Billions Have Been Spent on School Safety. But Is It Working?

The Gist: More than 219,000 students have experienced gun violence at school since the 1999 Columbine High School massacre, reports the Washington Post.

Compiled data released in April of this year from the San Diego Union-Tribune shows a total of 223 deaths since Columbine in a total of 85 school shooting incidents. This year, a gunman entered Marjory Stoneman Douglas High School in Parkland, Fla. on Feb. 14 and killed 17 students and staff members and injured 17 more.

Parents are terrified. School superintendents are scrambling to find the right safety measures. And more and more start-ups and businesses are trying to solve this safety problem with new inventions “guaranteed” to keep children safe. But the question remains, just how safe are they?

The Hardening of Schools

While the frequency of school shootings has not increased in the last few decades, the death toll has, reports Politico: “Since the mid-2000s, the incidence of mass public shootings on a per capita basis has been a bit higher than it was in the preceding 10 years,” it says. “But the rates over the past 10 years are no higher than in the late 1980s and early ’90s.

“What has increased over time is the number of people shot in these incidents. Looking at annual trends in the total number of victims shot in mass public shootings (on a per capita basis), you see the severity has recently increased, reaching a 40-year high.”

It is for this reason that schools are adding in new security measures. Once considered ‘soft’ targets, schools are working to harden their facilities against an attack.

Now schools can buy 300-pound ballistic whiteboards ($2,900 each); classroom-specific tourniquets; facial-recognition software; high-tech, armored classroom doors (at $4,000 each); guns that fire balls packed with pepper mixtures (which are most commonly used by U.S. troops in combat zones); and even an elaborate door-security and weapons-detection system, which includes a 2,500 pound aluminum-framed vestibule (all for $500,000 per system).

The list of protective equipment designed specifically for the classroom is endless. Home Depot and Walmart have even started selling $150 bulletproof backpacks alongside other back-to-school supplies each August.

“I know it’s a low occurrence rate, but it’s a high cost. [It’s] not just in dollar ways. It’s catastrophic — children getting killed and the unrest.” — Diane Howard, director of benefits and risk management for the Palm Beach County School District in Fla.

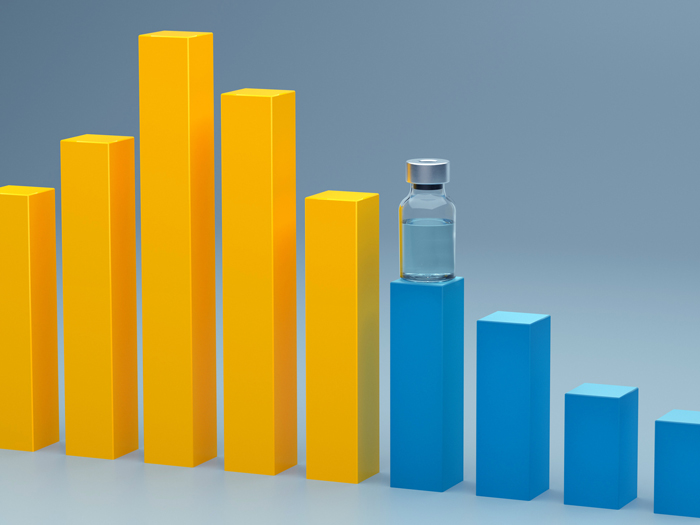

And schools are paying for it, too. The “education sector of the market for security equipment and services reached $2.7 billion in revenue in 2017,” reports IHS Markit, a team that tracks technology information and analytics. “As most schools have already implemented surveillance systems and access control systems, the market is expected to grow an average of just 1 percent annually, reaching $2.8 billion by 2021.”

Insurers and risk managers are working on new insurance solutions to protect entities in the event of a shooting as well, and while no policy can be the ‘one-size-fits-all’ solution for mass shootings, a number of facilities have invested in active shooter insurance to cover losses.

“I know it’s a low occurrence rate, but it’s a high cost,” Diane Howard told Risk & Insurance® earlier this year. She is the director of benefits and risk management for the Palm Beach County School District in Fla. “[It’s] not just in dollar ways. It’s catastrophic — children getting killed and the unrest.” Mass shootings and other violent outbreaks have changed the way she looks at risk. “I have to expand my mind. Risks are changing.”

Is It Working?

The Washington Post conducted a survey of every school in its database that endured a shooting since 2012, including Sandy Hook Elementary, where a gunman killed 20 school children, ages six and seven years old, and 6 adult staff members.

Of the 79 schools surveyed, 34 provided answers to the questions focused on safety measures. When asked if anything could have prevented their school’s shooting, “nearly half replied that there was nothing they could have done,” reported the Post.

Other schools said they believed encouraging staff members to speak with students and develop trusting relationships could prevent an incident, because often staff will hear about threats before teachers. One school said safety technology might have made a difference, while many of the other respondents replied they already had security plans in place before their incident.

“Even if we would have had metal detectors, it would not have mattered,” wrote one respondent. “If we would have had armed guards at the entrance of the school, it would not have mattered. If we would have required students to have see-through backpacks and bags, it would not have mattered.”

As the Post puts it, this answer “highlights a theme that appears throughout the survey responses: No amount of investment in security can guarantee a school protection from gun violence.”

What Schools Can Do

Safety training is vital to minimize damage, experts agree. Having a school-wide safety plan in place and making sure each teacher, staff member and student knows what to do can not only save lives but might also deter a shooter.

For instance, the Post’s study found one high school, Florida Forest High, had made it through a shooting with only one injured party. The teachers and students had undergone safety training and knew to lock their classroom doors and barricade them with chairs and desks when an active shooter with a shotgun entered the building. The gunman shot through one door, wounding a student, but then surrendered after failing to get inside.

Schools can also invest in school resource officers, who “are members of the law enforcement community who teach, counsel, and protect the school community.” Resource officers offer an on-site, trained professional for protection in school. They act as one more set of eyes and ears walking around with students daily, sometimes forming relationships with the students. Their presence has been known to not only protect students from imminent danger but to also intervene in possible drug overdose scenarios.

Additionally, The Conversation highlights 10 other useful methods schools can enact in their facilities to further prevent an incident and take care of their students.

Learn More: Check out the Washington Post’s in-depth exposé on school safety technology for more informaiton: Billions are now spent to protect kids from school shootings. Has it made them safer? &