Upfront

Risk Manager Role Continues to Evolve

Too many risk managers still don’t get it.

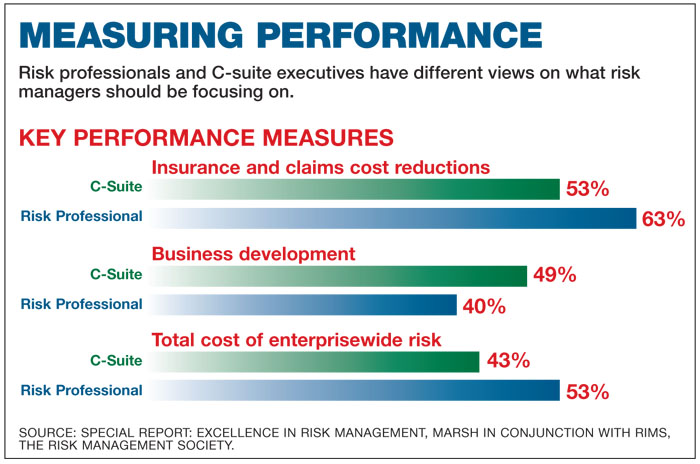

Recent surveys by Marsh and Towers Watson both suggest that some risk managers fail to connect operational risk with both performance and financial considerations.

To evolve beyond the function being seen as little more than insurance procurement, risk managers need an enterprisewide view, said Yvette Connor, director of client engagement, Marsh.

When they make decisions solely from a lens focused on differences in premium prices, they risk commoditizing their role.

When they make decisions solely from a lens focused on differences in premium prices, they risk commoditizing their role.

“That is a very limited decision-making view,” she said.

Nearly three-quarters of C-suite respondents said their organizations do not have a qualitative view of risk when making decisions around capital allocations, according to Special Report: Excellence in Risk Management, a Marsh report, produced in conjunction with RIMS.

“If an organization does not understand what risks it is willing to take, it will be difficult, if not impossible, to measure the risk itself,” according to the study.

“If an organization does not understand what risks it is willing to take, it will be difficult, if not impossible, to measure the risk itself,” according to the study.

Towers Watson’s 2013 Risk and Finance Manager Survey shows that, while 97 percent of financial services organizations had an ERM process in place, only 56 percent of non-financial services organizations did. But that’s not surprising, said Corey Gooch, senior enterprise risk management consultant, Towers Watson.

“They just don’t have the same kinds of drivers,” he said.

The chief reason cited for not having an ERM process? “According to our survey, 34 percent said that nobody has been able to articulate the value of implementing ERM to our company,” he said.

“It was kind of like spoon-feeding a baby.”

— Ellen Vinck, director, risk management and benefits, BAE Systems

During the economic slowdown, risk management departments were hit harder than some other functions because of the “difficulty in describing the value of risk management,” Connor said.

It’s up to the risk manager to rectify such a situation, said former RIMS President Ellen Vinck, director, risk management and benefits at BAE Systems, during a session at the RIMS conference in April.

She recalled one former company president who had no concept of the value of risk management. She delivered short educational snippets to him as part of her job. That worked better than a one-time, long-winded explanation, she said.

“It was kind of like spoon-feeding a baby,” she said, but he knew the importance of the function when he left.

“That is going to save you when the budget cuts come,” she said.