Sponsored: Liberty Mutual Insurance

Natural Catastrophes: Preparing for the Inevitable

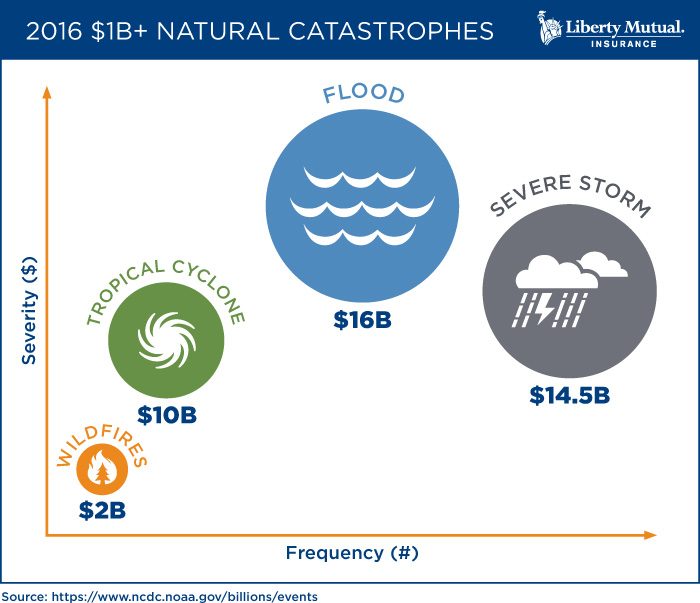

Frequency and Severity.

These two words are often used to quantify risk and under normal circumstances, they are inversely proportional. Losses that happen frequently tend to be less expensive while the billion dollar losses tend to be rare.

However, over the last several years, the loss trends for natural catastrophes have been going in a new direction, with billion-dollar events on the rise.

Recent U.S. weather data from the NOAA’S National Centers for Environmental Information paints the picture:

- In 2016, 14 separate weather-related events cost more than $1 billion each (see graphic below).1

- Losses from these 14 events totaled more than $42 billion, the highest amount since 2012.1

These trends are driven in part by storms affecting broader geographic regions outside of their normal zones. Hail, for example, caused significant damage as far south as San Antonio.

“Most people know that natural disasters are increasing in magnitude and cost, but many clients are not aware of how those trends are changing at their specific locations,” said Aja Atwood, Global NAT CAT Practice Leader, National Insurance Property, Liberty Mutual Insurance.

Businesses in areas with historically low exposure especially need to reevaluate their natural hazard risk. When it comes to natural catastrophes, preparation and prevention are just as vital as insurance.

Identify Exposures

With hail, wind storms and hurricanes broadening their geographic footprints, no business should assume that they are safe from any particular type of severe weather.

Companies can conduct routine checks of their properties and identify areas for improvement. Roof age and material are key factors impacting the level of damage done by a storm. Even a few years of exposure to the elements can weaken a roof’s integrity. Risk managers should establish timelines for roof repair or replacement.

Business interruption exposure is also an important consideration.

“Even if the reported physical damage values are low, you can still have a significant business interruption claim,” said Rob Morelli, Head of Engineering Technical Unit, National Insurance Property, Liberty Mutual.

“For example, a location has one primary electrical feed and the transformer for that feed is in a flood zone. It may be one small transformer that only costs $15,000, but has about $100 million tied to it in revenue,” he said.

Strengthen Vulnerabilities

Once the weaknesses are identified, it’s time to develop a mitigation strategy.

For businesses with large schedules of property, prioritizing repairs and creating a long-term maintenance schedule are key. That can mean replacing roofs or installing hail guards and rooftop equipment protections.

Keeping buildings in top shape can help minimize damage when severe weather hits, but it’s also critical to have emergency response and business continuity plans in place to reduce downtime. “A fast response not only mitigates business interruption losses, it also establishes a process to account for workers’ safety and helps a company report claims more quickly after a loss,” says Atwood.

Business continuity plans can include having replacement parts on hand for critical pieces of equipment, identifying sister facilities that can pick up some slack when operations are halted, and creating a communication plan to keep customers and employees informed.

Prepare People

Preparing buildings and equipment to withstand natural catastrophes is one thing. Preparing people is another.

Risk managers should consult with senior managers and employees to understand how weather could impact different operations. The people closest to the work – and most knowledgeable about its vulnerabilities – need to be involved in emergency preparation and response plans. Designate key personnel who have the authority to make decisions in the event of an emergency, like sending out alerts or shutting down a facility.

“Open communication should also extend to other facilities who may have additional insights or preparation recommendations for types of weather they experience more frequently,” Morelli said.

Leverage the Latest Tools

Existing CAT models provide a high level overview of exposure based on zip code, but risk managers with several locations need granularity. More advanced predictive models can map exposure on a micro level by factoring in unique property characteristics like roof age and material, type of construction, the overall condition of a building, number of stories, and any protections already installed.

Liberty Mutual is developing these types of predictive models to provide a clearer view of natural catastrophe exposure and to help guide mitigation plans.

While some data comes from client input, site visits conducted by a team of experienced risk engineers provide more detail.

“For customers with multiple properties, we schedule visits based on several factors, such as a location’s total insurable value, the level of NAT CAT exposure, time between visits, etc. Looking at these details enables us to provide guidance to customers as to where they should focus immediate efforts.” Morelli said.

“Only by walking on the roof can I know that it’s a single-ply roof cover that’s lost its adhesion, or that there aren’t enough fasteners. Or that they have unprotected skylights in a hail zone,” Atwood added. “My recommendations would be catered towards that location’s specific exposures, and what the budget allows for one month from now and one year from now.” A risk managers can then manage site-specific exposures and prioritize recommendations across the business’s entire portfolio of properties.

Imminent warning systems also help clients stay aware of potential threats in the area. Liberty Mutual monitors the National Weather Services and other local weather resources, tracking conditions like freezing temperatures, high winds and hail.

“If we see patterns that are cause for concern, we can send out an email blast to everyone in the affected area.” Atwood said. The communication provides guidance on storm preparation and what to do in the event of a claim.

These loss control services are what truly add value to an insurance solution.

“If you rely on insurance coverage too much, you forget there are things you can do proactively to protect your business and your livelihood,” Morelli said.

To learn more, visit libertymutualgroup.com/business.

1https://www.ncdc.noaa.gov/billions/events

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with Liberty Mutual Insurance. The editorial staff of Risk & Insurance had no role in its preparation.