Will Facebook’s New Cryptocurrency ‘Libra’ Upend the International Payments System?

As my grandmother used to say when she saw me quietly thinking about something, “A penny for your thoughts.”

When Sir Thomas More first used the phrase circa 1535 with the old English spelling, a “peny” had more value than it does today. Now or soon, a grandmother might say, “A bitcoin for your thoughts.” Or maybe a “Libra” if Facebook has its way.

Mark Zuckerberg’s recent announcement that Facebook is working with a consortium to create a single global currency, Libra by name, may be worth a dollar or two for us to share our thoughts about risk management. Where should we start?

Before we had Zuckerberg and Bezos, we had Gates. In 1994, he announced an effort by Microsoft to take over the banking system. The effort was propelled by his quote in July 1994: “Banks are dinosaurs … we can bypass them.” He even had a strategy, and he put Microsoft’s money where his mouth was.

Microsoft would acquire the Intuit corporation, a provider of personal financial software that ran largely using the MS Windows operating system. Intuit owned QuickBooks and TurboTax, highly-popular accounting and tax preparation software. Together, Microsoft and Intuit had 91% of the personal finance market.

Quicken also owned the National Payment Clearinghouse (NPC), whose facilities provided communication between users and their banks. It also allowed users to send payments to merchants.

Somewhere in the corridors of the U.S. Treasury, Homeland Security, the FBI and other agencies are watchdogs concerned about money laundering, financing of terrorism and criminal activity that may enter the discussion on easier and harder-to-trace mechanisms for transferring cash.

In October 1994, Microsoft offered to buy Intuit. At the time, Intuit’s stock was valued at $800 million. Gates offered $1.5 billion, an 87 percent premium over market price.

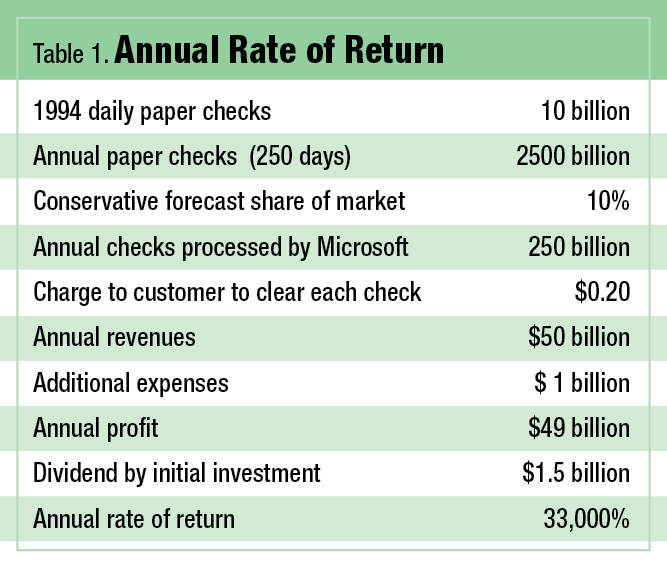

Was this a wise risk management decision? Not based on Intuit’s income statement. The company had $500 million in annual revenues, relatively low profits, and slow growth. What was Gate’s thinking?

The answer is “synergy.” From the Oxford dictionary, “the interaction or cooperation of two or more organizations … to produce a combined effect greater than the sum of their separate effects.” Gates saw a game changer in a merger.

To understand the risk, just do the analysis. Gates started with the fact that 90 percent of the world’s personal computers ran MS Windows. The company could link Intuit’s accounting and software. Microsoft could own an electronic payments system that eliminated paper checks.

What would be the expenses? On an existing network, minimal costs arise from each additional transaction. For sake of argument, let’s say the additional cost reached a billion dollars a year.

With a few assumptions on pricing and volume, Table 1 shows a 33,000% annual return on the initial $1.5 billion investment.

Now for the risk. How likely is the venture to fail because of a flawed execution? Not very. When all the pieces are in place, great strategies produce great results. Consider Apple, Google, Amazon, and Netflix.

The real risk was the United States Department of Justice. They did not see the conservative 10 percent. They saw a takeover of the banking system by Microsoft. This was untenable. They blocked the merger. Gates did not take the news well.

This brings us to the penny for our thoughts on Facebook and risks of cryptocurrencies. Led by Bitcoin, they comprise a valuation of $600 billion on the day this is being written. The day before, the entire market reached $710 billion before taking a 14 percent day-to-day fall.

Facebook is entering this volatile market in a new way. It will tie the Libra to an underlying basket of hard currencies. This should give it stability. Maybe not, if the dollar or Euro or whatever experiences a meltdown.

The biggest risk may lie in the parties that are in and out in the venture.

The Libra Association has some 30 firms committed to participation in managing the currency, including Visa, Mastercard, and PayPal, and maybe Uber, Lyft, Spotify, and others who make extensive use of credit-card like transactions.

Not likely to join are JPMorgan Chase, Bank of America, Citigroup, and other banks with extensive payments systems of their own.

Somewhere in the corridors of the U.S. Treasury, Homeland Security, the FBI, and other agencies are watchdogs concerned about money laundering, financing of terrorism, and criminal activity who may enter the discussion on easier and harder-to-trace mechanisms for transferring cash.

What is the risk assessment for Mr. Zuckerberg and his partners?

A penny for your thoughts. &