Regulatory Compliance

Clampdown on Corruption

If one doubts that progress is being made in anti-corruption enforcement in some of the world’s corruption hotspots, look no further than Brazil.

In a bid to clean up the country’s energy sector, investigators unearthed a network of bribery and corruption that would, over three years, lead to the impeachment of President Dilma Rousseff, a nine-year jail term for her predecessor Luiz Inacio Lula da Silva and the implication of 80 of Brazil’s political and business elite.

Corina Monaghan, senior vice president of credit, political, and security risk improvement, JLT Specialty USA

While this example is glaring and high-profile, the anti-corruption landscape is undoubtedly becoming more stringent around the world. China, for example, expanded the scope of its anti-corruption watchdog in October, while France this year introduced a game-changing ‘Sapin II’ framework.

Other countries are becoming more watchful, including developing markets with a history of corruption.

Multinational companies could find themselves facing heavy penalties if they fail to keep up with compliance demands. However, corruption is often deeply culturally rooted and traps remain.

According to John Kocoras, partner with the law firm McDermott, Will and Emery, the most susceptible companies are those that operate in countries where bribery is part of the business landscape, or in highly regulated industries involved in sales to foreign government agencies and government-owned corporations.

“In short, the more government touch points a company has, typically the greater the risk of anti-corruption compliance challenges,” he warned.

“Like crime, corruption cannot be totally avoided,” said Corina Monaghan, senior vice president of credit, political, and security risk improvement, JLT Specialty USA.

“What remains to be seen is whether these law changes are transparent and enforced consistently enough for foreign investors to clearly know what constitutes breaching the law,” she added.

“When there are gray areas in bureaucracy, this creates room for corruption.”

Legal Landscape

It is, of course, essential for multinational companies to get to know local conditions as comprehensively as possible in every jurisdiction in which they operate. That’s particularly true of systems, though the law can sometimes work differently in theory and practice.

Monaghan advises clients to find out who the key players and counterparties are in the sector in which they operate, including the government ministry with whom they’ll be dealing.

“If there are elections coming up, find out who may be elected and how this could affect your business,” she added.

“If your employees are colluding with third parties to create slush funds to further the business agenda, you have got a serious risk on your hands — and collusion is definitely rife.” — Annabel Reoch, head of anti-bribery and corruption, KPMG

However, even a granular knowledge of local legislation will only get multi-national companies so far, as they could run afoul of domestic law even if they do not break the rules overseas.

U.S.-listed companies, for example, are obligated to maintain accurate books and records. They also are obligated to enforce effective internal control. Failing to do so in a foreign operation could cause liability in the U.S.

“A substantial change over the last 10 years is our ability to address anti-corruption issues outside of the U.S.,” said Kocoras.

“This used to be seen as a U.S. concern, with the tail wagging the dog as far as multinational operations were concerned, but now cross-border conversations have become much more routine, which is good for serious compliance efforts,” he added.

“Considering the amount of fines we’re seeing and government interest in increasing fair competition, we expect that trend to continue.”

Governments also are increasingly willing to work together to investigate and resolve cross-border corruption claims.

In September, for example, Swedish, Dutch and U.S. authorities reaped the rewards of a combined effort when Nordic telecom giant Telia agreed to pay nearly $1 billion in penalties after admitting to paying more than $331 million in bribes to an Uzbek government official.

Formal, Effective Compliance

The most fundamental step a company can take to comply with the growing patchwork of international anti-corruption laws is to implement a formal compliance framework.

“Although anti-bribery laws and enforcement may differ from one place to another, there are common elements to an effective program that are important to legal compliance and good business,” said Kocoras.

This starts with prohibiting anyone within the organization from paying or receiving bribes to or from officials in either the public or private sectors. Bribery is not limited to cash payments and can vary in nature from sector to sector, from nepotistic hiring practices to extravagant entertainment. The perception of bribery also varies significantly between cultures and legal systems.

“It makes very good business sense to adopt a broad view of what constitutes a bribe, both to ensure compliance and protect the business,” Kocoras advised.

“Companies with operations around the world should enact policies and procedures that address the strictest standards they might face.”

According to Annabel Reoch, head of anti-bribery and corruption for KPMG in the UK, middlemen or ‘introducers’ are often at the heart of the problem.

“One of the biggest risks is third parties operating on your behalf. They may act unethically or make payments on your behalf to obtain or retain business,” she explained.

“If your employees are colluding with third parties to create slush funds to further the business agenda, you have got a serious risk on your hands — and collusion is definitely rife.”

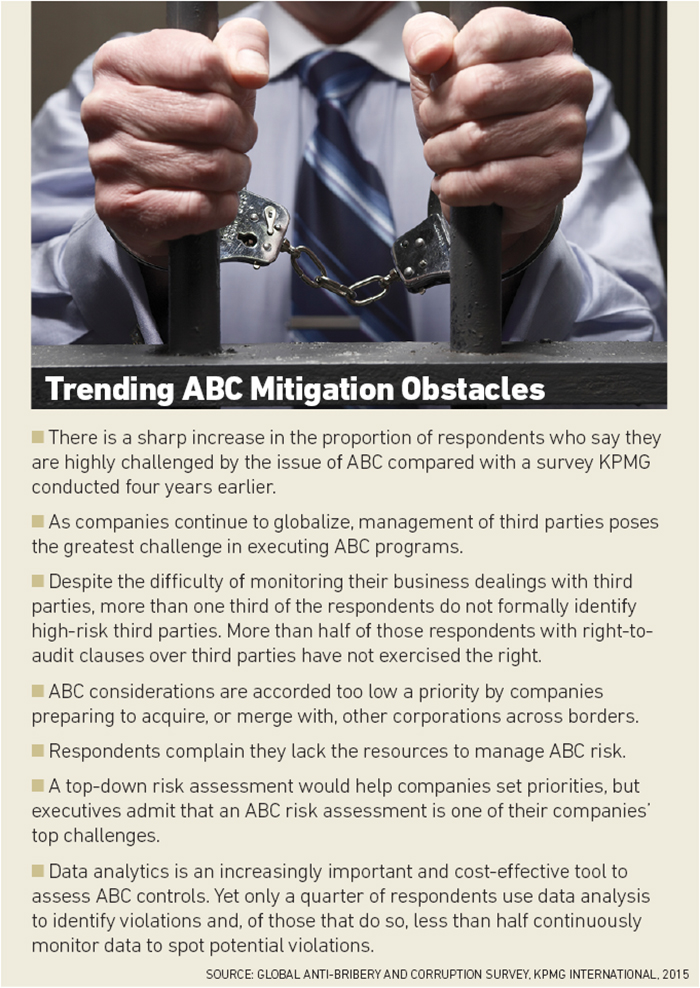

KPMG’s 2015 Global Anti-Bribery and Corruption (ABC) survey found that 70 percent of all corruption cases involved collusion and 61 percent included an individual from within the company itself.

“It is essential to know who you are doing business with, to conduct due diligence on those third parties, understand the risks and the business justification of working with the parties, and to have proper contract protections in place,” said Reoch.

Creating a More Ethical Culture

In the future, predictive data analytics that identify trends in bribery and corruption activity could help companies stay one step ahead of potentially risky behavior, though Reoch said this requires the complex triangulation of multiple data points.

“For example, you might look at the big contracts you’re tendering for, the employees involved in that tendering process and their gift, entertainment and hospitality activity and also any potential conflicts of interest.

You might look also at new third parties on-boarded around the time of that tender and the average commission payment and the outcome of any due diligence conducted,” she explained.

“Pinning those data points together could raise a red flag that proactively tells you there could be some problems in a particular region, rather than reacting after an incident.”

The most effective steps a company can take, she said, are to make sure its staff on the front lines knows the rules, procedures are embedded in the operations of those countries, and accountability for managing the risk is transferred to the staff working on the ground overseas.

“In remote jurisdictions, individual employees often claim they didn’t understand the process they were supposed to follow, they weren’t given proper training and that they didn’t recognize there was a problem because this is the way business is done where they are.

When operating really effectively, compliance has handed over that responsibility into the first line of defense so that they are the ones owning and managing that risk,” Reoch explained.

But Reoch added that while putting functions, controls and procedures in place is necessary for compliance, “delivering the right training to raise awareness, accountability and appreciation of bribery and corruption risk goes a lot further.”

“Capturing broad prohibitions on bribery and effective internal controls within a coherent policy is very important,” added Kocoras.

“But communication of that policy and compliance issues on all levels and with foreign operations is essential.” &