The Profession

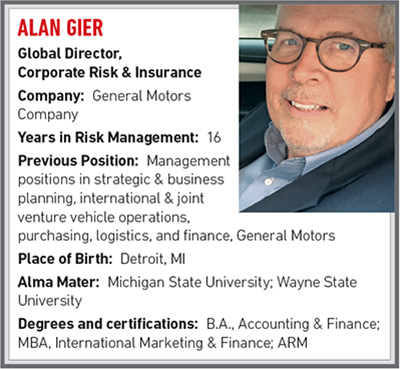

Alan Gier

I had a paper route when I was 12 and many odd jobs in my teens. My first automotive industry job was building rear axles for G vans at a local GM assembly plant during summers in college.

R&I: How did you come to work in risk management?

It took 20 years. While negotiating contracts with our JV business partners, I interacted frequently with our corporate risk management team and became intrigued by how to quantify and mitigate our exposures. Additionally, I managed a host of operational and strategic issues which required scenario planning and analysis around the risk of taking one course of action versus another. That piqued my interest in risk management as a science and financial discipline.

R&I: What is the risk management community doing right?

It’s focusing on analytics that drive better decision-making around program structuring. Risk managers are also being viewed as problem solvers and business facilitators, helping to drive their company’s strategic plan and overall business objectives.

R&I: What could the risk management community be doing a better job of?

Developing the next generation of risk managers by reaching out to college students via social media or college recruitment events.

R&I: What was the best location and year for the RIMS conference and why?

San Diego in any year. Great venue for the weather and access to the convention center and local eateries. Any place where you can walk to get around is better for meeting planning. Of course, there’s always Lyft!

One nephew thought I was a chef because I am forever cooking up something new after returning from a different part of the world.

R&I: What’s been the biggest change in the risk management and insurance industry since you’ve been in it?

Significant ups and downs in the insurance markets as a result of 9/11, Katrina, Rita, Wilma, and the “Great Recession.” Also underwriters becoming more focused on business and contingent business interruption exposures as they began to understand that their aggregate exposure could be much larger than expected. Finally, the rise of the Chinese insurers as they expand their capacity, competitive pricing and influence.

R&I: Are you optimistic about the U.S. economy or pessimistic and why?

Optimistic. The Internet of Things, the disruptive technology that we seem to see every day presents a lot of opportunity. However, I am concerned about the relative wage stagnation and whether others who are coming up now will enjoy the opportunities that I had.

R&I: Who is your mentor and why?

Art Raschbaum, a former executive director of risk management at GM and now CEO of Maiden Re. Art taught me the importance of maintaining strong relationships with the markets and delivering value to the C-suite. Also Ron Judd, of GM and later Ally and AMTrust, who is a model of integrity and leadership.

R&I: What have you accomplished that you are proudest of?

Maintaining relationships with my family and friends despite years of travel and the demands that working at a global company involve.

R&I: What is your favorite book or movie?

I read a lot so it is difficult to identify a favorite, but a few would include “Zen and the Art of Motorcycle Maintenance” by Robert Pirsig, “Into Thin Air” by Jon Krakauer, and “Free to Choose” by Milton Friedman.

R&I: What’s the best restaurant you’ve ever eaten at?

Fortunately I’ve had the opportunity to eat in many great restaurants across the globe. I remember certain dishes like mushrooms in butter foam in Paris, venison saddle or lamb curry in London, abalone and sashimi in Tokyo, a great steak in New York, and of course cheese anywhere in Europe.

R&I: What is your favorite drink?

That one is easy … a very dry martini followed by a chewy Cab or silky Pinot Noir with dinner.

R&I: What is the most unusual/interesting place you have ever visited?

Tuscany, Italy. Beautiful scenery, friendly people, great food, luscious wine and fantastic winding roads that are a blast to drive.

R&I: What is the riskiest activity you ever engaged in?

Backpacking and alpine skiing throughout the U.S. and Canadian Rockies.

R&I: If the world has a modern hero, who is it and why?

The U.S. military and Homeland Security; they have kept us safe since 9/11 through tremendous sacrifice and vigilance.

R&I: What about this work do you find the most fulfilling or rewarding?

The people I meet, traveling to new places, and balancing the mix of marketing and finance that every risk manager must master.

R&I: What do your friends and family think you do?

One nephew thought I was a chef because I am forever cooking up something new after returning from a different part of the world. Another nephew is convinced I have a “government” job because I don’t say much and I go to exotic places … others just think I buy insurance.