Sponsored Content by CorVel

Rx Roulette

A flurry of prescription pills – all different colors, shapes and sizes – pass across white counters. It almost looks like a blur of betting chips thrown across the slick surface. The click-clacking and pinging sounds they make as they ricochet off the sides of the metal pill counting tray create a white noise similar to that of a casino.

While it may appear to be a scene from the Vegas strip, it’s actually the high speed processing that takes place behind the counter of your neighborhood pharmacy.

A gamble, yes, but there is more than just money at stake. High speed dispensing too often comes at a risky price of compromised patient safety in exchange for maximized productivity and profits. With risks of potentially fatal drug interactions resulting from dangerous combinations, the winners and losers are differentiated by more than just a jackpot.

Risk versus Reward

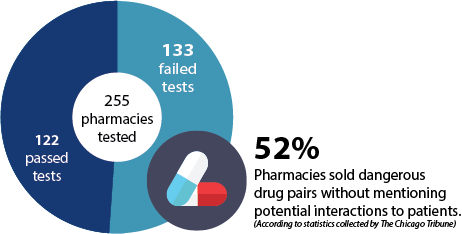

As evidenced by the Chicago Tribune’s recent study, many of today’s medication dispensing practices exemplify the need for speed to satisfy corporate productivity pressures. With success and compensation bonuses based primarily on high volume dispensing, pharmacists and staff may cut corners and compromise patient safety standards in order to meet targets.

While these targets are the focus behind the counter, the consequences for a missed alert can be staggering. Priority one should be protecting the patient, including identifying potential drug interactions. In a day-to-day battle that seems to constantly pit speed against safety, pharmacists are caught in the middle and patients are unknowingly playing a risky game of prescription roulette.

The pharmacists’ plight is not a new one. Fast paced and management free dispensing to facilitate consumer convenience and corporate production expectations fuel the multibillion-dollar pharmacy industry.

Pharmacies value high volume dispensing, and as found by the Chicago Tribune article, more than 50 percent of the time the tested pharmacies were in such a rush to dispense that they did not tell patients about potential interactions.

The Safe Bet

With patient safety being an industry priority, models that promote management, pharmacy accountability and compliance are in high demand.

A more cautious approach may be viewed as “slowing” the dispensing process, but if we apply the tortoise and the hare fable to the return to work race, safe and steady always wins. Prospectively managed medication dispensing improves compliance and patient safety and lowers pharmacy risk.

The pharmacies in the Tribune study were processing medications outside of prospective and concurrent pharmacy benefits manager (PBM) management. While internal alerts are built into pharmacy processing systems to warn pharmacists, they do not require any action. And, after so many endless, seemingly meaningless warnings, it is common for pharmacists to become desensitized. PBMs on the other hand add a second layer of safety to the dispensing process. PBM alerts require edits via overrides and phone calls. This requirement for an affirmative response disrupts the anesthetized alert fatigue and dramatically increasing pharmacist compliance.

In a prospectively managed PBM model, Drug Utilization Review (DUR) edits scan patients’ medication histories and flag unsafe drug interactions. These contraindications alert pharmacists to review each flagged medication to determine the clinical significance. Unlike the episodes detailed in the article, where the medications were processed and dispensed by the referenced pharmacies outside of PBM management, the PBM requires concurrent reviews to be performed by the pharmacist for payment.

A Sure Thing

CorVel delivers the resources to support accountable and safe medication dispensing. In addition to call centers fully staffed with CorVel associates that assist pharmacists nationwide, CorVel’s Certified Pharmacy Technicians work with pharmacies and share information with adjusters to improve decision-making, combatting the slowness that may mistakenly be associated with safety. By addressing key indicators at the front end through alerts and actionable data, prospective management promotes accuracy in concurrent interventions, ultimately driving safe pharmacy utilization practices.

At a time where risks stemming from the overuse and abuse of narcotic pain medications, and unmanaged prescription medications top payors’ lists of concerns, CorVel’s managed dispensing model holds a unique position within industry. CorVel’s process disrupts unmanaged dispensing and holds pharmacies accountable to PBM contracts.

CorVel’s program reduces risk of overdose, no risk of interacting medications and lowers the risks of opioid addiction, all of which contribute to significant savings and better care for patients. Everyone wins.