Risk Insider: Pat Hickey

Intelligent Use of Technology Is the Key to Managing Risks in Third-Party Logistics Arrangements

Estimates indicate that real gross domestic product (GDP) in the U.S. increased at an annual rate of 2.3 percent in the first quarter of 2018, with forecasts of +2.9 percent and +2.7 percent for 2018 and 2019 respectively.

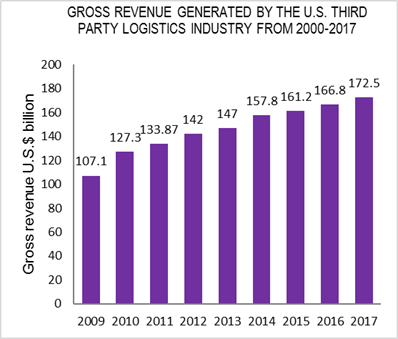

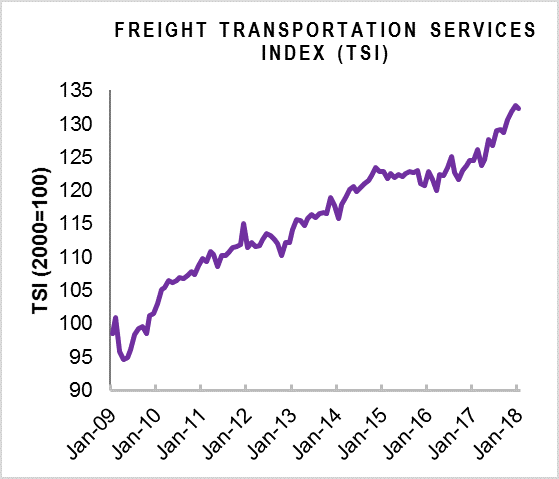

Simplistically speaking, economic growth leads to more freight in transit, but the trend of globalization and increased retail-to-retail partnerships is gaining momentum and contributing to the upward trajectory of the Freight Transportation Index shown in the chart below. Growth in third-party logistics (3PL) is a key contributor to this trend.

Most manufacturers and retailers now employ 3PLs for at least a percentage of their domestic activities and almost all of their global operations. 3PL services embrace essentially all aspects of the supply chain from transportation and warehousing to global services and information technology requirements.

The advantages are numerous and include reductions in current costs and capital expenditures. 3PL global expertise includes documentation, customs and freight forwarding services as well as arranging global air-freight, vessel and truck transit.

Outsourcing supply logistics enables manufacturers and retailers to focus on their core activities and improve customer relationships through more certainty of timely and accurate delivery.

These companies are in a consumer-driven market, producing and selling goods with little margin for error. They are not in the business of moving goods around the world within a complex, global supply chain.

Global 3PLs help by providing expertise, efficiencies and insight into shipping issues so these businesses are able to meet the ever-increasing needs and demands of their consumers.

These 3PLs not only offer the benefits of shared costs, scalability, accountability and global reach, but also have capabilities for improving and reducing a company’s environmental and personnel risk.

Reduction in certain risks is not to say that risks do not still exist. Questions surrounding global insurance should be included in any client’s assessment of 3PLs together with those concerning performance indicators of claims, order error and success ratios, as well as on-time shipping percentage and inventory management.

In turn, the underwriter must be fully informed of the delivery route from start to destination – that includes multimodal transport on road, rail, sea and air and all staging posts in between, such as warehousing facilities. This entails fully understanding a carrier’s legal or contractual liability for damage to customers’ goods in their care, custody and control, at all stages of the global supply chain.

Risk assessment includes the value of the goods and degree of fragility. Poorly designed packaging, for example, may be a factor in the latter and high-value goods, such as pharmaceuticals or electronics, are more susceptible to theft, especially if they can be resold easily.

The track record of the carrier is also a consideration not only for the client but also the insurer should there be any indication of an unreliable record or poor visibility of their subcontracted carriers.

A strong, global logistics provider will be able to work with their insurance broker and underwriter to offer their customer a variety of insurance solutions for their goods in transit. In addition, the 3PL should be able to demonstrate long-term relationships with the companies who help them move freight and prove the commitments their partners make to them for the safe delivery of the goods.

Without reliable partners and the proper controls, freight could be sub-brokered multiple times. The freight then becomes highly susceptible to loss or damage, due to breakdowns in communication and failures to exercise adequate controls.

Outsourcing supply logistics enables manufacturers and retailers to focus on their core activities and improve customer relationships through more certainty of timely and accurate delivery. These companies are in a consumer-driven market, producing and selling goods with little margin for error. They are not in the business of moving goods around the world within a complex, global supply chain.

Changes in Logistics

The logistics industry – like many others – is facing considerable change, which is introducing new challenges to deliver better service at lower cost. New entrants and new collaborative partnerships are part of the strategic change, but intelligent use of technology is the common thread. This includes data analytics, automation, platform solutions and the Physical Internet.

Risk management needs to span these developments as the more digitally-advanced providers are able to benefit from improved forecasting, appropriate scalability and route flexibility.

The rate of technological progress is likely to be determined by customers’ acceptance and regulatory oversight but the opportunity is great.

Cyber exposure in all its manifestations is an emerging risk and the potential benefits will have to be set against the new challenges. The Physical Internet could bring improved supply chain transparency and more efficient planning through standardization of shipment sizes and labeling, but this is likely to be accompanied by issues of data privacy and security.

Likewise, IT standardization could enable greater collaboration, efficiency and transparency while also raising questions of data security. This is also the concern for data analytics, cloud platforms and crowd sharing.

Automization is increasing and is a vital part of the push for low-cost service goals as supply chains continue to increase in complexity. Automated loading and unloading are already in use but, in the future, technology could bypass obstacles and amend routes automatically at the appropriately adjusted speeds.

The use of robotics and automation has the potential to reduce human error, but the use of autonomous vehicles and drones is likely to depend on regulatory approval with liability issues yet to be clarified. Blockchain technology could reduce incidence of fraud and errors but there could be increased risk of aggregation.

The name of the game for 3PL companies – and their insurers – is coping with complexity. Technology, spurred on by customer demands, shifting requirements and the possibility for new competition and collaboration, is introducing change to the industry, and risk managers need to be part of the conversation with manufacturers and retailers reassessing their strategic direction.

Transportation is operating in a different world than it was five years ago, and it will keep evolving over the next decade as just-in-time supply chains continue testing the limits of saving time and money while raising the bar on consumer expectations.

This new world means it is more important than ever for risk managers, logistics professionals, insurance brokers and underwriters to partner together and address these changes and challenges so that the shipper, and ultimately the consumer, can enjoy the benefits of a seamless, fully integrated global supply chain.