2014 Power Broker

Fine Arts

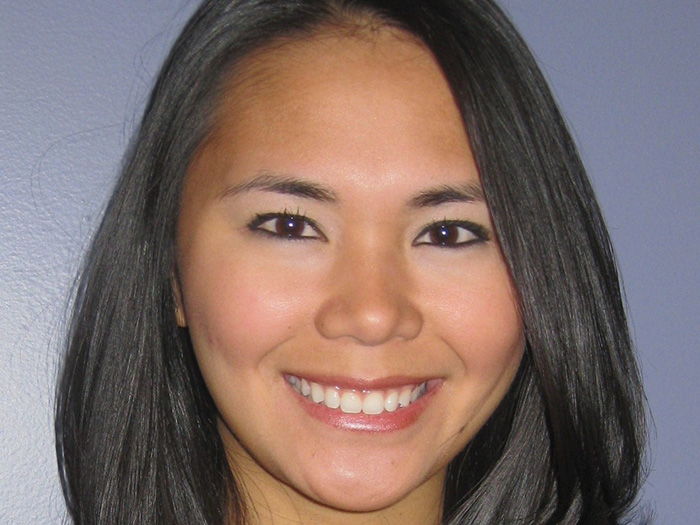

No-Drama Queen

Diane Jackson’s clients report no heart-stopping emergencies, and they like it that way. Rather, her client The Broad Art Museum frequently has routine but urgent last-minute requests, said Vicki Gambill, director of collections management. “I might call Diane and ask, ‘Can you drop everything and issue a policy to cover a piece on loan from this date to that date?’ ” And since Jackson always does, life proceeds peacefully.

Gambill is also a fan of Jackson’s superior customer service. “The thing I most value in Diane — in any good broker — is that she’s instantly and totally available.”

Jackson’s clients deeply value her commitment to saving them money. “She looked at the insurance program her predecessor set up, and right away saved us more than 25 percent on premiums,” said Tina Shierts, senior manager, corporate risk management, The Walt Disney Co.

Jackson helped Disney place a value on its priceless art collection, which includes Walt Disney’s original hand-drawn animation. “That’s good for us but a challenge for insurance purposes,” said Shierts. “Diane said, ‘Work out an agreement within the company and put a dollar number on it.’ She talked us through something we thought couldn’t be done.”

“Insurance brokers can feel shady,” said Portland McCormick, director, registration/collections management for The Hammer Museum in Los Angeles. “You ask, ‘Whose interest comes first?’ With Diane, you already know it’s yours.” And she saved the museum 10 percent of its insurance costs on coverage, compared to its previous program.

Disciple of Insurance

If Patty Decoster could build a team of life advisers, Lynn Marcin would be on it. “I feel like she’s one of my best friends,” Decoster said, for the same virtues that make her a great broker: tireless advocacy, unflappable calm and attitude-free explanations of the increasingly complex world of fine arts insurance.

This year, for example, the Kimbell Art Museum, where Decoster is registrar, had a “mind-bogglingly high-value” exhibition that far exceeded the limit on the museum’s domestic indemnity. Marcin “went all over the world” to weave together coverage through different underwriters that actually cost about $100,000 less than the original estimate.

Jonathan Bucci, collection curator of Willamette University’s Hallie Ford Museum of Art, also appreciates Marcin’s gift as a broker-educator. He manages the museum’s collection, but usually not its insurance, which is part of the university’s property insurance. “Lynn explained it all patiently, and repeatedly, since it was new to me. She gave me the complete picture of how it all works.”

And she does her homework, said Devron McMillin, risk administrator, City and County of Denver. When Denver added a billion-dollar collection gifted to the Clyfford Still Museum, Marcin gave the underwriters a sense of the loss preventions in place. The city even built “a bunker” for the collection. After a few minor losses during conservation and repair, McMillin expected a premium increase this year, but Marcin negotiated a good rate. “Our renewal was flat,” McMillin said. “That was very exciting.”

Master of Plan B

No brokers can predict natural disasters. But the best ones make sure they put their clients’ ducks in a row … just in case.

In the days before Superstorm Sandy, Mary Ryan, owner of the Mary Ryan Gallery in New York City, moved most of the art from the gallery to a safer location and lay down sandbags to protect the space. The gallery suffered no losses, but it faced cancellation of its policy simply because of its location. “Mary worked diligently to find us coverage, and finally she succeeded,” said Ryan.

Uovo Fine Art Storage, another of Pontillo’s New York clients, had a similar experience. “Since Sandy, underwriters aren’t excited about getting more exposure,” said Christopher Wise, Uovo’s executive vice president, “but Mary dug deep and found us a good policy at a good price.”

Even before Sandy, Pontillo helped Ryan’s gallery dodge another disaster: Iceland’s volcano eruption in Eyjafjallajökull, which snarled air traffic for weeks in 2010 and threatened a shipment of art en route to an art fair in London.

“It’s pretty hard to anticipate volcanoes when you’re writing an insurance policy,” Ryan said, but Pontillo rerouted the shipment over ground through France and made sure it arrived in time while disaster unfolded around Europe. And although Ryan never had to fall back on Plan B, Pontillo had alternate scenarios in place … just in case.

That’s no fluke, Wise said. “Mary understands what we need, and she goes above and beyond the call of duty to find it.” His organization has never made a claim and has a loss ratio of zero. “The best insurance is the insurance you don’t use,” he said.

Turning Clients Into Rock Stars

Paul So, owner of the Hamiltonian Gallery in Washington, D.C., had a rough year: A water main had broken on his block and flooded the gallery, destroying some art and jacking up his insurance premiums prohibitively. His underwriter dropped his building and business interruption policies. His then-broker, who didn’t specialize in fine arts, suggested “fixes” and imposed restrictions that would have shut down his business.

The gallery owner turned to Helena Lai, a graduate of Sotheby’s Institute of Art with an M.A. in Art Business. She was “a superhero” in putting together a package of insurance appropriate for fine arts. “Helena knew how to protect the art from damage in a way that didn’t intrude on the way we ran the gallery,” So said. “She knew how much insurance to get.”

Lai plugged in that resourcefulness for Baldwin Krystyn Sherman Partners, which covers fine art for museums and artists in the Tampa Bay, Fla., area. One client, said Rhonda Kinley, commercial risk adviser, shipped his art through FedEx and insured it separately. “Helena found out we could easily add that coverage to our policy for transit coverage. We gave a percentage of it back to the client,” Kinley recalled, which made the client very happy. “And we looked like amazing rock stars.”

With two workers’ comp policies, plus auto, property and liability, Margery Goldberg, owner of the Zenith Gallery in Washington, D.C., is a self-described “poster child for insurance.” Lai went to market for her and found one single policy with a single premium. “She saved me 75 percent of my insurance costs,” Goldberg said, “and got me much better coverage.”

Broker, Detective, Mind Reader

An insurance broker doesn’t usually play art sleuth or clairvoyant, but that’s what Blythe O’Brien Hogan does in addition to her more conventional broker roles.

After bumbling thieves stole — and finally returned — a Salvador Dali painting from Venus Over Manhattan Gallery, Hogan was on the case with the insurance company, which initially pushed back against the claim. “Blythe argued that the artwork we got back was not the artwork that was fully insured,” said Eran Schreiber, the gallery’s chief financial officer.

It had been shoved into a tube, covered in tell-tale fingerprints, and mailed by regular post across the ocean to Kennedy Airport. “She got us a full payment of the value of the work.”

The insurance company later sold it at auction for less than its insured value.

Even when her role doesn’t include high drama, Hogan’s clients say she comes through for them. Before her initial negotiation with prospective client the Estee Lauder Cos., Hogan got program summaries and information about coverage. “She came to the table already informed on information about our renewal. That was huge to us,” said Hilary Feldman, manager of ERM and Insurance. “She anticipates our needs.”

Ted Vassilev, owner of DTR Modern Galleries, said Hogan is refreshingly accommodating. “I prefer a personal approach,” he said, such as meeting over drinks or dinner instead of in a gallery. “I prefer phone calls to emails, and I prefer repetitive engagement. If you don’t get a response, send it again to get my attention.” Whatever the client needs, she delivers.

The Devil’s in the Details

The David Zwirner Gallery was trying to assemble an Ad Reinhardt exhibition from various lenders, who were understandably skittish about the risks that attend moving and handling extremely fragile works of art. “Sam [Pugatch] walked each of them through the insurance requirements,” said Kelly Reynolds, the gallery’s director of registration and conservation. “He helped us tailor certificates of insurance for each and every lender.”

In addition, Reynolds said, Pugatch helped formulate ways to exhibit works in the safest way possible from an insurance standpoint. “Working in tandem with him on what kind of situations might arise for very fragile artworks really helped us convince the lenders to lend the works.”

That patience and painstaking attention to detail gave both client and lenders the peace of mind that made the exhibit possible. The result: one of the gallery’s most successful exhibitions in its history. “He established a precedent that will be reflected in gallery and museum exhibitions around the world,” Reynolds said. “That’s a pretty impressive feat that he helped us accomplish.”

Pugatch applied the same kind of attention to the gallery’s post-Sandy claims process. “He was in our gallery space every single Friday for months,” Reynolds said, talking them through claims, future exhibitions and hurricane preparedness.

“A weekly meeting for a year? I call that a big deal,” said Reynolds. “And he always came prepared.”