorney and partner with Anderson Kill, has generally been upheld in New York courts.

“In New Jersey, it’s still an open issue,” he said. “That’s one component issue that will have to be resolved by the New Jersey Supreme Court so people will know if they have coverage when flood may have played a role, but was not the sole cause of their loss.

“We are seeing a lot of disputes, and some litigation, over policies which provide separate coverages, limits and deductibles for named storm and flood.

“The policyholders expect to be entitled to the most coverage available under both of those perils for Sandy losses, while the insurers try to limit coverage to the greatest extent possible under those clauses,” he said.

Harckham said he has seen fewer contested claims resulting from Sandy than from previous catastrophic events such as Katrina, but “I wouldn’t say the process is necessarily going smoothly.”

Many insureds whose claims were denied had electrical systems, HVAC machinery, computer hardware and other critical infrastructure in building basements.

“A lot of buyers who had buildings in flood zones were very upset about that,” said Tobin, noting that many organizations since then have made plans to move their equipment to higher levels. New York building codes may actually make that a requirement in the future.

It wasn’t just mechanical equipment that was damaged in basements. One insurer filed suit on behalf of a client against Christie’s Inc., claiming the well-known auction house left more than $1.5 million in artwork exposed to flooding on the ground floor of a warehouse in Brooklyn.

Organizations also suffered unrecompensed losses because their employees or customers just couldn’t get to the area because roads or tunnels were closed, access was denied or gasoline was nearly impossible to get.

Physical damage is generally needed to trigger business interruption coverage, said Sheri Wilson, National Property Claim director at Lockton.

“I think there was a lot of exposure to companies that was just not insured,” she said. “It was not insured and it wasn’t insurable.”

One of the peculiarities of the storm hitting the Northeast, said BDO Consulting’s Schweers, is that the commercial organizations affected were predominantly retail or service establishments, which are “not as attuned to having these types of losses,” as manufacturing or tourism operations in the Southeast.

Plus, trying to determine the coverage and losses for as many as several thousand different locations is a huge undertaking. Just some of the questions that need to be answered for each individual location are whether the losses were due to flood, wind, power outages, evacuation orders, or inability to get supplies or even get to the business location, he said.

“To try to tell the story of each individual location, when you have so many properties impacted, can be very, very difficult and it takes time to gather that information,” Schweers said.

Establishing the period of restoration to bring the property to its pre-loss condition is also a potential dispute between insureds and carriers, Krekstein said.

“In a lot of these cases, you need a forensic accountant [to determine the loss],” he said. “Generally, only a small percentage of cases ever go to trial.”

In some states hit by Sandy, policyholders are usually required to institute legal proceedings within 12 to 24 months, so it’s not unusual that the courts have not seen a surge of lawsuits thus far. That’s not to say litigation is nonexistent, however.

In the Courts

As always, when insurance disputes hit the courts, decisions often turn on the choice of words used in policies, the definitions of those words and the relationship of various concepts found throughout the policy forms.

In one case, Fisker Automotive Inc. settled its $32 million lawsuit with XL Insurance America over the loss of 338 hybrid electric vehicles that were damaged at a Port Newark, N.J., facility. Before the settlement, Fisker argued the claim involved a loss in transit, as many of the cars were to be delivered to dealerships.

The insurer argued Fisker had no transit coverage, and the claim was limited to $5 million, at most, because Fisker’s commercial property policy had a transit sublimit. Fisker argued that a $100 million named storm sublimit applied. The amount of the settlement was not disclosed.

In another case, New Jersey’s utility, PSEG, filed suit against 11 insurers, claiming the carriers capped coverage at $50 million because of flood sublimits, instead of the $426 million in damage that it suffered from Sandy.

Some brokers, also, are finding their professional services questioned in legal complaints because of the wide-ranging impact of the storm. Companies, whose claims were denied, have filed suit against their brokers, claiming inadequate advice or a failure to purchase requested insurance.

“A lot of those claims,” Krekstein said, “fall back on ‘he said, she said’ types of situations, so it’s a little more fact-intensive” instead of interpreting policy language, as is common with many insurance disputes.

When it comes to contingent business interruption issues, it’s even more complex because that is a “relatively new type of coverage,” he said, that is triggered when a supplier has a loss that directly impacts the insured.

“The issue with that coverage is that there is not a lot of law on it,” Krekstein said.

Aon’s Tobin said the storm should bring “a greater awareness and greater attention to how clients buy insurance and it’s also driving significant attention for insurers on how to price the product and how much capacity they will offer, specifically for wind.”

The event has resulted in an “explosion of Cat bonds,” he said, since that’s a solution for some clients that have significant wind and earthquake limits. RMS has also been involved in a Cat bond deal for the MTA, New York’s transportation authority, which saw eight tunnels flooded and suffered about $5 billion in damage.

“It is important to remember,” Tobin said, “these Cat bond deals only work for modeled perils.”

III’s Hartwig said he believes “more businesses will start to get the message that they need to have complete and full protection against these types of events,” he said, “including flood, business interruption and, possibly, contingent business interruption coverage.”

“These are lessons very, very hard learned,” Hartwig said. “When you look at the experience of the past decade now, it’s very difficult to understand how businesses would not fully and completely insure themselves. Is coverage expensive in some areas? Yes, it is, but it is available.”

“It’s just the same lesson,” Frappolli said, “we keep learning over and over again.”