Black Swan

Raining Down Destruction

When the asteroid strikes earth’s atmosphere, it is traveling at approximately 56,000 mph. At 50 meters to 60 meters wide, it is not large enough to wipe out humanity or irrevocably alter the tilt of the Earth’s axis or its orbit. But it’s going to do plenty of damage, particularly because of where it is headed: right at New York City. The asteroid, made of rock not too dissimilar from the rocks found on Earth, begins to break up nearly 200,000 feet in the atmosphere. About three miles up, or 18,800 feet, the projectile bursts into a cloud of fragments.

When it does that, it releases the power of 1,000 A-bombs — 10 megatons of TNT.

On the ground, the sound of the explosion reaches 105 decibels, enough to cause people to cover their ears in pain. That is, if the explosion’s incendiary heat and blast wave with its 500 mph winds don’t reach them first.

For residents of the metro area about 25 miles from the detonation site, the fireball looks like a second sun in the sky. The pressure from the explosion reaches them with 70 mph winds, though, wreaking havoc with homes and small business structures.

For about 19 miles surrounding the blast site, the fireball inflicts third-degree burns and ignites clothes.

Within 10 miles — reaching into the Bronx to the northeast, Brooklyn to the south and into Queens to the west — the blast wave reaches even higher pressure. That level of pressure is enough to generate wind speeds of a Cat-5 hurricane, strong enough to raze or severely damage factories, offices and residences.

The air is filled with glass, bricks and jagged concrete, and those half of the Outer Borough residents who do not die are surely injured.

For those within 2.5 miles of the blast, the news is worse. About 17.6 seconds after the explosion, come those 500+ mph winds — arriving faster than the speed of sound. The effects of this phenomenon are not for the faint of heart to consider, but take the worst tornado stories imaginable, multiply by two, and overlay them across almost all of Manhattan.

The force tears already scorched flesh off bones and limbs from bodies. Windows and walls of buildings implode. Multistory, reinforced concrete buildings collapse. Nothing is left of wood frame buildings. Highway truss bridges collapse. Nearly every tree in Central Park is leveled. And what falls down become missiles that kill and maim.

Perhaps luckiest are those closest to ground zero. Within the first second of the detonation, the heat energy within a mile turns flesh into steam, clean to the bone. Assume near total demolition at ground zero with fatalities as good as 100 percent.

The Fallout

Research for creating this description included information from the Earth Impacts Effect Program sponsored by the Imperial College London and Purdue University, It also used research provided by the Nuclear Weapon Archive. In its scale and effects, an asteroid impact would be similar to a fusion bomb.

But the most relevant source for the above scenario was a research report published in 2009 by RMS, the catastrophe modeling solutions provider.

The RMS report explored a 1908 event, the Tunguska asteroid impact in Russia at its 100th anniversary. In that strike, a mid-size asteroid (about 50 meters in diameter) exploded 3 to 5 miles above the Siberian forest. It leveled trees across 770 miles, and the pressure waves generated were measurable around the world.

Eyewitnesses were few and far between, but the few recorded for history including one person who experienced the event from 40 miles out and said, “at that moment, I became so hot that I couldn’t bear it, as if my shirt was on fire.”

The modeler asked: What if this occurred above New York City?

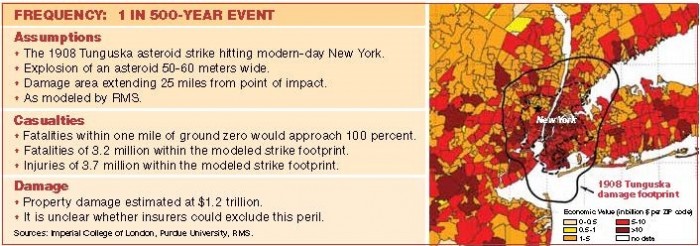

To calculate the probable maximum loss, RMS placed the proposed Tunguska damage footprint over Manhattan. It assumed a mean damage ratio, fatality rate and injury rate within the inner footprint of destruction to be 70 percent, 50 percent and 40 percent, respectively. In the outer footprint, they were 30 percent, 2 percent and 35 percent, respectively.

Then, RMS populated its map of Manhattan with datasets for population concentrations and insured assets. As much as $760 billion in property exposure and 3.61 million people exist within the outer swath of destruction, and with the inner ring of fire and death, $1.38 trillion and 6.25 million people.

According to RMS calculations, that translated to property losses of $1.19 trillion, 3.2 million deaths and 3.76 million injuries.

Such a biblical tally — and indeed, an asteroid impact may have caused the flood behind Noah’s ark — leads us to a question: Would property insurance companies even have to pay such a massive bill?

When a meteor exploded over Chelyabinsk, Russia, on Feb. 15, 2013, this question was raised. Michael Barry, vice president for media relations at the Insurance Information Institute, was quoted in Time.com as saying, at least with homeowners policies, “it’s got to be a direct hit” to trigger coverage. If an asteroid were to explode miles in the air and level everything below it, “the coverage is going to be open to interpretation.”

RMS conceded in its report that “it is unclear if, on any current contractual grounds, insurers would exclude damage caused by such a peril.”

Yet, the consensus appears to be that comprehensive commercial multiperil and all-risk policies ought to cover damage from an asteroid blast, unless specifically excluded.

“Generally, losses from the impact of meteorites or asteroids are covered in standard insurance policies. However, differences do exist from country to country,” was the simple statement put out by Munich Re after Chelyabinsk.

The Recovery

In Earth’s history, larger strikes have happened. The dinosaurs were made extinct by an asteroid that could be measures in kilometers, not meters.

If that were the case, “it’s a whole new world the next day,” said Lou Gritzo, vice president of research at insurer FM Global. It’s literally a whole new world.

That sort of impact would extend beyond the affected region and country, and have geopolitical security implications. Countries might cease to exist, let alone insurance companies.

A Tunguska-sized space rock could have ripple effects beyond the New York region, given the “brittle” economic situation in today’s over-connected financial and business worlds, Gritzo said. The word he used to describe such a threat is “reset” — to geopolitical and economic systems, but also to the well-being and daily lives of people on the East Coast and the insurance industry.

After a significant event like this, the insurance industry would be “really in ‘only the strong survive’ mode,” Gritzo said.

We can’t define “the strong” as those specifically prepared for an asteroid strike. As Robert Muir-Wood, chief research officer at RMS, explained, no one on the insurance side has a strategy to handle such an event at the moment.

Nor should they. It’s not practical to chase every Black Swan that flies under the sun.

If you’re running an insurance or reinsurance company, said Muir-Wood, you have to decide what is the risk threshold that you’re worried about and manage to that risk, so you will survive.

“Generally,” said Hélène Galy, head of proprietary modeling, managing director, Global Analytics, at Willis and the Willis Research Network, “when we provide catastrophe modeling results to clients, for example for a flood model, they are more interested in the low return periods, which should match their recent loss experience. Typical return periods are 100 year and 250 year.”

Gritzo at FM Global said that company underwrites to the 500-year risk level and advises its clients to protect their own properties to that 0.2 percent annual probability.

The odds of a Tunguska-like event striking a major urban area — let alone the major urban area in the United States — are very high.

The frequency of rocks this size hitting Earth in any one place, however, could fit within this 500-year window. According to the Asteroid Terrestrial-impact Last Alert System (ATLAS) at the Institute for Astronomy at the University of Hawaii — its purpose: to identify these rocks before they hit — “city killer” sized asteroids arrive once every few hundred years.

Given that location uncertainty but surety of occurrence, standard rules of catastrophe management apply for reinsurers and insurers. Prepare for the disaster that really scares you, and likely you will be relatively prepared when another disaster strikes.

One such rule of the “only the strong shall survive” school of thinking is diversity — away from insurance lines like property and away from concentrations of underwriting in any particular urban area or region.

“In this extreme scenario, losses would be so regional and total that a number of regional insurers would probably disappear. Reinsurers with enough diversification should survive,” said Galy.

She added, “insured losses would be dwarfed by economic losses, so it is the economy and civil society that would be most impacted.”

It would be a “reset” unlike anything we have seen.

“It would look a bit of a mess,” said Muir-Wood. The nearest historical equivalent would be the Tokyo earthquake in 1923, when the city burned and total insured losses were beyond insurance coverage.

The government then allowed insurers to pay back as much as they could without going under. In that way, it could be comparable to another recent Black Swan — the 2007-2008 financial crisis.

As long as it is still standing, the U.S. government would not sit by and let all the big insurance companies disappear, like the dinosaurs did.