3 Reasons Why We Expect the D&O Market to Harden

There are many elements that come together in a perfect storm when major changes occur, and the developments behind a harder D&O market for 2019 are no exception — there is a lot of disruption in the marketplace, especially with respect to claim patterns; this has carriers on edge.

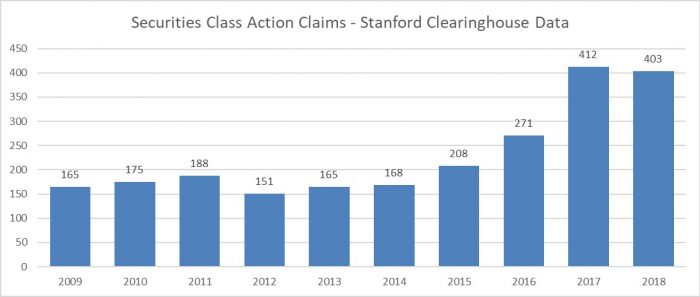

Our most reliable indicator of market movements is changes to the annual count of securities class actions (SCAs). SCAs have rocketed upward — as shown on the graph below — for a number of reasons. The annual claim counts shown for 2016, 2017 and 2018 exceed all years of the post-1995 modern period, except 2001 and 2002 (incidentally being the key years for the last big hard market for D&O). Note also when reviewing the SCA Claims chart that normal expectations have been for SCAs in the range of ~200 per year, as the 2002-2016 average was 195 claims per year.

Driving the aberration years of 2017-18 are many factors, some viewed as highly problematic, whereby we may need Congress versus the courts to slow claim cost trends as respects IPOs or M&A litigation. Here is a summary of a few items to consider:

1) M&A related claims have shifted and their claim costs are higher than anticipated.

- The shift has been for more Federal claims versus state court actions that were prevalent before the 2016 Trulia decision in the Delaware Chancery Court.

- Claims costs for “typical” settlements of M&A disclosure only issues are ~$2M for the settlement portion but matched by another $2M in plaintiff attorney costs before we add about ~$1M for defense costs. Some of this data is courtesy of Chubb, which has been researching why these “minor” claims have been so costly in total. The good news is that many such claims are still dismissed, resulting in defense costs only.

- The bad news is a few M&A claims have blown up into dramatic claims stories, such as two of the largest derivative actions (Activision Blizzard and Freeport-McMoRan)

2) Event-driven claims are a new category brought primarily by “emerging” D&O plaintiff firms.

- Such claims focus on operational issues, such as Arconic’s cladding of the Grenfell Tower, Anadarko’s shutting down 300 wells after an explosion or Caterpillar’s overseas tax strategy coming into question. The emerging plaintiff group represents more than 40 percent of SCAs today — just 12 years after entering the D&O claims arena. They tend to have smaller average settlements but against smaller than average companies and with larger than average defense costs associated with their claims.

3) D&O claims for cyber breaches and EPL events (sexual harassment or discrimination) are rising.

- More than a dozen new claims about cyber security mismanagement are sometimes becoming costly (e.g., Yahoo! and a $80M settlement).

- More than a dozen #MeToo-oriented claims have settled for big numbers as well, with recent settlements including $90M involving Twenty-First Century Fox.

- Some events are morphing into Derivative Actions or other “Side-A” claims against the individual directors and officers, including the Fox claim as well as another 10+ claims with settlements in excess of $60M.

- The recent Cyan decision allows alleged violations of The 1933 Act (think IPOs) to be brought in either federal or state courts (or both) and suggest large defense costs to defend.

- D&O prices have headed down for most publicly traded companies for several years in a row in part due to new capacity over the last 5 years and reasonable profits until 2016 or 2017. Now both new and old capacity are being run over by claim costs without sufficient premium to break even.

In short, two trains running on parallel tracks have recently turned to face each other and now are accelerating at each other for a collision unless one or the other moves. The trains are D&O premium costs and D&O claims costs, and their collision is a hard market that has gently begun in the U.S. with small increases being demanded for some very good accounts. &