Sponsored: Delphi Technology Inc.

Digitization and Automation: Bringing Speed Where it’s Needed

Technology offers advantages of speed, efficiency and accessibility, but it can also be a disruptive force. Insurance has struggled to keep up with the pace of advancing technology. As an industry, it manages vast amounts of data but also contends with bulky legacy systems that make it difficult to implement new solutions.

Technology offers advantages of speed, efficiency and accessibility, but it can also be a disruptive force. Insurance has struggled to keep up with the pace of advancing technology. As an industry, it manages vast amounts of data but also contends with bulky legacy systems that make it difficult to implement new solutions.

On the other side of the coin, technology acts as an equalizer for newer, smaller carriers that are better positioned to implement the latest tools, allowing them to compete on the same playing field as larger players.

When speed to market offers a critical competitive advantage, large carriers have to find ways to update old processes and harness technology’s benefits.

Product managers in particular shoulder the largely manual process of importing industry-standard updates, analyzing them, and implementing any changes needed to existing coverages. The multi-step process is both time-consuming and expensive.

“According to Novarica research commissioned by the ISO, any carrier performing this in a manual way without any electronic means to do the analysis and evaluation are about half as current and are spending twice as much money as carriers using some automation,” said John Flavin, Senior Vice President and Chief Business Development Officer, Delphi Technology, a provider of business software solutions to the insurance industry.

Large carriers with many product lines in multiple territories could be receiving circulars from The Insurance Services Office (ISO) on a weekly basis. Each one contains product definition updates that the carrier may have to implement either to stay compliant or simply to stay competitive.

John Flavin, Senior Vice President and Chief Business Development Officer

Product managers have to compare the updates to their current product and examine what underwriting rules, rating algorithms and forms may need to change if the update is implemented — and how those changes will impact their book of business. They need input from internal stakeholders, including underwriting, legal, marketing, IT and actuarial representatives. And don’t forget external approval from regulators. All this before policy administration systems can be updated with the correct product information.

Completing each step of this process manually can take months, and a lot of dollars.

“On average, based on industry research performed for ISO, implementing an ISO circular completely manually costs about $45,000,” Flavin said.

In the meantime, companies with digitized methods are getting to the market sooner and nibbling away at market share.

Accelerating Product Management

Delphi Accelerator helps to digitize and automate this process.

Delphi Accelerator product workbench allows imports of ISO ERC and AAIS product data and rate tables into a central dashboard — a self-contained area where product managers have easy access to the information and tools they need to configure and maintain insurance products. Importing industry standard or proprietary content digitizes the content, making it easy to analyze and manipulate.

Key product processes can then be carried out in the dashboard: comparison and analysis of product definition changes for rate maintenance, configuration of product definitions to carrier-specific conditions, sharing with stakeholders and obtaining approvals.

Finally, updated definitions can be deployed from one central dashboard to many policy admin or point-of-sale systems. When done manually, there is no way to mass export new information to many systems from one source. Using Delphi Accelerator cuts down on the time it takes to make new product definitions available for the market.

This digitized process not only cuts months of work down into just weeks or days, but also yields significant cost savings.

“Using electronic means, ISO circular implementation costs 60 to 85 percent less than the manual method, according to research done for ISO by Novarica,” Flavin said.

Any new or updated products of course need both internal and external approval before they can be deployed. The sheer number of stakeholders involved in decisions to implement ISO changes, or launch or consolidate products, is perhaps the biggest speedbump for the insurance industry.

Delphi Accelerator’s dashboard packages new ISO, AAIS or proprietary content, product comparisons and impact analyses into a centralized and easy-to-navigate space where internal stakeholders can review proposed changes easily and deploy and maintain products. Without Delphi Accelerator, product managers have to configure carrier-specific product definitions separately on each policy admin system for different parties to see.

Quick Comparison

While there are many benefits of this technology, one of its most impactful features is its comparison tool.

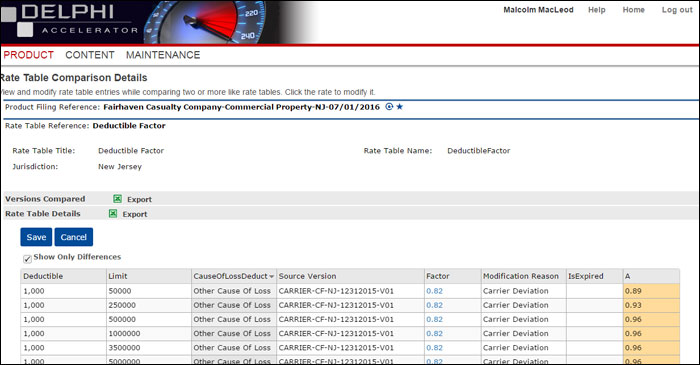

“If ISO publishes a circular with rate changes, product managers can quickly compare the proposed changes to the policy definition that’s in place already,” Flavin said. “They’re able to see key pieces of information that make up the product definition, including coverages, rates, algorithms and domains.”

Figure 1 – Rate Table Comparison Details – shows Deductible Factor differences between the Product Manager’s override in the “Factor” column and the industry standard table in column “A”.

The comparison tool helps product managers determine quickly whether or not a change needs to be implemented, but it also expedites the process of launching new products or consolidating existing ones.

“If a product manager is debating launching into a new territory, they could easily pull down that state’s industry standard product definition, layer on their own carrier-specific configurations, and start to run test quotes within Delphi Accelerator,” Flavin said.

Without automation, gathering ISO data and assembling test quotes to share with stakeholders would require a large chunk of IT resources, and a lot of time. Delphi Accelerator allows decision-makers to see proposed quotes in a test environment before publishing those quotes to a network of policy admin systems.

Improving the Bottom Line

Delphi Accelerator’s analysis features also help carriers capitalize on business opportunities by facilitating product consolidation.

More carriers are looking for ways to deliver the same coverages in a more efficient way in order to reduce expenses. In the current low interest rate environment, insurers can’t rely on investment income to bolster their expense ratios. Merging product lines offers a way to trim overhead expenses without compromising coverage or sacrificing premium dollars.

Take for example a business owner’s policy. Traditionally, this policy covers all the exposures that a small- to medium-sized Main Street storefront businesses might face — general liability, property, crime, business interruption, etc. Over time, though, the product has expanded in the market to cover independent contractors and various business services. Many BOPs now resemble a commercial package policy that is geared more towards more complex and specialized risks.

“Rather than maintain both a business owner’s and a commercial package policy, product managers may look into joining the two into a single product. This would cut down overall expenses while meeting the needs of both target markets,” Flavin said.

Delphi Accelerator’ s rating impact analysis tool allows product manager to create benchmark pricing for the new product and compare it to the books of business for the two original products.

“The rating impact analysis will help users to understand what the true premium change will be and how that impacts the overall book of business,” Flavin said.

“The gains in efficiency offered by automation are clear. The old paper processes simply won’t cut it anymore,” Flavin said. “Any carrier that can maintain, manipulate and share their content efficiently in a cost-effective manner will win the day.”

To learn more about Delphi Technology, visit http://delphi-tech.com/.

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with Delphi Technology Inc. The editorial staff of Risk & Insurance had no role in its preparation.