Risk Report: Construction

Boom Risk and Opportunity

September, the City Council of New York voted unanimously to approve a bill requiring workers on most construction projects to participate in at least 40 hours of safety training.

A building boom in the nation’s largest city was accompanied by a rise in the number of fatalities: eight so far this year; 12 in each of the two previous years, but only eight total in 2014.

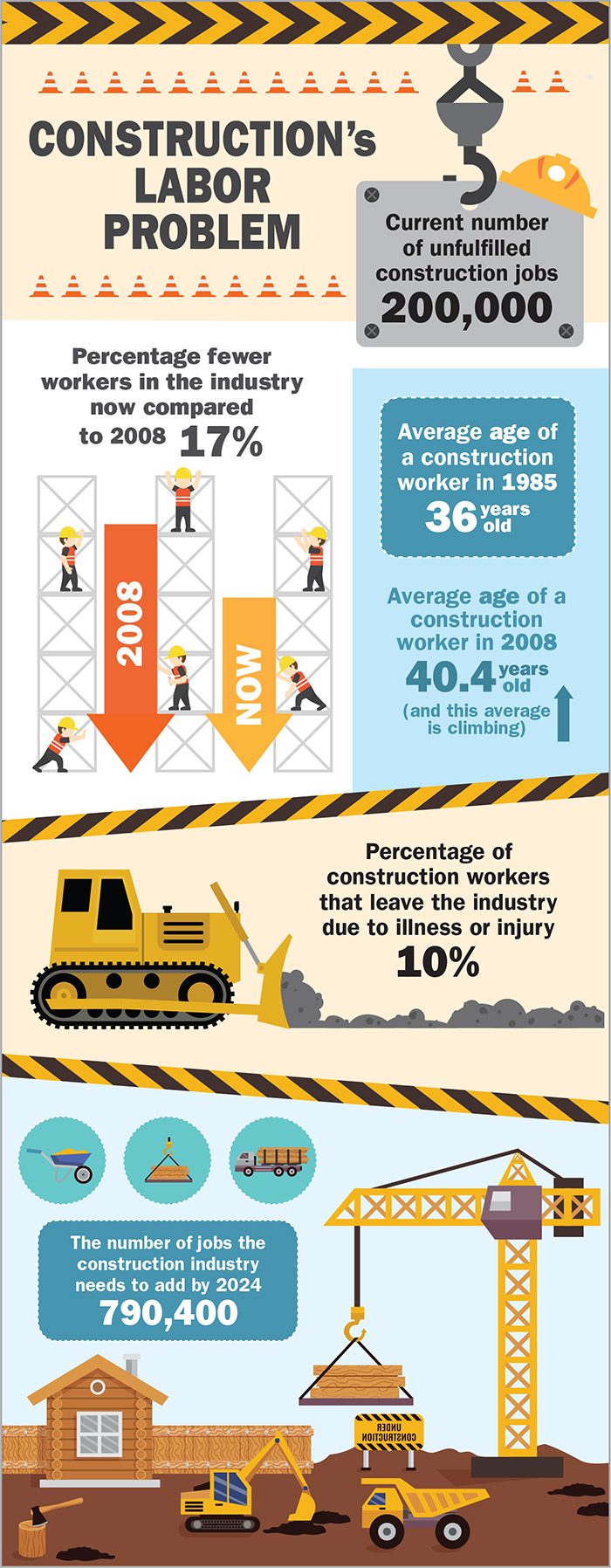

Across the country there are calls for large infrastructure projects. But builders, along with their brokers and underwriters, are worried about several troubling trends. Fewer young people are entering the building trades as the industry grays. Diversity also is a stubborn challenge.

The new law in New York is one large step — among many efforts across the country — to address the issues.

“We are glad these questions are being asked,” said Gary S. Kaplan, president of North America Construction at XL Catlin. “We have been asking these questions or years, and I am just starting to feel a little better about the answers, at least what we hear from the larger contractors. We are seeing fewer claims that are related to traditional safety issues.

“Kaplan has written extensively on demographics, recruiting, safety and training, including an essay on his firm’s website. Older workers, despite their expertise and safety training, face an increased likelihood of injury, he said.

“Ask any actuary,” Kaplan wrote. “Older workers are more prone to injury than younger ones. It’s just a biological fact. They’re especially susceptible to soft-tissue injury. Worse, the older the worker, the longer soft-tissue injuries can take to heal.”

The other risk is less obvious, but it’s every bit as debilitating for the industry, said Kaplan. It’s part of a massive shift in the demographics of the construction industry and the U.S. economy: retirement.

“While an injury might never happen — retirement will.”

According to the Social Security Administration and Pew Research, Baby Boomers are reaching retirement age at the rate of nearly 10,000 per day.

Construction occupations make up roughly 10 percent of the total labor force in the U.S. If representation is proportional, that means about 1,000 construction workers reach retirement age every day.

Benefits of Diversity

Diversity is part of the answer, said William B. Noonan, executive vice president and industry leader for North American construction at brokerage Willis Towers Watson.

“Diversity is tied to the talent shortage. The more diverse your recruiting, the better you are able to recruit from across the whole talent pool,” said Noonan.

Workforce management and talent optimization was one of the megatrend challenges identified in the white paper “Deconstructing Risk,” the Willis Towers Watson 2017 Construction Risk Index.

It also matters in winning contracts. “Before you can put people to work, you have to win work,” Noonan added.

“Proposals will only get you an interview with an owner to present your ideas and answer questions. You have to show up for those looking as diverse as the clients you hope to work for.”

The same is true in insurance. “For most lines of coverage, underwriters are going to be looking at your past performance,” said Noonan.

“They are going to look at your loss metrics, but you are going to have to tell your story in person. I was previously a chief risk officer and we would always look at our own losses, our own story, before going to the underwriters.”

“Diversity is tied to the talent shortage. The more diverse your recruiting, the better you are able to recruit from across the whole talent pool,” — William B. Noonan, EVP and industry leader for North American construction, Willis Towers Watson

Internally and externally it all comes down to how a company presents and represents itself. Better selected, more diversified workers are also easier to train, especially for highly skilled trades.

“One thing that worries me is that first-line supervisors are having to spend more time training than on supervising work,” Noonan lamented. “That directly affects construction defect claims. You can trace supervision to quality assurance and quality control.”

He also is concerned that the recent string of natural disasters, from earthquakes across Mexico to hurricanes along the U.S. Gulf Coast and in the Caribbean are “putting a very big strain on an already thin pool of construction workers.

“Where people go will be about who offers the best pay and conditions, and which workers are willing to travel.”

Much rebuilding to be done in many places at the same time will draw new workers, but that goes directly back to the challenges in training and supervision. “The more front-line supervisors are diverted from their primary purpose, the more QA/AC, project completion times and budgets are directly affected. It goes hand in hand,” said Noonan.

Stephen Buonpane, senior vice president of construction at Chubb, concurred.

“Construction companies facing a shortage of skilled labor need to know that a lack of proper training and experience could lead to an increased likelihood of worker injuries, resulting in higher workers’ compensation and potentially general liability losses,” said Buonpane.

Any increase in workers’ comp claims not only increases costs associated with the project but could also lead to reputational concerns and project delays, Buonpane added.

“However, increased workers’ comp claims are not the only liability associated with construction sites.

“For instance, if construction sites aren’t properly maintained and controlled — especially in densely-populated areas such as New York City where there has been a boom of construction activity over the past four years — construction companies are exposed to third-party liability if their [work] injures a person or property outside the construction area.”

Further, the shortage of skilled labor also can affect the quality of construction and increase the loss exposure on the project post-construction.

“Construction companies need to be aware that if there are construction defects due to poor building quality, there could be liability losses down the road. And depending upon what has been built, those losses could be in the tens of millions of dollars,” Buonpane cautioned.

Kaplan at XL Catlin said he sees signs of improvement. “I was traveling recently and there was a construction project next to my hotel. I saw a guy flying a drone with a laser sensor. There was another driving an automatic compactor by a remote joystick controller. There also are 3D surveys and digital monitoring for level, heat and water.”

The key is engagement at all levels, Kaplan stressed.

“Construction companies are making more of a career path, from supporting shop classes in high school, to return-to-work paths as part of the worker’s comp process.

It’s important to grasp that an injury doesn’t necessarily mean having a worker totally sidelined. Studies have shown that injured workers are more likely to experience better health outcomes when a return-to-work plan is in place, said Kaplan.

“You have to be proactive to move the needle,” he said.

“On workers’ comp, you don’t want people to practice retirement. They might get good at it.”

Similarly on diversity, it takes active effort. “Equal opportunity is not sufficient. You have to push. It’s more than just wanting it. The better companies are stepping forward, but there is a long way to go.

“In gender, for example, of 10.3 million construction workers in the country about only 9 percent are female. I think that is the lowest of any major industry group.” &