Risk Scenario

A Dim View

Disclaimer: The events depicted in this scenario are fictitious. Any similarity to any corporation or person, living or dead, is merely coincidental.

All’s Well That Begins Well?

Darryl Korn shook off his loafers and propped his bare feet next to an errant branch of rosemary on the stone wall that separated his patio from the long slope down to the Missouri River. As the light faded, he sipped the Provencal rosé in his glass and let the fruity dryness of the wine pucker his mouth into a happy grimace.

Korn, the CEO of Heaven’s Gardens, a Midwestern retailer based in Jefferson City, Mo., specializing in high-end patio and lawn furniture and accessories, was literally in his element.

A wood fire burned not far away in one of his company’s stone pizza ovens. Just a few minutes now and the flatbread he’d made with his own hands would be in there bubbling.

With his wife and children in town seeing a movie, this was one of those moments he wished he could capture; peace of mind, how rare it was.

It was the sight of the dying light on the river that got him thinking about work again. River: flood risk.

Korn’s workday included a review of his company’s risk management program with his risk committee. Most CEOs wouldn’t sit in on such meetings, but Korn did.

Korn felt great about the meeting. He reflected on how the company documented and ranked all property risks, flood, named storm, earthquake and tornado on a matrix broken down by zip code.

The company also worked with its carrier on an engineering risk assessment that provided the carrier with crucial information such as the age of the buildings and the construction materials they were composed of.

With operations bordered by Idaho, Utah and Arizona to the West and Tennessee, Kentucky and Ohio to the East, the company was particularly keen on showing underwriters its crisis management and business continuity muscle in the wake of a tornado, flood or earthquake.

Transparency and good data, that was the way to good coverage at the best price, Korn told himself, secure that he had mastered risk management wisdom that people at the C-suite level, even in mid-2015, didn’t usually concern themselves with.

Equally satisfying to Korn was the risk committee’s report on the company’s financial and operational resilience risk management strategy. From interest rate swaps to alternate energy suppliers in the face of catastrophe, it was all there.

***

The underwriter for Heaven’s Gardens, Hammond Kresley of regional insurer Butte Mutual, was enjoying a similarly peaceful sunset from his deck across the river. Although, being an underwriter, Kresley had a single malt in his hand.

Butte Mutual’s property portfolio, which roughly mirrored Heaven’s Garden’s geographic focus, was also broken down and ranked by zip code and degree of risk. Just as it did with Heaven’s Garden, Butte Mutual worked with many of its property insureds to provide risk engineering services that provided a deeper dive in the underwriter’s quest for transparency and good data.

Butte Mutual’s confidence in the diversity of its book of business and its approach to risk engineering was such that it had aggressively sought out new property business in this rate-challenged environment.

The company considered its approach to data, engineering and underwriting a differentiator, something that allowed it to take on business that its competitors wouldn’t dare to.

Darryl Korn was setting down his glass of rosé to slide the pizza in the oven when it hit. As his wine glass fell and shattered and the plate glass windows on the back of his house cracked, Korn initially thought the region was being bombed. It took seconds until he realized that for the first time in his life, he was experiencing an earthquake.

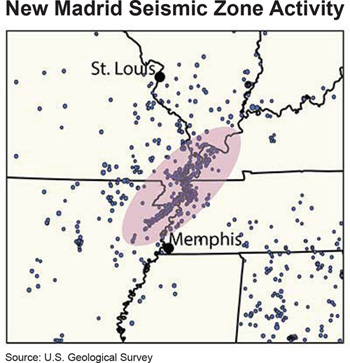

The earthquake was a 6.9 on the Richter scale on the New Madrid Fault, severely damaging numerous regional companies.

Scrambling for Information

Thankfully, Korn and his family escaped injury in the rare Missouri quake, but his company didn’t.

Yes, everyone knew about the New Madrid Fault. But no one thought it would rupture, or at least not at this intensity.

Yes, everyone knew about the New Madrid Fault. But no one thought it would rupture, or at least not at this intensity.

One of the cruelest twists for Heaven’s Gardens was that the facility which housed its servers– which the company boasted to underwriters was well out of reach of a flooding Missouri River or any of its tributaries– was badly damaged in the quake.

Store managers and operations staff accustomed to digital communication with headquarters were knocked off line and were slow to get important information to headquarters.

Thus, exquisitely bad data clouded company leadership’s perspective for the first few days after the quake.

“I don’t think we lost a single major supplier, “the company’s logistics chief, Raif Heck, told Korn and other leadership the day after the quake.

But due to poor communications, the company learned two days later that Heck was wrong.

Two of the metal fabricating companies that supplied Heaven’s Gardens with its grills and additional oven hardware were severely damaged. Ten Heaven’s Gardens stores in Missouri and Illinois were also hit hard.

Two of the damaged stores were in St. Louis, which meant the loss of key sales producers.

After suffering a delay due to bad information, the company scrambled to identify alternate hardware suppliers, but the process dragged on and on. Even undamaged stores suffered delays in reopening due to overwhelmed municipal inspectors being unable to visit properties quickly enough to issue certificates of occupancy.

The inspection delays got so bad that Korn himself got on the phone with the deputy mayor of St. Louis.

“There’s not a single crack in those structures,” Korn said, in one of several instances where he completely lost patience with the chaos all around him.

“No way can we issue certificates of occupancy until we get those properties inspected and we are still days away from that,” the deputy mayor replied.

“Days?” Korn exclaimed.

****

“Days.” said Hammond Kresley, in a meeting with the Butte Mutual reserving oversight committee (ROC), as it tried to get a handle on what sort of reserves it was going to need to set aside to cover insured quake losses and business interruption losses.

That screeching sound they all heard was Butte Mutual’s aggressive underwriting program — that it built up and justified over years — grinding to a halt.

Until it could get a handle on its quake losses, the carrier wasn’t going to take on any new business that looked even remotely risky.

A month after the quake, Heaven’s Gardens was seeing double-digit sales drop-offs in its undamaged stores due to its supply problems. The company prided itself on locally sourced materials and simply didn’t have the backup suppliers to keep it going in a meaningful way.

Quake damage to retail sites and first- and second-tier suppliers was something the company had known was possible. What was so maddening was the fact the company had paid a good deal of money for a risk engineering assessment and now all of that looked like it was going to waste.

The risk engineering assessment was great from a premiums paid and eventual claims perspective, but not much use with business recovery. Not from this rare earthquake event anyway.

It was like the company was blind where it most needed vision. What exactly was down and how bad was the damage? That was the problem.

Permanent Impairment

By the summer of 2016, a mere year after the ῀M 6.9 quake that rattled Missouri and Illinois, Heaven’s Gardens, from a revenue perspective, had lost 15 percent its pre-quake size.

When it came to design and product execution, the company was spot-on with its approach to functional, rustic outdoor furnishings. Its “locally-sourced” mantra was also golden.

But that ended up mattering little to frustrated customers who couldn’t pick up the equipment they’d ordered due to supply delays. Brand loyalty still meant something in this country, but not so much that somebody who ordered a pizza oven in April was happy to get it in October.

A year after the quake, the company still hadn’t found the second of two grill and fittings suppliers that met its local sourcing and design criteria.

Competitors to the East and West, some of them whose design couldn’t hold a candle to what Heaven’s Gardens produced, moved in to pick up pieces of the company’s business.

***

It took Butte Mutual six months to determine something that should have been good news but wasn’t. It turned out that the carrier had more than enough reserves to comfortably withstand insured losses from what became known as the “Hannibal Cannibal,” the quake named for its epicenter in Hannibal, Mo.

But a lack of visibility into its property portfolio meant the carrier failed to take the aggressive action it needed to take in these market conditions.

Deprived of the fullness of its topline growth potential, Butte Mutual survived, but its tepid growth for the next three years was off-putting to shareholders.

The company should have been a regional carrier star and instead became a mediocrity.

![]()

Risk & Insurance® partnered with Esri to produce this scenario. Below are Esri’s recommendations on how to prevent the losses presented in the scenario. This perspective is not an editorial opinion of Risk & Insurance®.

1. Engineer success: Using GIS to determine property vulnerability on the front end of a catastrophe is a well-accepted practice. But what about the back end? Consider leveraging access to high resolution geographic information from ArcGIS that can provide disaster damage assessment on the back end, mitigating the chance of overwhelming field staff and supporting faster and more efficient response to your property customers.

2. Protect against data and communication losses: Depending on access to your own company’s physical data storage and communications infrastructure following a disaster could be severely shortsighted. Consider ArcGIS cloud and mobile solutions that house data and provide communications capabilities outside of your natural threat footprint.

3. Ask more of business partners: Using location information Heaven’s Garden constructed reasonably sound business continuity and disaster recovery plans for each of its facilities. But its network of suppliers lacked this same insight. As a consequence, the company suffered supply chain failures that greatly inhibited its ability to recover from the New Madrid earthquake.

4. Demand and ensure better transparency: Using ArcGIS post event data and imagery gives you visibility in real time to property damage and other crucial information in the aftermath of a disaster. Settling for a listing of possibly affected properties categorized by ZIP code is an outmoded method of assessment that will not be looked at favorably by underwriters and will be a boon to your unimpacted competitors.

5. Speed of recovery: Risk managers and their organizations cannot place enough emphasis on speed of recovery. Stories are emerging post-Superstorm Sandy and other recent disasters about risk managers who through preparation and boldness got on the loss scene and had their businesses back up in a fraction of the time that it took competitors. Nothing is holding you back but conformity.