Cover Story

Evan Greenberg

Evan Greenberg oversees a company with $95 billion in assets, operating in 54 countries.

So one might think the president, CEO and chairman of ACE Limited would be stretched to capacity leading global strategy and directing execution.

Despite the vast reach of ACE, however, Greenberg’s appetite for detail is so keen that he could show up just about anywhere.

Peter Zaffino, the president and CEO of Marsh, said he has walked into a room anticipating a meeting with ACE practice leaders or regional managers and found Greenberg at the table.

It doesn’t matter the topic, the audience or the geography. If he can, those who know and observe him say that Greenberg will dive into the layers and seek to understand the topic as well as anyone in the room.

“He is tireless in his pursuit and it is quite impressive,” said Zaffino.

“His mind is never at rest and it is almost always thinking about our company and our industry,” said John Keogh, ACE’s chief operating officer and vice chairman.

“There is an unbelievable capacity I have noticed in him to seek more information, whether it is company information or more information about the world.”

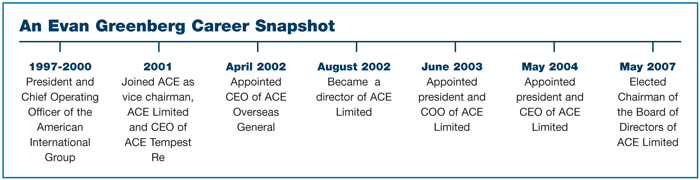

This May marks 10 years since Evan Greenberg became the president and CEO of ACE. He added the title of chairman in 2007.

In March, Risk & Insurance® sat down with Greenberg in an exclusive interview to discuss his career and personal interests.

Disciplined Underwriting

One might never encounter anyone quite like Evan Greenberg. His intensity, drive and intelligence are immediately apparent.

In conversation, Greenberg displays depth and range and is as animated in discussing his views on leadership and international politics as he is talking about what he treasures in his personal life.

A primary focus of Greenberg’s is the art and science of underwriting.

“This is a company of underwriters,” Greenberg said when asked about some of the keys to ACE’s success.

“We are managed by underwriters. All of senior leadership has a very strong underwriting background. We don’t take that lightly.”

ACE’s results support that statement.

From 2009 through 2013, the company recorded an average combined ratio of 91.4. In 2013, a record year for the company, ACE recorded a combined ratio of 88 and $3.8 billion in net income.

Those are superior results. You get them through vigilance, Greenberg will tell you.

“You know that you have to be standing on this business with two feet at all times,” Greenberg said.

“ACE prides itself on being a superb underwriting company, able to attract very smart and passionate underwriting talent,” said Greg Case, the president and CEO of global brokerage Aon plc.

“They are good at deploying their talent around a client where solutions are needed for risks that are difficult to transfer through conventional underwriting,” he added.

“A true leader is someone who recognizes the need for top talent and Evan has surrounded himself with an exceptional leadership team that is completely aligned.” — Greg Case, president and CEO of Aon plc.

Greenberg admits that his expectations are high and that he can sometimes be difficult.

“When I know it’s the right thing, I won’t compromise, even though it may be painful,” Greenberg said, in talking about what he demands of himself and the people that work for him.

“Evan can be demanding but it is always demanding from the point of view of being informed,” John Keogh said.

“He’s somebody you respect because usually what he wants out of you is no more than what he expects out of himself.”

ACE grew significantly in the past five years. It increased net premiums by nearly 30 percent and doubled its market value.

As the company grows, Keogh said its leaders keep a sharp eye out for the impediments of bureaucracy.

The company recently catalogued the number of committees it has to make sure they serve a purpose. Instead of bureaucracy, the focus at ACE is on individual accountability.

“We want to be a meritocracy,” Keogh said.

“We want to reward people and promote them based on what they have done, not based on the politics of who they know or who dislikes them,” he said.

Greenberg said he is loyal to those who prove themselves.

Keogh said the loyalty Greenberg engenders can be seen in how few upper level executives leave ACE.

“I have been here eight years and there has been very little turnover in the most senior ranks of the company,” Keogh said.

“Not only has he recruited top talent, he has also developed and advanced existing talent,” Marsh’s Zaffino said.

“A true leader is someone who recognizes the need for top talent and Evan has surrounded himself with an exceptional leadership team that is completely aligned,” said Aon’s Greg Case.

“Quite frankly, ACE moves as fast as any company that I interact with,” Zaffino said.

“And this has really been driven by Evan’s leadership. He carefully thinks through the strategy, decides to execute and then moves very quickly,” he said.

John Keogh said Greenberg pushes to get the details he needs to make decisions.

“He is definitely very involved in that company, he is not just some big picture guy,” said Cliff Gallant, an insurance analyst with Nomura Securities.

“Having a highly respected management team beneath him depends on having a guy who can press them and push them. That comes from many years of experience. Certainly his pedigree is unique. There is no one who has quite got his resume,” Gallant said.

As the result of an environment where frankness is encouraged and the need for bureaucracy challenged, ACE is earning a reputation as a company that makes careers.

“If you are a senior manager at ACE, you are asked to do a lot and you are asked to know a lot,” said Gallant.

“All of the executives that I hear about coming out of ACE, are highly respected industry-wide.”

Natural Leader

Evan Greenberg started his insurance career at AIG working for his father, Hank Greenberg, but nothing was handed to him there, his father recalls.

“I ran the company in such a way that I treated everybody the same,” Hank Greenberg said.

“Nobody got special privileges and that’s what made AIG what it was at the time,” he said.

Hank Greenberg said Evan Greenberg took full advantage of his background and went on to distinguish himself through his own hard work.

“He has done a great job,” Hank Greenberg said.

“In many companies, the higher the individual goes, the less they are involved in the business and that has never been true in the Greenberg family.” — Hank Greenberg, chairman and CEO of the Starr Cos.

“I’m very proud of what he has achieved. He certainly has demonstrated that he has the skills, the insight and the maturity to lead a big company.”

Not many insurance leaders earn the same degree of praise from Hank Greenberg.

“In many companies, the higher the individual goes, the less they are involved in the business and that has never been true in the Greenberg family,” Hank Greenberg said.

Evan Greenberg is also an industry leader, sources said, someone who is willing to address global regulatory and economic issues.

For example, he returns time and again to the topic of global financial services regulation and the shortcomings of Solvency II, the European-based financial regulation regime which he views as unnecessarily costly and bureaucratic.

Greenberg is vocal on the importance of the renewal of TRIA, and on the need for a strong U.S. foreign policy.

Few insurance leaders are making public statements like that these days, said Paul Newsome, an analyst with Sandler O’Neill.

“The industry over the last several years lost a number of leaders who would come out and make political comments that would have impacts for the industry,” he said.

“I wouldn’t say it’s completely unique, but he is definitely one of a relatively small number of individuals running big companies who will publicly take positions,” Newsome said.

“He is very comfortable taking his positions on key issues to public forums in an effort to encourage an industry-wide focus, and I have always found him to be willing to listen to opposing points of view,” said Aon’s Case.

Case said that is true not only for regulatory topics but in the area of innovation.

“Evan is right about the need for continued innovation — it is what clients expect from our industry,” Case said.

A Unique Path

After high school, Greenberg eschewed the beaten path and took to the road.

“I spent three and a half years living in a lot of different places and doing a lot of different jobs,” Greenberg said.

“And I learned a few things. I learned it’s not so bad to have nothing,” he said.

He also learned that anyone who takes their job seriously can find themselves in the work.

“It’s something that someone has the discipline to find, or not,” he said.

After getting his start at AIG, Evan Greenberg rose through the ranks, eventually becoming president and COO from 1997 through 2000 before leaving to join ACE in 2001.

Hank Greenberg says going over to ACE was a good move for Evan.

“Evan decided at one point that he wanted to strike out on his own and I don’t blame him for that,” Hank Greenberg said.

“I think it was the right thing to do. He did it and he has done very well at it,” Hank Greenberg said.

A big reason Evan Greenberg does so well in insurance is because he loves the business, numerous sources said.

A big reason Evan Greenberg does so well in insurance is because he loves the business, numerous sources said.

“As the magnitude, complexity and speed of risk continue to grow, the leadership roles in our industry become even more challenging,” said Greg Case.

“But whenever Evan and I meet or talk on the phone, you can tell he is really enjoying what he is doing,” Case said.

ACE’s John Keogh said that’s also evidenced by the speed at which Evan Greenberg works and how much he packs into a day.

“You have to love what you are doing to be that committed, day in and day out, the way I observe him,” Keogh said.

“You know I think there is no substitute for hard work,” Greenberg said.

“There is no substitute for truly knowing your craft and loving it. To really know it, you have to love it.”

If you don’t have a genuine passion for what you are doing, he said, those who report to you can tell.

In Private

Evan Greenberg is as multi-faceted as the company he runs. He expresses a love of nature and activities that require quick and precise action.

He is an avid skier and horseback rider.

“I am a curious cat and my natural state is not at rest,” he said.

“I love nature and animals. When I am not working in an urban environment you will find me in nature,” he said.

And he’s a blues rock fan.

“I think Gary Clark Jr. is the best guitarist on the planet today,” he said.

Greenberg places a great emphasis on family. In his New York office, family photographs line the book shelves.

“I don’t have the need for lots of friends,” Greenberg said.

“But I have a real need for my wife and children. I love my family and I love spending time with them,” he said.

John Keogh said that Greenberg picks his spots when it comes to charity work and other activities outside the workplace.

“He will not do something unless he can give it his full energy and attention,” Keogh said.

Despite the high position he holds in business, Greenberg sees himself as “just a guy,” someone who can relate to anybody.

“I believe most people want to live their life with a sense of dignity and a sense of pride,” he said.

“And what you do, not what you may think you do, is the key to life.”