2017 Most Dangerous Emerging Risks

2017 Most Dangerous Emerging Risks

Every year since 2011, Risk & Insurance® editors and writers have set about determining the Most Dangerous Emerging Risks for a package that runs in our April issue. As we’ve monitored which risks have the potential to cause the most damage, one thing is becoming apparent: Most Dangerous Emerging Risks seem to be emerging at a faster and faster rate.

Just last year, we wrote about the risk that a populace that self-selects information sources, relying mostly on unsubstantiated sources on the internet, could come to erroneous conclusions, with dangerous consequences.

We called that story “Fragmented Voice of Authority.”

Fearful proof of that premise came to life in December when a gunman shot up a pizza parlor in Washington, D.C., after reading bogus information on the internet that former Secretary of State Hillary Clinton was running a child sex ring there. Fortunately, no one was injured in that incident.

Now it looks like fake news stories emanating from Russia could have played an interfering role in our Presidential election.

Another focus of last year’s issue was our crumbling infrastructure. That topic received terrifying confirmation when heavy rainfalls pushed California’s aged Oroville Dam to the bursting point. Should the dam break, billions in real estate losses as well as potential loss of life would result.

That April 2016 story, titled “Crumbling Infrastructure: Day of Reckoning,” warned that we now face the consequences for too long foregoing spending on important infrastructure upgrades.

That April 2016 story, titled “Crumbling Infrastructure: Day of Reckoning,” warned that we now face the consequences for too long foregoing spending on important infrastructure upgrades.

We’ve seen that Most Dangerous Emerging Risks can take years to develop and emerge. But in both of these cases, they emerged in a matter of months.

The process of determining the Most Dangerous Emerging Risks begins in January, when we start placing calls to insurance carriers, risk modelers and brokers.

We ask executives with those companies to engage us in an off-the-record conversation about which risks concern them the most. A defining characteristic of a Most Dangerous Emerging Risk is that it has the potential to cause widespread losses, but might not be on the radar of many risk managers.

Once we pick the brains of industry executives, we compile a list of the risks that look like they could qualify as Most Dangerous Emerging Risks. The editors then meet to determine which of those risks we should focus on for the April issue. It’s at that stage that we go back to our original sources, and if we picked one of their stories, ask them for an on-the-record interview on the topic.

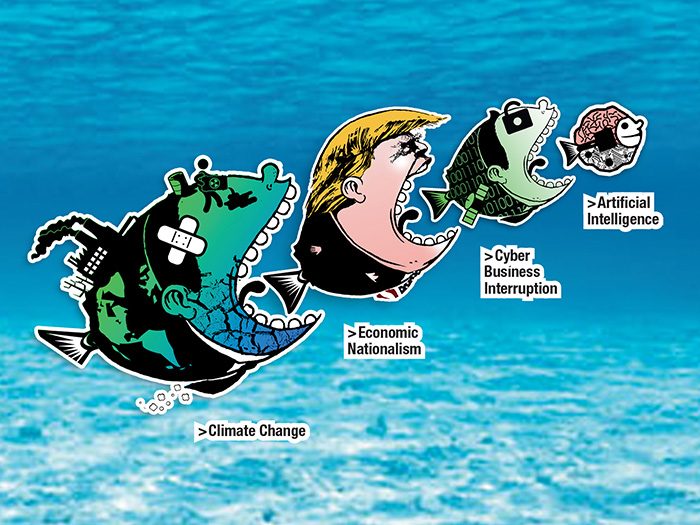

This year, after distilling our conversations with our sources, we came up with five emerging risks that could cause massive losses for commercial insureds and carriers.

The risk that sea rise could wreck coastal real estate values is one. Economic nationalism, both domestically and globally, are two and three.

The risk that sea rise could wreck coastal real estate values is one. Economic nationalism, both domestically and globally, are two and three.

The layered risk presented by the use of artificial intelligence in manufacturing and other processes is our fourth most dangerous emerging risk this year, and the threat that hackers could take down the internet and cause massive cyber business interruption is number five.

Experts say that trillions in property values could literally be underwater due to sea rise in the next mortgage cycle, or the next 30 years, according to a story by editor-in-chief Dan Reynolds.

Hopes are that public and private sector stakeholders can pull together to devote the thought and the resources necessary to create the infrastructure necessary to protect our ports, our office buildings and our homes from sea rise.

China is doing it and we should too.

The risk that many find most concerning is the fear that a hack could take down the internet. Business interruption for that kind of event would be so widespread that insurers just can’t cover it.

Check out managing editor Anne Freedman’s story on that risk.

Check out managing editor Anne Freedman’s story on that risk.

Protectionism is on the rise in this country. Politicians that want to firm up our borders represent a threat to supply chains and the free flow of commerce.

The U.S. tech industry, in particular, fears a talent shortage should the new administration’s efforts to limit immigration become law. Associate editor Katie Siegel’s piece details that risk and others that stem from domestic protectionism.

The fear for multinational companies, according to a story by staff writer Juliann Walsh, is that global business uncertainty will increase unduly; prompted by events such as Britain’s vote to leave the European Union and Venezuela’s decision to close its borders with Brazil.

Associate editor Michelle Kerr’s piece looks at the tangle of liability questions created by artificial intelligence.

Our award-winning Most Dangerous Emerging Risks coverage is, of course, intended not to scare people but to advance the thought leadership and dialogue we need to mitigate risk and ensure a more resilient, sustainable economy.

On that point, we can all agree. &

________________________________________________________________

2017 Most Dangerous Emerging Risks

Artificial Intelligence Ties Liability in Knots

Artificial Intelligence Ties Liability in Knots

The same technologies that drive business forward are upending the nature of loss exposures and presenting new coverage challenges.

Cyber Business Interruption

Cyber Business Interruption

Attacks on internet infrastructure begin, leaving unknown risks for insureds and insurers alike.

U.S. Economic Nationalism

U.S. Economic Nationalism

Nationalistic policies aim to boost American wealth and prosperity, but they may do long-term economic damage.

Foreign Economic Nationalism

Foreign Economic Nationalism

Economic nationalism is upsetting the risk management landscape by presenting challenges in once stable environments.

Coastal Mortgage Value Collapse

As climate change drives rising seas, so arises the risk that buyers will become leery of taking on mortgages along our coasts. Trillions in mortgage values are at stake unless the public and the private sector move quickly.