Legal Developments

High Court to Decide 3 Controversial WC Cases

Advice to employers in Florida: Have a comprehensive loss control program and ensure there are no holes in your liability policy. That’s an industry veteran’s recommendation as Florida’s workers’ comp statutes are under scrutiny.

The state Supreme Court recently scheduled oral arguments in a third case it is considering that challenge portions of the law. While some attorneys question the merits of the arguments in each of the cases, observers are nevertheless warning of potentially significant repercussions for Florida, as well as other jurisdictions.

“If [the plaintiffs] are successful, you will see these challenges in other states because there are other states in the last 10 to 15 years that have changed their statutes to make them more restrictive and to reduce benefits to injured workers,” said Mark Walls, vice president of communications and strategic analysis at Safety National and founder of Work Comp Analysis, the largest LinkedIn group devoted to workers’ comp.

“A lot of the reforms have been very pro-business and so are designed to lower costs for employers; but often times that’s by capping benefits. If this is successful, I wouldn’t be surprised to see similar challenges in other states because this will provide the roadmap.”

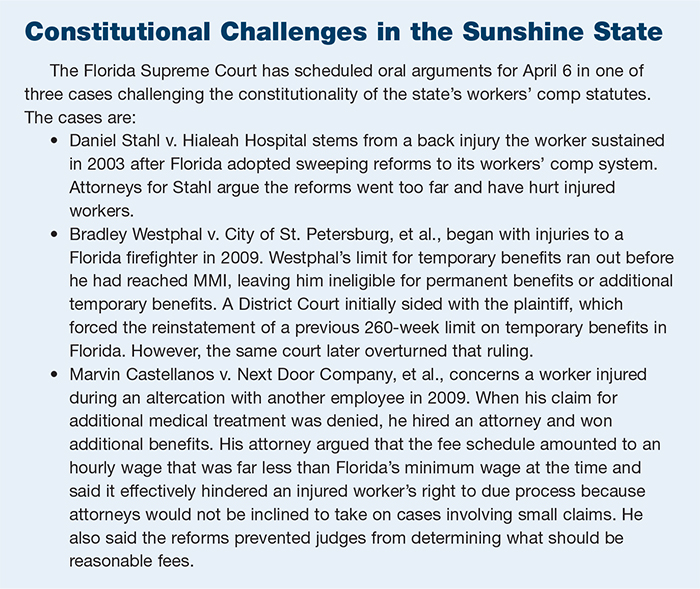

The case of Daniel Stahl v. Hialeah Hospital is the broadest of the three cases in terms of the challenge to Florida’s workers’ comp statutes. While the court heard oral arguments on the other two cases in 2014, it has yet to rule on either.

“The common thinking is that [the court] received these piecemeal over the last couple of years and want to get all of these at once and make one sweeping proclamation on the law,” said W. Rogers Turner Jr., a partner at Hurley Rogner Miller, Cox & Waranch in Winter Park, Fla. “It’s another constitutional challenge [to the workers’ comp statutes] and they want to put as many of them together as they can.”

If this is successful, I wouldn’t be surprised to see similar challenges in other states because this will provide the roadmap.” — Mark Walls, vice president of communications and strategic analysis, Safety National

Turner is among several attorneys and organizations that don’t believe the Stahl case has much chance of rendering the workers’ comp statutes unconstitutional. But industry insiders are closely watching all three cases, any of which could portend major policy and financial ramifications for the workers’ comp system.

Stahl Case

The case Daniel Stahl v. Hialeah Hospital alleges the state’s workers’ comp law is inadequate and violates the U.S. Constitution. It also challenges a $10 copay, once an injured worker has reached maximum medical improvement.

“The Stahl case confronts the elimination of elements of partial disability benefits, and is yet another case challenging the exclusive remedy protections of the Florida workers’ compensation system,” said Thomas A. Robinson, coauthor of LexisNexis’ Larson’s Workers’ Compensation Law and Larson’s Workers’ Compensation, Desk Edition. “Really the issue is, is there still a grand bargain in Florida’s [workers’ comp system]?”

Some attorneys believe the case is actually the least likely of the three to be successful. “There are a lot of legal reasons why I don’t even think their argument should be considered,” Turner said. “One reason is that they are using an incorrect test to challenge the statute’s constitutionality.”

The appeal argues the court should apply the “strict scrutiny” test rather than the “rational basis” test which has a lower standard.

“When you are alleging a law is unconstitutional, the test you apply depends on the classification of people the action impacts,” Turner explained. “What they say is, ‘because people who have workers’ comp claims can be disabled, that is disability, and that is strict scrutiny.’ It seems pretty clear that that is not the case. Everyone with a workers’ comp case is not disabled.”

Turner, who assisted in writing an amicus brief on behalf of the Florida Association of Insurance Agents and the American Association of Independent Claims Professionals, also says many of the arguments were not brought up or challenged in the lower court.

“If you allege the judge ruled in error, you have to say that at the time … you can’t be quiet during the trial then make an appeal,” Turner said. “If you don’t make an objection, you haven’t preserved your error.” Turner points out, for example, the $10 copay was not litigated.

The amicus brief contends that the “true goal” is to end employers’ protection from civil suits for occupational injuries. “Petitioner envisions an Act that is mandatory for employers (thus providing guaranteed recovery at great cost to the employer even where the employer’s negligence did not cause the injury,) but optional for employees (allowing them to sue their employers when it suits them.)” the brief states.

Despite the potential legal hurdles for the plaintiffs, Turner and others say the fact the high court agreed to take on all three cases means the court considers them important enough to hear. “I certainly take them seriously,” he said.

A ruling in favor of the plaintiffs is worrisome to industry observers. While it would not bring the workers’ comp system to a complete halt, it would allow injured workers to pursue their cases in civil court.

“The immediate impact may not be huge because most people are going to choose the statutory benefit of workers’ comp over taking the time and effort to litigate something in civil court where they may or may not recover,” Walls said. “But you could see the types of claims where there is a negligence component to the injury where the injured worker could chose to pursue this in civil court rather that workers’ comp.”

Death claims, for example, and those involving catastrophic injuries might be ripe for suing the employer. “For employers in high-hazard industries, this could result in potentially huge additional exposures,” Walls said. “If you think about it, those are employers who do not opt out of the Texas’ workers’ comp system because of the potential risks.”

To Walls, a win for the plaintiff points to the need for employers to ensure their loss control programs are carefully implemented and documented. “One of the defenses in a civil suit is showing all the steps you’ve taken to prevent accidents form occurring,” Walls said.

“In manufacturing it means having a lock-out/ tag-out program in force, or harnesses for working on elevations — things like that are a good defense for civil liability claims.”

But there are other concerns as well. Walls also advises employers to work with brokerages to ensure there are no gaps in their liability coverage.

“The next concern is coverage issues,” Walls said. “If they can pursue it in civil court and allege negligence of the employer, they’re most likely going to fall under the employer’s liability section of their policy, and for employers that retain risk, there are typically policy limits in those policies.”

Challenge to Benefit Limits

In Bradley Westphal v. City of St. Petersburg, et al., the issue is the state’s 104-week limit on temporary benefits.

“For my money, in Westphal the claimant has a much stronger argument than does the claimant in Stahl,” Robinson said. “In Westphal, one primary feature of the Florida system is at stake — the 104-week limitation — not the entire benefit structure. As such, the issue in Westphal is just so much more narrowly defined, and courts like narrow issues. From a claimant’s standpoint, I think that Westpahl is the most promising of the three cases.”

Turner, however, remains skeptical as to whether the high court will rule in favor of the plaintiff in that case either.

They have two arguments there; one that the 104-week limit was unconstitutional and therefore everything is unconstitutional so go back to [the workers’ comp statutes from] 1968,” Turner said. “Would they really do that? I don’t know.”

Turner also points out that the 2003 reforms have been in place for 13 years and, except for a case in 2009, have not been successfully challenged. He says the 104-week limit on temporary benefits was not the only change to Florida’s workers’ comp statutes.

“The [reforms] also say psychiatric impairment ratings are limited to 1 percent,” Turner said. “No one’s ever appealed that, or if they did, it was withdrawn prior to appellate ruling.”

Industry observers remain concerned, though, especially in light of the District Court’s initial ruling. “The 104-week cap on temporary disability benefits — that’s something that, if tossed out, is, again, going to potentially increase employers’ exposure on more complex injury claims,” Walls said. “It will not impact routine claims, but on more complex claims could certainly have an impact.”

Attorney’s Fees

The third case, Marvin Castellanos v. Next Door Company, et al., centers on attorney’s fees. Specifically, it questions whether restrictions on attorney’s fees included in legislative reforms hurt an injured worker’s ability to obtain legal representation.

The plaintiff was injured during an altercation with another employee in 2009. When his claim for additional medical treatment was denied, he hired an attorney and won additional benefits.

“Claimant’s attorney fees are an issue in virtually every jurisdiction, and there is no easy answer.” — Thomas A. Robinson, coauthor, Larson’s Workers’ Compensation Law

Castellanos’ attorney argued that the fee schedule amounted to an hourly wage that was far less than Florida’s minimum wage at the time and said it effectively hindered an injured worker’s right to due process because attorneys would not be inclined to take on cases involving small claims. He also said the reforms prevented judges from determining what should be reasonable fees.

“The conversation around that is that Florida used to have huge attorney fees that allowed for add-on attorneys’ fees based on the hours put into a case,” Walls said. “So you’d see on a complex case, attorneys receiving six-figure attorney’s fees. They were the highest in the country and used to be a huge cost driver in Florida. Going back to that is not a good prospect for employers.”

Workers’ comp attorneys say the case is reminiscent of previous cases which led to the changes by the legislature. “The question [in the case] is, is it equitable to restrict claimants’ attorneys to what they get under the fee schedule,” Turner said.

“There are still a lot of petitions being filed despite the limits on the fees. To argue that people can’t get attorneys, the evidence would suggest otherwise. There’s no doubt claimant attorneys have less incentive to pursue claims especially those that are not monetarily worth it, but that was the intention [of the reform].”

Some argue that it’s patently unfair to restrict attorney’s fees for injured workers but not on fees for attorneys representing employers or insurers. The issue, while not as large as those in the other two cases, may be just another straw on the camel’s back.

“Claimant’s attorney fees are an issue in virtually every jurisdiction, and there is no easy answer. Either the fees are added to the award, which some argue adds incentive to litigate virtually every issue, or they are taken out of the claimant’s recovery, which many see as unsatisfactory since workers’ comp benefits were never crafted to make an injured worker whole,” Robinson said.

“At stake in Castellanos is whether the Florida fee structure has been so degraded that an injured worker cannot obtain counsel from seasoned, experienced attorneys.”