2017 Power Broker

Public Sector

A Hard Negotiator

Blazing a trail for an independent brokerage, Karen Bartak impresses with her connections in the excess casualty markets.

“I rely on her to get me access to the big players in the public entity space,” said Greg Kildare, executive director of risk at the LA Metro Transportation Authority. “I regularly sit down with senior executives to whom I can sell our risk as best in class. I didn’t get this with a lot of the bigger brokers.

“And she negotiates hard,” he added. Indeed, Bartak recently secured LA Metro a flat renewal with a higher limit despite adding two new train lines.

Bartak also helped Contract Cities of Los Angeles retain its existing retention this year despite adverse claims, bad public sentiment toward police and delayed implementation of body cameras, saving hundreds of thousands in additional reserve expenses.

And she was instrumental in helping Sonoma Marin Area Rail Transit (SMART) insure its new rail line through various stages of development, including negotiating policy extensions during testing phases and keeping premiums as-is for its first full year of operations.

With SMART soon taking its first passengers, this is a crucial time. “Karen has done an awesome job, particularly on the rail liability,” said CFO Erin McGrath.

“Karen, in partnership with our team at Alliant, has done a lot of hand-holding as we’ve gone from virtually no insurance program to a very robust $200 million liability policy, from 20 employees to 120, and from almost no assets to 44 miles of property.”

A Benchmarking Power Broker®

In late 2015, Marcus Henthorn designed a software tool that transformed the working lives of not only his clients but dozens of Gallagher insurance pools and brokers.

Henthorn’s data collection and questionnaire software aggregates schedules and statement of values, and digitizes applications on large complex accounts. By late 2016, more than 60 Gallagher pools in the U.S. and Canada, (insuring over 2,200 individual pool members) and numerous large clients were launched on the system. The data’s underwriting benchmarking offers a distinct advantage in the marketplace. Meanwhile, the platform is an invaluable administrative time-saver, allowing easy aggregation of forms.

“The renewal process is now much quicker and efficient. It’s saved literally months of work,” said Bob McDermott, president of the Prairie State Insurance Cooperative.

“Time is our biggest asset — saving time allows us to focus on the things we need to,” added Brad Goldstein, executive board member of the Collective Liability Insurance Cooperative. “We are a large pool and need to benchmark against others, and now we can access information to learn from other pools.”

Henthorn gets the basics right too.

“He has far exceeded my expectations of a broker, and I deeply appreciate how much I’ve learned because of Marcus. I didn’t understand what a risk pool was, but I do now,” said Tina Hubert, executive director of the Six Mile Regional Library District.

Creating the Parametric Trigger

Changes in Federal Emergency Management Agency rules meant David Marcus had to get creative last year for hurricane-exposed clients in Florida.

Facing reduced protection, but unable to afford higher premiums or larger deductibles, both Miami-Dade and Broward county public school systems needed fast, creative solutions.

Marcus worked with Swiss Re to restructure Miami-Dade’s program, combining a multiyear structured insurance program (MYSIP) and a new parametric trigger insurance product that allowed the system to cover its “obtain and maintain” obligations at a reasonable cost. “We have to find unique solutions to find adequate insurance without breaking the taxpayer’s back. It’s a tightrope,” said Michael Fox, Miami-Dade’s executive director of risk and benefits. “It would have been very expensive buying first dollar coverage, so this solution was a win-win. David’s knowledge is top of the line.”

Broward was less keen on parametrics, so Marcus instead created a new MYSIP with Lexington to house part of the system’s primary layer, and through negotiations with carriers, lowered Broward’s hurricane deductible by 25 percent for no change in premium.

Marcus also helped the district implement a six-year master rolling builder’s risk program to cover all property risk on major renovations taking place across the system.

“We needed that badly,” said risk management director Aston Henry. “David saves us money every year. He knows the public sector really well — especially the school systems.”

Increasing the Cover, Cutting the Rate

By the spring of 2016, the Commonwealth of Virginia, with total insured values exceeding $30 billion, outgrew its single domestic carrier and wanted to take its program global.

Duncan Milne knew price was a key motivator. Leveraging his experience in the London market, he introduced Virginia to world-leading carriers. He improved terms, conditions and catastrophe limits, including critical wind and flood enhancements, and also updated its cyber policy — all while reducing premiums— in the space of just one month.

“Aon’s Duncan Milne did a terrific job putting together a package with some outstanding companies. It was an excellent deal for us — we saved a lot of money and have a solid program in place,” said risk management director Don LeMond.

“We put a lot of pressure on brokers. We see how far we can push them and ask them questions they don’t necessarily want us to ask, but Duncan and his team have raised our expectations,” said LeMond.

Milne is widely regarded as an expert in his field. When a real estate client added 40 percent to its property portfolio with a single acquisition in March 2016, Milne renegotiated the firm’s rate structure and terms to meet lending requirements, while also securing a 15 percent rate reduction off the back of a 20 percent saving the previous year.

“Duncan has a great temperament,” said the firm’s risk manager. “We are in and out of deals all the time. It’s great to work with someone who is so responsive and level-headed.”

Michigan’s Finest

“Joe Perry is one of the most knowledgeable people in the State of Michigan as far as public entity risks and insurance is concerned,” according to Detroit Public Community School District risk manager Doug Gniewek.

When the district was instructed by the state to purchase excess workers’ compensation cover, having self-administered for 20 years, the placement proved difficult. Perry secured coverage in less than 30 days.

He also helped veteran risk manager Michael Tilley transform the risk profile of Great Lakes Water Authority (GLWA), which recently spun out of Detroit’s bankruptcy. With no underwriting information and no WC license to self-insure, Perry first secured a temporary multiple lines program that included a workers’ comp deductible program. GLWA later obtained a license to self-insure and Perry converted the workers’ comp coverage to an excess workers’ compensation policy as part of a new permanent multiple lines program.

Detroit’s $100 million self-administered scheme was undisciplined and overpaid on coverage for 20 years. But Perry helped construct GLWA’s first ever commercial insurance program across multiple property and casualty lines, securing $750 million of coverage at a 40 percent premium discount.

“It was phenomenal, and couldn’t have been done without someone like Joe who knows the market and the public sector. I rely on Joe almost as if he is an extension of the department.” said Tilley.

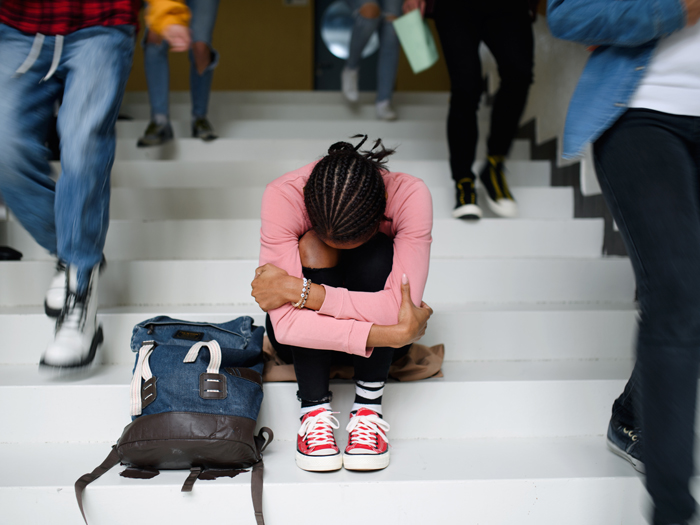

Getting Culver City Out of the Pool

Culver City, Calif.’s 25-year membership in an insurance pool was no longer beneficial. Premiums were spiraling and the city’s concerted risk management efforts were being overlooked. Fortunately, the city found an ally in Aon’s Julie Theirl.

Formerly a local government risk manager and a consultant to pools herself, Theirl was uniquely positioned to help.

Despite an excellent loss history, Culver City’s excess GL premiums had risen 17 percent and 35 percent at its last two renewals, and were slated to rise 29 percent in 2016-2017. With the GL placement the top priority, Theirl went to market with the city’s superior loss experience and found massive savings. After much soul searching, the city entrusted Theirl with withdrawing it from the pool entirely.

Under pressure to place the city’s whole program commercially, Theirl aggressively marketed with outstanding results. The city saved close to $1 million in insurance costs — a near 50 percent reduction — with many lines enjoying broader coverage and higher limits.

“Costs were becoming astronomical. It seemed our city was subsidizing other cities, because we were considered a good risk,” said Culver City’s HR Director Serena Wright.

“Julie exceeded our expectations of a broker, not just in cost saving but also the exceptional service and level of care she has shown us.

“Under the risk pool everything was taken care of. We entered into a new relationship with trepidation, but I am happy to say Julie and Aon still hold our hands.”