Cyber Talent

A 1.8 Million Worker Shortage Looms for Cyber Security. Here’s How to Build a Resilient Workforce

In an increasingly digital economy, the supply of talent for cyber roles is no longer meeting demand. Last year, a workforce study projected a shortfall of 1.8 million cyber security workers by 2022, an increase of 20 percent on the 1.5 million shortfall it projected in 2015.

“With automation and digital transformation changing business models, every sector is becoming a technology sector and will be affected by the cyber skills shortage,” said Tracey Malcolm, Willis Towers Watson’s Future of Work leader.

A cyber security shortfall has a range of implications for businesses, from increased vulnerability to cyber attacks to losing ground to competitors with sophisticated digital capabilities.

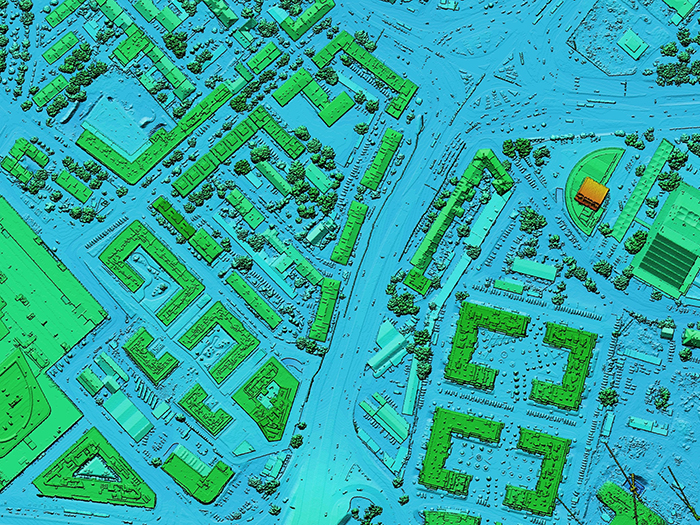

“New AI-supported processes, cloud-based databases hosted by third parties and the Internet of Things make it critical to have the right talent and processes in place to effectively mitigate risk and execute the demands of the business,” said RIMS board member Patrick Sterling, senior director, legendary people and risk management, Texas Roadhouse, describing AI as a “game-changer” for his business.

“Technological disruption is here and is not going away. With the speed of change, the last thing you want is a competitive advantage or money-saving technology sitting in the hopper waiting a long time for resources.”

The Need for More Women in Cyber

One of the biggest drivers of the skills gap is the under-representation of women in cyber security.

North America has the highest proportion of female cyber security talent of any global region, yet women are still hugely under-represented at just 14 percent (versus 48 percent) of the total workforce. Globally, that figure is just 11 percent.

According to the Global Information Security Workforce Study (GISWS), many women feel undervalued and discriminated against in the profession and earn less than men at every professional level.

Globally, men are four times more likely to be in a C-level cyber security position, four times more likely to be in executive management and nine times more likely to be in a managerial position, the study found.

“Companies must take swift and considerable actions to engage, develop and retain women in the field, or the global workforce gap will continue to grow year over year,” said the International Information Security Certification Consortium, or (ISC)²

Ethnic diversity is also key. According to a review of 180 publicly traded companies by McKinsey & Co, returns on equity were 53 percent higher on average for companies ranking in the top quartile of executive-board diversity than those in the bottom quartile.

Minority representation within the cyber security profession (26 percent) is slightly higher than the overall U.S. minority workforce (21 percent), however the majority are concentrated in non-management positions. Those in leadership roles are often more qualified than their peers, (ISC)² found.

Fixing the Cyber Security gap

According to Sterling, companies now have to be “laser focused” on inclusion and diversity: “It is a war for talent right now. If you don’t have a workplace where everyone can come to work and feel comfortable being their authentic best self, then you are behind in creating a culture that supports finding and retaining the best talent.”

Unconscious bias and cultural competency training is a good place to start, though it should be done by highly qualified trainers, Sterling explained.

Employers should also evaluate recruiting, hiring and retention practices to look for unintended barriers to improving workplace diversity, he said

“Rather than diversity and inclusion feeling punitive and compliance-driven, employees should be included in the positivity of building diverse teams. Bonuses for strategic referrals and hires are just one example.”

According to (ISC)², companies should implement mentorship, leadership and training programs, executive leadership programs and company-wide recognition programs and events to promote the advancement of diverse workforces.

“In order to be competitive today, you must have a highly talented IT leader who is passionate about creating a great workplace culture and knows how to recruit and cultivate great teams,” said Sterling.

Some companies are already laying the groundwork.

“We are seeing some companies being very proactive in building relationships with the cyber community and education organizations in order to boost the talent flow coming through,” said Malcolm.

“In order to be competitive today, you must have a highly talented IT leader who is passionate about creating a great workplace culture and knows how to recruit and cultivate great teams.” — Patrick Sterling, RIMS board member and risk management executive, Texas Roadhouse

One concern, she added, is that many HR departments still underestimate future cyber security talent needs.

“If you suddenly have a cyber breach and it’s all-hands-on-deck 24/7, you expect the cyber team to be there and respond, but what if 60 percent are permanent staff and 40 percent are contingent and contract?” she said.

“Your permanent cyber talent may be accessing supportive benefits like child care, but what about your contingent cyber talent? All of the talent you rely on should have a well-defined value proposition such as access to benefits programs.”

According to Malcolm, strategic workforce planning must be done frequently, regularly and proactively.

“HR sometimes keeps the cyber team at arm’s length, because its specific skillset and cyber people are plugged into other cyber people and often will be sourcing through their own networks or the security sector. However, HR needs to jump in and get active to support alternative recruitment approaches,” she said.

Cyber talent can be nurtured from a variety of backgrounds, including legal and law enforcement.

“It’s not all just tech engineers,” said Jason Hogg, CEO, Aon Cyber Solutions.

Compensation packages and perks for cyber professionals make retaining existing talent another key challenge. (ISC)²’s research found millennial workers are more likely to change employers than other generations, putting value in career development, training, professional certifications and association memberships.

Millennials want to be intellectually stimulated and they also want to be up-to-speed with technology, “so they need to have access to all the best and latest tools,” said Hogg.

“Home-growing talent is critical,” he said. Aon developed a cyber associate program onto which dozens of college graduates are onboarded each year, receiving mentorship and gaining practical experience.

Aon also introduced a formal mentoring and development program to nurture female cyber security talent.

“We have taken a strong stance on developing female leaders, and 42 percent of our current cyber associate class is female,” Hogg said. “You have to be systematic in how you attract, retain and develop talent, just as you do with managing risk.” &