Environmental Risk

Hurricanes Leave a Moldy Legacy in Their Wake

When Hurricane Katrina hit the Gulf Coast in August 2005, a storm surge dumped at least 15 feet of water onto the city of New Orleans. The National Weather Service and the CDC later reported that 80 percent of the city remained flooded for two weeks.

It took 43 days to pump flood waters out of lower-lying areas, and the cleanup process was stalled by the arrival of Hurricane Rita one month later.

The standing water and Louisiana’s warm temperatures created ideal conditions for mold growth. Environmental researchers estimated that more than 100,000 homes in the flooded areas experienced significant mold damage.

The Louisiana Department of Health and Hospitals recommended property owners remove and replace any drywall that had been in flood waters.

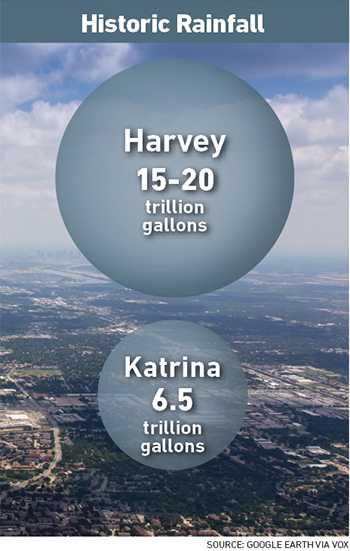

Similar conditions played out over this year’s turbulent hurricane season. Hurricane Harvey inundated Houston with roughly 50 inches of rain — more than the city had seen in the past several years combined. According to a report by the Washington Post, 9 trillion gallons of rain fell across Southeast Texas just two days after the storm made landfall.

A previous construction boom in the Houston area covered up much of the surrounding land with concrete and steel, preventing water from draining.

Environmental carriers are ready for an influx of mold claims as cleanup continues in Houston and other hard-hit areas.

“We saw a spike in the amount of mold claims in Florida after previous hurricanes. We saw it in New Orleans after Katrina,” said Jeff Slivka, president, New Day Underwriting Managers.

“In many cases the buildings just weren’t constructed to withstand water intrusion, especially rain driven by hurricane winds. Sometimes the parking lot wasn’t graded correctly, so all of that water drained into the basement of a structure.”

Challenges in Mold Remediation

It doesn’t take much water to cause mold growth. Small leaks or clogged gutters can lead to mold that makes its way into a building’s structure. When several feet of water stand for weeks at a time, the problem is magnified.

Flooded properties typically need to be gutted to remove moldy material, thoroughly dried out, cleaned and usually sprayed with an anti-microbial solution to help prevent further growth. The process can take months and cost millions, but the impact also depends on the type of property and the level of water intrusion.

“An older building that’s wood-framed could be damaged beyond repair altogether. A concrete and steel high-rise building can take several months and even up to a year to remediate after extensive flooding,” said John Matthew Lumelleau, team leader of Lockton’s Texas-based environmental practice.

Lumelleau and his team were on the front lines in the aftermath of Hurricane Harvey — an experience he said he hopes never to repeat.

Lumelleau and his team were on the front lines in the aftermath of Hurricane Harvey — an experience he said he hopes never to repeat.

“When Buffalo Bayou flooded in Houston, it rose about four stories above the subgrade of a high-rise office building that was right across the street from where we were stationed. When the water receded, contractors had to hook up a large conduit and pump water out of the building for 72 hours straight,” he said.

“Then emergency staging began. It’s around-the-clock, 24/7 work to dry out the building with large fans and other drying devices powered by large generators. They’re still engaged in that process now, and it will probably continue for another five months before they can get people back in there in a safe working environment.”

Access issues and lack of power — common obstacles impeding disaster recovery — can extend that timeline. Puerto Rico has felt this most acutely. Two months after Hurricane Maria, half of the island remained in the dark.

“It’s pretty tough to dry out your building if you don’t have any power. And it’s tough to get emergency contractors out to your site when your entire city needs emergency contractors,” said John O’Brien, environmental insurance veteran and former CEO of Ironshore Environmental.

The longer it takes to remove the water and dry out a building, the worse the mold growth will be.

Most environmental and property carriers align with emergency response contractors and provide those services as part of a property or pollution policy. Post-hurricane, however, the availability of those contractors could grow very limited very quickly.

“To the extent there is widespread damage within a region, there may be a shortage of construction workers and resources necessary to remove water-impacted materials and thoroughly dry out a building after an event, so the potential for mold to grow is amplified,” said Craig Richardson, EVP, Chubb Environmental.

Coverage Evolution

The insurance industry got its mold risk wake-up call in June 2001 when a massive claim settlement turned heads.

In Ballard v. Farmers Insurance, Melinda Ballard and her husband filed suit against the insurer, alleging their claim for water damage and mold throughout their 22-room Texas home was mishandled. The couple claimed mold contaminated their house as well as the surrounding structures, leading to respiratory illness.

A judge awarded the couple an unprecedented $32 million for property and punitive damage and mental anguish. The award was eventually reduced to $4 million, but “the initial verdict sent shockwaves through the industry,” Slivka of New Day Underwriters said. “All of a sudden, insurers were realizing they may have an uninsured exposure.”

Since that case, coverage for mold remediation and removal has become fairly standard in environmental policies and in some property policies. But most carriers typically think about mold risk in the context of a non-CAT event.

“Storms add a layer of complexity,” O’Brien said.

Pollution and Property Overlaps

The circumstances surrounding property damage after a hurricane can call multiple coverages into play. Carriers, adjusters and insureds will need to determine whether mold was pre-existing or a direct result of water intrusion resulting from the storm.

If a structure needs to be demolished and rebuilt anyway, due to the extent of overall damage, is a property policy the sole recourse or will mold coverage pick up any of the reconstruction cost?

“Let’s say there’s a flooding event and you’ve got water damage to your drywall. That drywall will need to be replaced whether or not mold is present. But maybe some mold is growing there too. Is that a property loss or an environmental loss?” O’Brien said.

“There’s no norm in what’s covered under a property policy. Some exclude mold exposure, some include it but with large self-insured retentions. Some cover it with sub-limits. Variation in coverage is the only constant.”

Variation in pollution policies exists as well. Some pollution policies have per-room deductibles; others have one single deductible. Some are triggered by the assessment of an indoor air quality expert; others are still tied to environmental laws.

“There aren’t any bright lines delineating coverages for commercial properties between property and pollution for losses from CAT events,” O’Brien said.

“There’s no norm in what’s covered under a property policy. Variation in coverage is the only constant.” — John O’Brien, former CEO, Ironshore Environmental

Expenses related to the removal of mold are most often covered under pollution liability policies or, in the case of unfinished properties still under construction, contractors’ pollution liability policies.

But Slivka estimates less than half of contractors purchase CPL coverage, relying instead on general liability. Professional liability may also come into play if contractors don’t properly remediate mold growth on unfinished projects.

Coverage for business interruption expenses is another gray area. Some environmental policies cover BI losses related to mold remediation, others don’t. Ditto for third-party claims for bodily injury.

Property owners and risk managers should not assume they have coverage for mold remediation, reconstruction, business interruption and third-party liability in their property or general liability policy.

“You want affirmative environmental coverage for all microbial matter, including mold, bacteria and viral matter,” Slivka said.

Many property owners, however, are uninsured or underinsured for environmental risks. In manufacturing, energy and construction, the exposures are obvious, but the owner of an office building is more likely to shrug off any environmental exposure as inconsequential.

Lockton’s Lumelleau said there are three types of property owners: those who buy environmental policies now because they had an uninsured loss in the past, those who self-insure or buy insufficient coverage because they don’t think the risk applies to them, and those who are unaware of mold’s expensive consequences altogether and don’t know their coverage options until they have an uninsured loss.

Staring at a flooded property after a hurricane is no time for an owner or risk manager to discover into which bucket they fall.

Risk Mitigation

There’s little property owners can do to protect their buildings from 100+ mph winds and floods that rise multiple stories. In the face of a hurricane, water intrusion is nearly unavoidable, and mold damage is likely.

But owners and risk managers can minimize the damage by having a disaster response plan that pre-emptively lines up emergency resources. Speed is the name of the game in mitigating water and mold damage.

Examining policies for gaps and overlaps can help property owners know who to call and align resources faster post-event.

“Most carriers have access to experts in mold remediation. Coordinating the resources and services provided by your property, your GL and your environmental carriers is key to minimizing delays in recovery and reconstruction,” said Matt O’Malley, president, North America Environmental, XL Catlin.

“The faster you can get emergency contractors to your site, the more you minimize your loss,” Lumelleau said.

Even if emergency consultants aren’t immediately available or can’t physically get to a site, property owners could ensure backup generators and other equipment are on hand to begin pumping out water and drying materials as quickly as possible.

Additionally, ongoing operations and maintenance plans can help identify ways to make buildings more resilient against water intrusion. Recognizing a structure’s vulnerabilities can help building owners gird their defenses ahead and prioritize actions immediately following a storm.

“Many carriers will help insureds develop or fine tune an [operations and maintenance] plan,” O’Malley said. “So when an event happens, there’s a formalized process in place to ensure quick notification of the loss, so resources get to insureds faster.” &