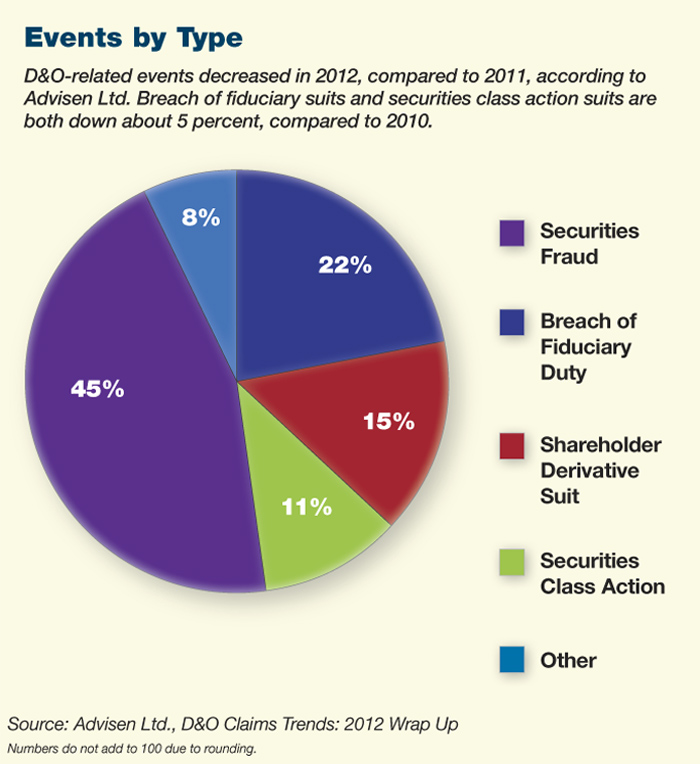

D&O Indemnity

Call to Duty

We are all familiar with “duty-to-defend” language commonly associated with general liability policies. There is “non-duty-to-defend” language in the marketplace as well. This language is often found in public, private and some nonprofit directors’ and officers’ (D&O) liability policies and employment practices liability (EPL) policies.

Confusion arises when risk managers, insureds and agents do not understand the differences and true context of these clauses.

“Duty-to-defend” language is routinely found in most EPL (1,000 or less employees), private company D&O policies, and almost all nonprofit D&O policies. The term essentially means that, in the event a claim is made against a policyholder for an alleged wrongful act, the insurance carrier has the right and duty to defend the claim — even if it is groundless, false or fraudulent.

A “non-duty-to-defend” policy — also known as an “indemnity” — is used in all public D&O policies and some EPL and errors and omissions (E&O) policies. This type of policy states that it is the policyholder’s responsibility, not the insurance company’s, to defend a claim.

Then, there are some policies that state the carrier has the right, but not the duty, to defend a claim. In some unique circumstances, we have seen manuscript wording that allows an insured to choose the preferred option at the time of the claim. Such a choice needs to be part of the negotiation between the broker and carrier before the policy is issued.

In one recent case, we had negotiated the right for the policyholder to choose between duty-to-defend and indemnity at the time of a claim. The insured, a manufacturer that had just suffered its first EPL claim, was able to select the option that best fit the company’s needs. It chose indemnity, because the policyholder felt the litigation would be settled quickly and at normal costs.

In one recent case, we had negotiated the right for the policyholder to choose between duty-to-defend and indemnity at the time of a claim. The insured, a manufacturer that had just suffered its first EPL claim, was able to select the option that best fit the company’s needs. It chose indemnity, because the policyholder felt the litigation would be settled quickly and at normal costs.

Choosing Self-Insured Retention or a Deductible

Self-insured retention (SIR) and deductibles are excellent tools for underwriters that want to avoid claims frequency and for insureds that want to manage their premium cost. As types of co-insurance, they hold the policyholder responsible for partial payment of a loss.

It is important to understand the difference between SIR and deductibles as well as the roles they play in the defense of a claim.

Most often, duty-to-defend policies use a deductible, which is always included as part of the defense costs and is not normally “first dollar” defense, as often perceived. When a deductible is used, that amount is subtracted from the amount of a claim as defense costs are incurred.

Because the carrier has a duty to defend the insured, the carrier can advance all defense costs on the policyholder’s behalf until a settlement is reached, then it will subtract the amount of the deductible. In situations where a claim was settled within the deductible amount, the carrier will require reimbursement from the insured for all of the defense costs it incurred.

The advantage is that the insured bears no out-of-pocket expense until settlement, helping their cash flow. Recently, a claim was reported that included covered and uncovered allegations filed against a security guard company in New Jersey. Because it was a duty-to-defend policy, the carrier defended all the allegations. This case was settled in August, and because of the global nature of the settlement, the insured avoided any allocation issues with the insurance company arising out of covered and uncovered allegations.

In contrast, a SIR is used almost exclusively in a non-duty-to-defend policy. In that situation, an insured must manage the litigation process from the time the claim is initially made until the amount of the SIR is satisfied. Then, the insurance company pays or advances funds.

Pros and Cons

When carriers have duty-to-defend clauses in their policies, they are obliged to manage the litigation process from the initiation of the claim.

That means the policyholder’s defense strategy is predominantly in the control of the insurance company. Insurers have the right to select defense counsel, who are usually, but not always, on their counsel panel. When the insurance carrier’s counsel is used, the overall costs of the litigation are usually minimized.

The duty-to-defend policy form is customarily used with smaller, less sophisticated privately held companies and nonprofit organizations that benefit from the insurance company’s choice and relationship with qualified defense counsel.

On the other hand, policies with non-duty-to-defend clauses put the management of the litigation process squarely on the shoulders of the insured. That includes the selection of defense counsel and payment of defense costs as they are incurred, although arrangements are often made for the carrier to make quarterly payments.

This approach is employed most often with either sophisticated large insureds and/or catastrophic potential exposures. Due to the nature of this type of D&O claim, it is in the insured’s best interest to control its own defense — particularly when allegations of fraud and misrepresentations are involved.

This approach is employed most often with either sophisticated large insureds and/or catastrophic potential exposures. Due to the nature of this type of D&O claim, it is in the insured’s best interest to control its own defense — particularly when allegations of fraud and misrepresentations are involved.

The reasons for this are fairly obvious. If a carrier providing the policy suspects the insureds have misrepresented themselves or committed dishonest, fraudulent or even criminal acts, the insurance company is less likely to view the policyholder in a favorable manner.

In some cases, the insurers may even try to rescind the policy because of such conduct. That has been the case for a number of notable, publicly held companies that have filed D&O claims during the past few years.

One drawback to the non-duty-to-defend option is the cost of defense, which may total hundreds of thousands of dollars. Such a protracted defense can become a financial burden. For this reason, the non-duty-to-defend form is frequently used by more sophisticated entities experienced in complex litigation matters.

The distinguishing difference between the non-duty-to-defend and the duty-to-defend policy is that the carrier does not step in to defend the claim until the SIR is satisfied. In practice, however, it remains the sole discretion of the carrier as to how they handle the SIR or deductible when a claim is made, because each policy contract varies, and each carrier handles claims differently.

Selecting Counsel

As mentioned before, when a duty-to-defend policy is used, the carrier generally retains the right to select legal counsel. In some instances, however, an insurance company may allow the insured to use its own defense counsel, if pre-approved in advance of a claim. This can be negotiated at the time coverage is placed. As an alternative, a number of insurance carriers now provide defense coverage via “panel counsel.”

Panel counsel consists of a group of pre-approved attorneys used by the carrier to handle claims on its behalf. They are experts in their fields, so the panel counsel acts as the insured’s claims counsel and manages the litigation process on the insured’s behalf, while working with the carrier to settle the claim.

Because of this relationship, the cost of defense is usually less — mainly due to lower pre-agreed hourly rates and efficiency due to counsel’s legal expertise.

When panel counsel is used, the policyholder will select their representation from a list provided and developed by the insurance carrier. This is routinely done once the policy is issued. But in some instances, the insured may have the option to make that choice at the time of a claim.

A non-duty-to-defend policy stipulates that it is the “duty of the insured and not the insurer” to select his or her own defense counsel. Contractually, the carrier still retains the right to approve the selected defense counsel, but such consent cannot be unreasonably withheld. Most often, the carrier just wants to be comfortable that the insured’s choice is qualified for the particular area of law.

With the non-duty-to-defend clause, the cost of defense, as mentioned, is borne by the insured and is only reimbursed at designated periods throughout the claim process once the SIR is satisfied. To help with those costs, the insurance carrier often will “advance defense costs” to reimburse out-of-pocket expenses incurred by the insured, thus limiting the hardship on the policyholder’s working capital.

This type of arrangement is typically associated with D&O policies, and reimbursement is usually made quarterly or, in some cases, monthly. However, this is not without stipulations. The rule of thumb is, the more sophisticated the insured (i.e., public company, industry, size, etc.), the more likely they will be better served with an indemnity policy.

Under most policies, a carrier will require compliance with a number of conditions before the insured is reimbursed. As an example: The claim must be a covered claim; the SIR must be satisfied; and the insured and carrier must have agreed to the costs of defense. And lastly, if it is established that there is no liability under the policy, then the insured will reimburse the insurer for all costs of the defense.

Whether a deductible or SIR is used, the payment of defense costs will almost certainly reduce the limit of liability in most policies. Nevertheless, there are a few duty-to-defend carriers that will provide defense costs in addition to the limit of liability.

Also, as the market changes, D&O and EPL carriers may permit an endorsement that allows insureds to select either the duty-to-defend option or defend claims themselves. As a rule, that option must usually be exercised within 30 days of notice of a claim.

When selecting coverage, it is important to know what defense provision is the correct one for your organization. Risk managers should talk to their brokers about the differences in the policy forms and how that relates to the organization’s needs.

The ability to have a choice can be a big advantage for the insured and should always be considered when deciding which coverage proposal is the best option. With that said, there are tradeoffs that need to be evaluated when the defense is outside of the carrier’s or policyholder’s control.

Of course, there is no absolute answer when selecting the appropriate defense provision because each insured’s business and needs are different. For smaller entities, economics may play an important role, whereas a larger entity may feel more comfortable using its own defense counsel.