2018 Most Dangerous Emerging Risks

Social Media Acts as Reputation’s Existential Threat

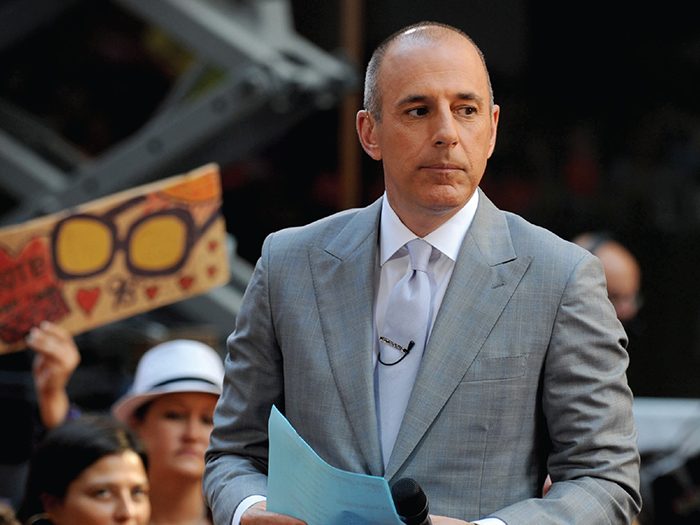

Weinstein. Spacey. O’Reilly. Lauer.

We don’t need to consult Google to know who these men are or what they’ve allegedly done. Now stitched into the very fabric of our society, the entertainment industry “elite” accused of sexual misconduct are part of the mantra of a movement to end harassment and call out others who violate trust. Their reputations are ruined.

But reputation exists outside the person; the Weinstein Company, for example, filed for bankruptcy four months after the story broke that the man in charge allegedly sexually harassed or assaulted more than 80 women during his career.

“Threats to reputation always involve anger or disappointment from stakeholders triggered by a failure to live up to expectations,” said Nir Kossovsky, CEO, Steel City Re.

Stakeholders, he said, expect companies to have systems in place that act as deterrents for bad behavior, like sexual harassment in Weinstein’s case.

The value of reputation-related claims is on the rise, too.

“Because of #MeToo and the gymnastics scandals, there is a concern that employment claim values could go up,” said Larry Reback, managing principal and leader, policy response unit, Integro Insurance Brokers, referencing the former USA Gymnastics doctor Larry Nassar, who has been convicted of serial child molestation.

Reputation risk isn’t new. But the way a business’s reputation is threatened has entered a new realm of uncertainty because of how fast information can travel. The #MeToo movement is just one example of how hundreds of thousands of people can band together globally. It acts as a reminder of just how fast a reputation can fall: reputation is now an existential risk.

The Speed of Social Media

Companies big and small can be ruined with a tweet, a like or a share.

“Reputation risk is, in part, a function of culture-linked expectations. Social media is a channel in which culture is spread. New expectations can be global in minutes. In a way, the internet has been weaponized,” said Kossovsky.

“Look at the headlines,” said Natalie Douglass, senior managing director, management liability practice, Gallagher, in regard to #MeToo.

“The Weinstein Company tried to sell its assets to avoid bankruptcy. A year ago, it was the most successful entertainment company in the world. Social media is playing the largest role. It moves fast and reaches more people in an instant.”

But with the way #MeToo has swept the country by storm, are businesses approaching reputation coverages differently?

“It’s too early to tell,” said Douglass. She added that the movement does hold the possibility to change how reputation cover is handled over time, but that would need to be monitored moving forward.

“There’s a notion that reputation risk spread through social media can descend like a tornado; one does not prepare for the tornado as it’s descending.” — Nir Kossovsky, CEO, Steel City Re

What #MeToo did do, however, was show just how fast a reputation can be put at risk. What may start off as a disgruntled post on social media can turn into hundreds of thousands of voices ringing out against someone and their business.

“#MeToo isn’t necessarily a watershed moment,” said Kossovsky. “But it forced the leadership of companies to appreciate the speed at which reputation can be threatened.”

Reputational risk has always been there, said Sandy Crystal, executive vice president, Crystal & Company, whether it be a cyber event or a product recall or #MeToo.

“In the age of social media, things happen more quickly. Social media exacerbates reputational risk,” he added.

In the last few years alone, a number of companies faced the wrath of social sharing:

After a doctor was dragged off a United Airlines flight at Chicago O’Hare International Airport, one bystander’s video of the incident surpassed four million views on YouTube. It led a number of Twitter users to spread the hashtag #BoycottUnited. Within days, the hashtag had more than 3.5 million impressions.

The modern-age taxi service Uber faced a bevy of crises in February 2017, from allegations of workplace sexual harassment to a leaked video of the company’s CEO berating an Uber driver. A survey showed that some 57 percent of rideshare users held the company in a negative light following the allegations. That same survey also showed 56 percent of users between September 2016 and March 2017 stopped using Uber because of the negative news associated with it.

Another big name affected by the speed of the internet? Wells Fargo. One scandal on top of another, from opening unauthorized credit card accounts to failing to issue refunds on policies where people paid auto loans off early, the bank is still working to rebuild its reputation.

#MeToo and these similar events placed reputation in the spotlight with a whole new force. It’s become a risk that moves so fast, it’s hard to be certain where it’s headed next.

Difficult to Cover

As an existential risk, underwriters find reputation difficult to price because of the wildly different outcomes that could arise. Defining how to put value to a company’s brand is equally as challenging. Many are hesitant to even write the risk at all.

“Underwriters need to model losses to underwrite a risk,” said Reback. He used Chipotle as an example. After numerous health-related outbreaks, including norovirus, salmonella and E. coli, the food chain suffered significant financial losses and a drop in its consumer base.

“How do you measure an organization’s reputation? Each company is different, but the consequences of a reputational event can be catastrophic. It would also likely require the participation of the worldwide insurance market for meaningful risk transfer and, right now, there aren’t a lot of markets willing to provide protection for financial loss.”

“Only a handful of insurers have been willing to cover reputation as a stand-alone policy,” said Douglass. “I don’t see that changing.”

Though some insurance products — from cyber to D&O to liability — include aspects of reputation to fill in the gaps, the lack of stand-alone policies poses an interesting challenge for risk managers to implement practices to prevent damage from spreading.

With social media, reported Forbes, it’s actually worse for a business to ignore a negative post online.

Even a simple response acknowledging a customer’s complaint is better than leaving it unanswered. A RightNow Customer Experience Impact Report found that 89 percent of consumers begin doing business with a competitor following a poor customer experience.

The same report found that half of the people surveyed only give businesses about a week to respond before they stop doing business with them. And once the social media storm begins, the stakeholders hold the power. What tends to bring a company to a grinding halt is how its stakeholders perceive a blow to reputation.

“Is it a rogue employee in a well-governed business who stepped out of line? Or is it deeper than that? Is the behavior of the person a symptom of something more systemic?” asked Kossovsky.

Waiting until a sexual harassment claim is filed or a misguided employee acts up won’t cut it; risk managers have to prepare for the worst before the worst can happen. When an issue is deeply rooted in the culture of the company, fast action to expel the behavior and the person or people behind the behavior is quickly taken.

Take Volkswagen for example. After the Environmental Protection Agency found that VW diesel engines were rigged to pass carbon dioxide emissions tests when they were not street legal, the company’s chief executive resigned within a week of the scandal coming to light.

VW also endured a company-wide internal inquiry and suffered a quarterly loss of more than $3 billion.

“This is an opportunity for risk managers to show their value to an organization. They can get involved with the board and the C-suite.” — Larry Reback, managing principal and leader, policy response unit, Integro Insurance Brokers

“The topic [of reputation] is getting a lot of attention from the C-suite and board levels,” said Reback. Despite reputation not typically being an insured risk, those in higher positions are not taking reputation risk lightly.

“The board and CEOs recognize that business reputation risk can become personal reputation risk,” said Kossovsky.

Stakeholders expect quick action to expel those in charge of a company blunder. In Weinstein’s case, a zero-tolerance policy was just one tactic used to soothe its stakeholders. But it was too little too late due to the magnitude of the allegations and how deep the behavior went.

“This is an opportunity for risk managers to show their value to an organization. They can get involved with the board and the C-suite,” said Reback.

Mitigating Reputation Risk

“A lot of the conversation surrounding reputation happens narrowly, product by product,” said Crystal. “The conversation needs to be broader.”

With the growing force that is social media, companies are cognizant of how easily their brands can fall. There are some key ways businesses mitigate reputation risk today, like company-wide training or investing in liability or D&O coverage to fill in the gaps, but this risk requires a proactive approach. Not reactive.

“There’s a notion that reputation risk spread through social media can descend like a tornado,” Kossovsky said. “One does not prepare for the tornado as it’s descending; they have to build defenses to prepare for it from the get-go.”

“#MeToo is a wake-up call to employers and risk managers. While, unfortunately, the underlying conduct is not new, it is an opportunity to review corporate culture and training,” said Reback.

“Some organizations use a captive to help fund some of these losses,” he added. “But it’s still a growing exposure.”

The best outcomes come when risk managers are aligned with human resources, IT and other departments, said Douglass.

She added: “Reputation needs to be a part of the culture of a company. From top-down, there needs to be a focus on protecting the brand.” &