2018 Most Dangerous Emerging Risks

Climate Change as a Business Interruption Multiplier

A string of winter storms dropped more than 60 inches of rain on California’s Central Coast this year, washing out roads, triggering massive mudslides and threatening the integrity of already-fragile bridges. The Pfeiffer Canyon Bridge is one such structure. As the ground beneath gave way, the bridge slid downhill several feet and developed a sizable crack, making it too unsafe for travel.

The Pfeiffer Canyon Bridge is also the only link between popular vacation destination Big Sur and the rest of the world to its north. To its south, a landslide left Highway 1 — the only road in from that direction — covered with boulders and hills of dirt. Four hundred and thirty-five people were left trapped in between.

Businesses scurried to arrange other ways to bring in needed supplies while dealing with a shortage of workers who were blocked out by the rubble. Hotels would obviously not be greeting any new guests for some time — that stretch of Highway 1 is set to be closed for 18 months.

Failing infrastructure increasingly poses business interruption risk. Collapsed bridges and mudslide-barred highways may be extreme examples, but more commonplace events like burst pipes and sinkholes can shut down streets and leave the businesses populating them stranded, disconnected from suppliers, distributors, employees and customers.

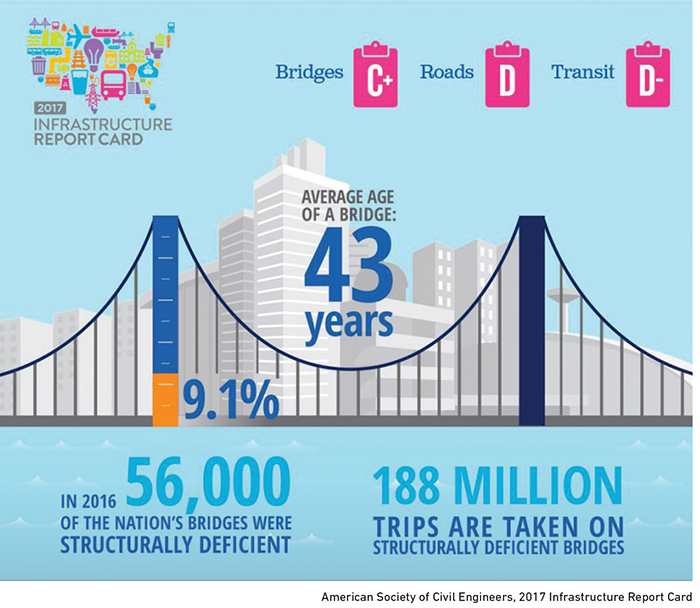

The American Society of Civil Engineers (ASCE) has evaluated the state of the nation’s infrastructure since 1988, when the congressionally-commissioned National Council on Public Works Improvement put out its first “report card.”

Even then, the marks weren’t good.

“After two years of study, the National Council on Public Works Improvement has found convincing evidence that the quality of America’s infrastructure is barely adequate to fulfill current requirements, and insufficient to meet the demands of future economic growth and development,” the 1988 report said.

Since then, the ASCE has given U.S. infrastructure a “D” grade in every subsequent report card.

In 2016, “9.1 percent of the nation’s bridges were structurally deficient,” according to the latest report card. The ASCE estimates that rehabilitation and improvements to highways and bridges alone will require $836 billion — a number that doesn’t include repairs to railways, airports, dams, levees, ports, or energy, water or waste systems.

“The elephant in the room is the funding,” said Adrian Pellen, North American infrastructure leader, Marsh’s construction practice. “Governments have deferred maintenance on infrastructure forever, and we’re at this critical juncture where we need the investment, and the funding mechanisms just aren’t there.”

The gas tax — the primary revenue source for government-sponsored infrastructure projects — is not adjusted for inflation and has not risen in more than 25 years. And with more electric and fuel-efficient vehicles replacing gas-guzzlers, the tax is yielding less than ever.

“Getting a gas tax increase right now would be very difficult. And there is a political divide over how to fund large projects that is causing further delay,” Pellen said.

Democrats call for more federal investment, while Republicans want to pass the bulk of responsibility to the private sector. Public-private partnerships (P3) have been successful on some large projects.

“P3s push design, construction, financing and the operation and maintenance of infrastructure down to the private sector,” Pellen said. “These can be a very efficient way to deliver infrastructure on time and on budget, but they aren’t the magic bullet for all of our infrastructure needs. There are still politicians on both sides of the aisle who aren’t fond of them.”

Amid the political and financial delays, climate change and increasingly severe weather patterns are adding more and more pressure to aging structures not equipped to handle it. This exposure will get worse before it gets better and is going to create business interruption losses in the millions for some, knocking other businesses out altogether.

Insurance Options

Businesses like those in Big Sur, cut off by failures of critical infrastructure, have few insurance options to help them recover their losses. Traditional business interruption (BI) coverages stipulate the covered property must incur some physical loss or damage. Contingent BI policies are only triggered if the insured’s suppliers incur such damage.

So what happens when there’s no physical loss to a property or any of its supply partners?

“The market struggles with non-damage business interruption,” said Rich Clark, managing director, Gallagher’s hospitality practice.

“Standard ISO-based policy wording would not provide coverage for this type of scenario regardless of the cause of the loss to critical infrastructure,” said Brendan Osean, principal, EPIC Insurance Brokers & Consultants. “But if they have broader manuscript policy wording, there may be some coverage.”

Ultimately there are three potential solutions — ingress/egress, civil authority and parametric policies — but each comes with its own limitations.

Ingress/egress and civil authority coverages may offer indemnity for non-damage business interruption losses, but only if the cause of the loss is specifically covered.

For example, a hotel may experience a loss of business if a flood washes out the road to their property. But if they aren’t located in a flood zone, and flood is not a named peril under their ingress/egress policy, then there would be no coverage.

“Governments have deferred maintenance on infrastructure forever, and we’re at this critical juncture where we need the investment, and the funding mechanisms just aren’t there.” — Adrian Pellen, North American infrastructure leader, construction, Marsh

Same goes if the cause of loss to a piece of critical infrastructure is simple deterioration. Gradual wear-and-tear is not considered a covered cause of loss, so if a bridge or tunnel collapses simply due to its age, any affected business could not recover from an ingress/egress policy.

Insured perils could include earthquake, windstorm, heavy snow, rainfall, hurricane or flood, depending on the location.

“Even if an ingress/egress policy is triggered by an insured peril, these policies typically only offer coverage for 30 to 90 days of interruption. If you’re dealing with a total bridge or tunnel collapse, it’s likely to be longer than that,” Clark said.

Similar exclusions apply to civil authority policies. These cover instances where a government authority shuts down a roadway or transportation system due to an imminent safety threat. Again, that safety threat must be an insured peril and must actually come to fruition in order for the coverage to respond.

Both types of coverage may also impose mileage limitations. The loss to infrastructure would have to occur within a designated radius from the insured location.

“We most commonly see 5- or 10-mile limits, sometimes up to 25 miles,” Clark said, “but there is no standard.”

Greg Schiffer, global head, engineering, Swiss Re, said neither ingress/egress nor civil authority coverages were designed to address exposure related to loss of critical infrastructure.

“These policies are usually sub-limited, and they have waiting periods and time limits. They were not designed for this type of loss, and any recovery from them would be indirect or unintended,” he said. “They might respond to a loss caused by a natural peril, but when it comes to infrastructure, lack of maintenance is a bigger issue, and lack of maintenance is not a covered cause of loss.”

Parametrics, a relative marketplace newcomer, offers a third option.

Parametric Possibilities

“Parametric coverage triggers are not indemnity-based, so they aren’t based on an individual client’s actual loss. If you hit the coverage triggers, you get the payout,” EPIC’s Osean said.

Most parametric coverages are built around weather events. Typical triggers would include a certain wind speed sustained or inches of rainfall over a designated period of time, an earthquake of a certain magnitude, or extreme temperature changes.

“Depending on your risk tolerance, you could manuscript wording to apply these triggers to a radius around your property that includes a critical piece of infrastructure,” Pellen said.

If severe weather meeting the policy parameters causes a road or bridge to become impassable — as in the case of Big Sur — the insured property still receives the payout, even if it sustained no physical damage itself.

“You can define the payout in line with what your anticipated business interruption losses would be,” Pellen said.

Some airports, he said, are already using parametric solutions this way. With finite budgets for maintenance, snow removal and salting, airports have used payouts from parametric coverages to supplement those funds and help with cleanup after a storm — even if the airport sustained no significant physical damage.

As with ingress/egress and civil authority policies, however, gradual deterioration would not trigger any coverage. There’s also the possibility that a storm will cause damage to critical infrastructure — and a subsequent business interruption loss — without hitting the triggers set by the policy.

Parametric products may also be too pricey for some. Osean said they come with frictional expenses and “may not be economical for mid-size organizations.” But Jamie Crystal, EVP, Crystal & Company, disagreed.

“As opposed to buying a year’s worth of BI insurance, you may only need this cover for a few weeks. If you’re buying a million dollars’ worth of insurance at a 4 percent rate, that’s still only $40,000. And you might not need more than $1 million,” he said. “To me, it’s a very viable and cost-effective way to protect a company from loss to critical infrastructure.”

Risk Mitigation Strategies

Risk Mitigation Strategies

Plenty of examples from the CAT-heavy year of 2017 show this risk is real. One only has to look to California, the Florida Keys or any number of small coastal islands to see how infrastructure failure cuts off the livelihood of an entire town.

But these aren’t Black Swan events — it is possible to plan for them. And as increasingly unforgiving weather weakens already-vulnerable infrastructure, there’s no time like the present.

Risk managers should consider their dependency on critical infrastructure as part of a risk analysis. Having only one way in or out, for example, should spark some concern. How reliable or exposed is that route? A probable maximum loss study should consider all peril-related losses, including losses related to neighboring assets. Simulations can estimate the likelihood and extent of a loss.

“It requires the recognition on the part of the organization that this could happen, and putting thought into how it will respond if it does happen,” said Jill Dalton, managing director, Aon Global Risk Consulting. “Do tabletop exercises. Try to quantify the financial impact. Once you figure that out, you can prioritize how to respond.”

“If your business is dependent on a bridge or a major road, what are you going to do if that bridge goes down? Each organization has to figure that out on its own.” — Jill Dalton, managing director, Aon Global Risk Consulting

Though no organization can prevent a bridge collapse or mudslide, they can develop a plan of action to maintain operations as best as possible.

“Whether it’s your employees, or guests getting to a hotel, or goods getting to and from a manufacturer or distributor, it’s all about having a business continuity plan,” Dalton said.

“If your business is dependent on a bridge or a major road, what are you going to do if that bridge goes down? Can any other location pick up the extra work? Are there third parties you can rely on? Do you have other supply chain options? Each organization has to figure that out on its own.”

Beyond continuity plans, the best course of action is to obtain the broadest coverage available. According to Clark at Gallagher, coverage for an infrastructure-related business interruption loss will often come down to what you can negotiate out of your property policies.

“Analyze your coverages and see what’s excluded and how you might be able to get more of the exposure covered. Manuscript forms or endorsements can give you more options,” Osean said.

“You can determine your exposure and what your appetite for that is. There may not be off-the-shelf solutions, but brokers certainly are capable of bringing some solutions to the table if they have the foresight to ask the right questions,” Crystal said. &