Sponsored Content by IWP

CTE: What Lies Ahead for Workers’ Comp?

The summer of 2017 saw the first claims paid out to retired NFL players from the $1 billion settlement fund created in the wake of the class-action lawsuit brought by former athletes against the league. In the suit, retired players alleged that the NFL covered up evidence of the damaging neurological effects caused by repeated hits to the head.

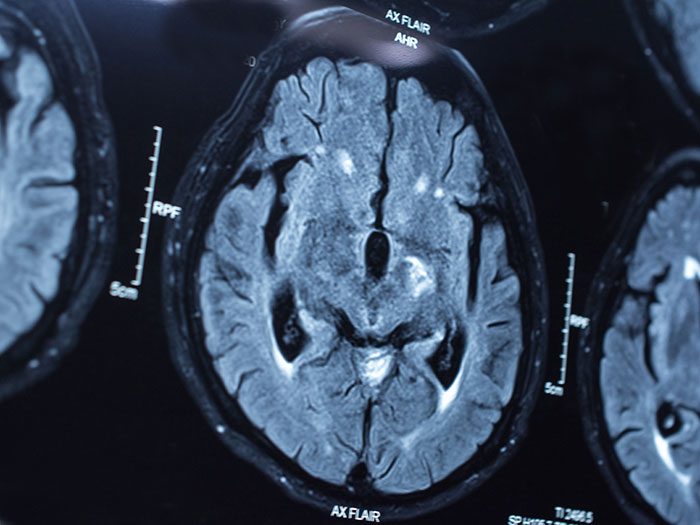

At the root of that neurological damage lies Chronic Traumatic Encephalopathy, or CTE.

CTE may cause a host of cognitive and behavioral problems, including depression, aggression and violence, paranoia and impulse control, impaired judgment, confusion, progressive dementia, Parkinson’s and Alzheimer’s disease.

But those symptoms may not manifest until someone reaches their 40s or 50s. The brain damage can begin decades earlier and builds over time through repeated sub-concussive hits to the head. The type that linemen can sustain dozens of times within a single game.

Linking the symptoms to CTE is difficult, though, because the condition currently can only be diagnosed after death.

The NFL controversy might have swiveled the spotlight onto CTE and raised public awareness, but it has also raised questions and concerns in other industries. There’s no telling how many other professions are at risk of sustaining head trauma and developing the disease.

“As we learn more about CTE, it opens the door to other types of professions where it’s not an emerging issue yet because they are not as high-profile as professional sports,” said Danielle Jaffee, Manager of Government Affairs, IWP.

As research sheds more light on this neurodegenerative disease, proactive discussions about the risk of CTE can help the workers’ comp industry stay ahead of the curve.

Researchers Take on CTE

Danielle Jaffee, Manager of Government Affairs

The NFL settlement compensates former players experiencing CTE symptoms for medical testing and further care, but freed the NFL from admitting fault or disclosing what it knew and when about the link between repetitive head trauma and CTE.

But others are quickly filling in the gaps.

Boston University’s CTE Center has identified markers in brain tissue that indicate CTE, and researchers are moving toward the goal of developing a method to diagnose CTE in living people, as well as potential treatments. It draws on a bank of 425 donated brains, 270 of which have been diagnosed with CTE.

Other entities like the Brain Injury Research Institute and Stanford University are also studying ways to identify CTE in a living brain, and what sources and types of trauma may lead to degeneration of brain tissue.

But they remain a long way off from understanding how to diagnose or effectively treat the condition.

Workers’ Comp Implications

“We don’t yet have a test in place that could indicate if a living person has CTE,” said Jaffee. “And you can’t have a workers’ comp claim without a diagnosis. So while CTE hasn’t impacted our industry yet, it certainly has the potential to do so.”

The NFL lawsuit could provide a rough blueprint for how claims may be handled in the future, but challenges emerge in variations among states’ classification of professional athletes.

Many states bar professional athletes from filing workers’ comp claims or set caps on payout amounts, so claims filed in the NFL settlement won’t translate directly to a workers’ comp scenario.

“There are states like Kansas that define professional athletes as employees, but other states like Florida specifically exclude them. And then there are states that defer to labor union contracts,” Jaffee said. “If there were less restrictions on professional athletes, you might have greater likelihood of them filing claims.”

Thirty-eight former players involved in the NFL lawsuit did opt out of the settlement, preferring to pursue their own claims individually in state court.

“They’re trying to force the NFL to cover CTE as a workers’ comp claim, but the court system is slow and we haven’t seen yet how that will play out,” Jaffee said.

Even if the courts allow athletes to file a works’ comp claim, it’s uncertain whether they’ll recognize CTE as a compensable injury due to its cumulative nature. State laws again vary in whether cumulative trauma qualifies as a workers’ comp injury, and claimants will bear the burden of proving a direct link between their symptoms and their tenure as pro football players.

Despite these challenges, “I think a professional athlete making a workers’ comp claim for CTE is how we’re going to figure out how it works – if it works – and how we should respond as an industry,” Jaffee said.

Getting the Conversation Going

In the face of so many unanswered questions, how can stakeholders in the workers’ comp industry prepare for future CTE claims?

“At IWP, our goal is start a conversation around this topic with all stakeholders: the insurers who would cover claims, the PBMs that would handle the medications, the pharmacies and doctors treating the injury, and the legislators and policymakers crafting state law. Even the lawyers who could represent claimants, whether they are professional athletes or not,” Jaffee said.

“We’re trying to stay on top of things that will impact our industry and make sure that these discussions are happening now so that no one is caught off guard.”

It will take time for further research to illuminate the details of how CTE develops and progresses, and what could be done to treat the disease before it’s too late. But there is enough understanding to drive preventative measures and find ways to reduce repeated head trauma.

Even the NFL has encouraged safer tackling techniques and flag football as an alternative for younger players.

CTE might not have an impact on worker’s comp in the next year or even five years, but planning ahead will yield less confusion and better outcomes for providers, payers and claimants alike.

“Through these conversations, and as we learn more about CTE, we’ll be looking at our workers’ comp systems and questioning if those systems are the best avenue to handle these claims. And if not, do we need to figure out a better way?” Jaffee said.

“We’re here to start and facilitate that conversation so that states can effectively serve their communities in this area as it emerges.”

To learn more, visit https://www.iwpharmacy.com/.

This article was produced by the R&I Brand Studio, a unit of the advertising department of Risk & Insurance, in collaboration with IWP. The editorial staff of Risk & Insurance had no role in its preparation.